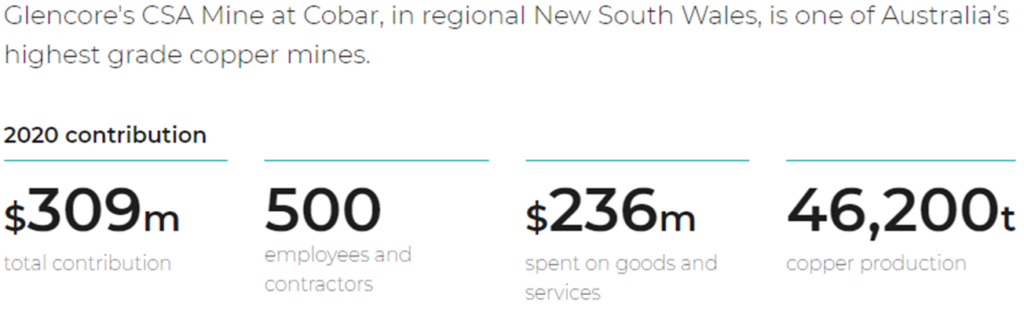

Blank check firm Metals Acquisition Corp. (NYSE: MTAL) announced today the definitive agreement to acquire the CSA copper mine in New South Wales, Australia. The acquisition’s price tag is reportedly valued at US$1.1 billion.

The transaction, effected through the firm’s Australian subsidiary, aims to acquire 100% of Cobar Management, a subsidiary of Anglo-Swiss mining giant Glencore (LSE: GLEN) and the owner of the Australian copper mine.

The acquisition is said to be satisfied with US$1.05 billion in cash and US$50 million worth of common shares. The total acquisition price represents 4.5x the estimated 2022 EBITDA of the mine.

Included in the consideration for the acquisition is a 1.5% copper net smelter royalty to Glencore.

The company said the mine produced 41 kilotonnes of payable copper and 459 kilo ounces of payable silver in 2021. It also has an estimated 15-year mine life.

The SPAC completed its US$250 million IPO in September 2021. The company said it intends to focus its search for business combination on green-economy-focused metals and mining businesses in high quality.

Metals Acquisition last traded at US$9.66 on the NYSE.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.