The Bridgemark Group appears to be at it again. Previously, we covered the news that a new fake meat issuer, known as Modern Meat, would be coming to the Canadian Securities Exchange via the reverse takeover of Navis Resources (CSE: SUV). With the shell now renamed to Modern Meat Holdings (CSE: MEAT), it appears that the new issue is expected to commence trading this week. The problem, is that it appears to be the latest Bridgemark controlled firm.

Modern Meat is focused on developing plant-based meat alternatives that contain a slurry of buzzwords, including “non-GMO,” “soy-free,” “gluten-free,” and “100% vegan.” Their current product lineup consists of a total of nine products, six of which are “ready for commercial phase,” although their listing statement indicates that they currently have extremely limited distribution. Current manufacturing capacity is “on target” for 10,000 units being produced each month, with the company pursuing a co-packing partnership currently.

Admittedly, on paper many aspects of the company look to have potential – Modern Meat currently has a long list of products nearing launch, with over 10,000 units of its product already manufactured since the launch for promotion of the new brand. It currently has several additional recipes in development as well, and it appears that it has put together these items in short order. Further, there seems to be plenty of investor appetite for alternative meat issuers currently. The problem, however, is the management team and their history.

Quite frankly, it’s a blatant Bridgemark Group firm.

How so? Let’s look at the management team. In a news release issued on Friday, Modern Meat, while still trading under the symbol “SUV”, announced that the business combination had been completed. Within, they identified the management team as consisting of the following people:

- Tara Haddad, as CEO

- Yuying Liang, as CFO

- Nawaz Jiwani, as director

- Cassidy McCord, as director

Let’s start from the top. First and foremost, Tara Haddad was implicated in the original Bridgemark Group scandal, going so far as having seen certain assets frozen as a result of the involvement in the schemes by both her and her husband, Abeir Haddad. Haddad is also believed to be the sister of Anthony Jackson, the supposed head of the group and CEO of Bridgemark Financial Corp.

Next, is Yuying Liang, the chief financial officer of Modern Meat. This one is fairly cut and dry in terms of her connection to Bridgemark. A November 2018 investor presentation for Prize Mining (TSXV: BDGC) lists her as being a senior associate of Bridgemark Financial Corp.

Next up is Nawaz Jiwani, whom currently serves as a director for Koios Beverage Corp, a company where Anthony Jackson has previously served as a chief financial officer. However, it is unclear if they know of each other based on the timing of their appointments.

Last on the list is Cassidy McCord, whom we recently covered the background on as a result of her becoming a director of the now defunct RavenQuest BioMed (CSE: RQB). Her appointment to RavenQuest’s board followed the appoint of two other Bridgemark connected individuals, Usama Chaudry and Jatinder Dhaliwal. The company subsequently performed a transaction at RavenQuest with other Bridgemark associated individuals, including Wilson Su and Kevin Su.

Modern Meat’s Share Structure

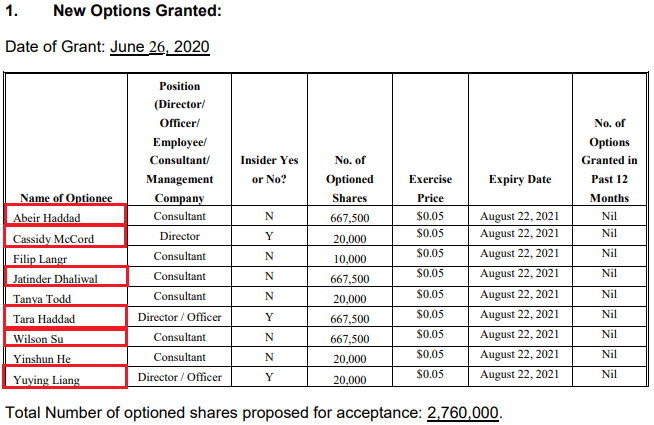

When it comes to the share structure of Modern Meat, things are rather unsurprising when acknowledging the involvement of Bridgemark. The shell that was Navis Resources underwent a split on a two for one basis, following by the post-split issuance of 2.76 million options at a price of $0.05. Unsurprisingly, many of those options issued went to numerous known Bridgemark Group collaborators.

The shell acquired all of the common shares of Modern Meat through the issuance of 11.5 million post-split shares, at a valuation not provided by the company. In total, Modern Meat has a total of 28,306,498 common shares outstanding as of the date of the filing statement, along with 2.76 million options and 50,000 common share purchase warrants.

Furthermore, the company closed a private placement financing at a price of $0.25 per share on June 26, raising proceeds of $700,000. While those shares are subject to a four month lockup, it signals that the company is looking to enter the market at a price per share much higher than recently issued options and shares were issued at.

Modern Meat is currently expected to commence trading this week, however a bulletin has yet to be filed by the Canadian Securities Exchange identifying specifics on when trading will resume with the issuer. The listing statement date was June 26, however it typically takes the exchange a few days to process the filing before resumption of trading occurs.

While the company itself appears to be real, the management team behind the firm appears to be highly questionable based on past experiences. Is this Bridgemark’s attempt to clear their name, or can investors expect more of the same?

Information for this analysis was found via Sedar, The CSE, Modern Meat and Navis Resources. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.

7 Responses

same group as YUMY

same group as YUMY as well…

“While the company itself appears to be real, the management team behind the firm appears to be highly questionable based on past experiences. Is this Bridgemark’s attempt to clear their name, or can investors expect more of the same?”

Anyone with the necessary experience can go public and acquire/setup a miniscule fake meat company like these people have done, taking advantage of investor stupidity and hype in an industry like this to massively overprice the company. Unfortunately this kind of pump and dump, where there is a front of legitimacy in a massively overvalued “real” operation attracts the same kind of ignorant and gullible investors with a serious case of FOMO.

How is it fake if they have real products in stores that you can buy? I made money off this shit, maybe you should too if you know so much.

You can always make money off any stock that goes up and down.

Congratulations on your gain.

We’re sure this is a real company with a real valuation given the track records of the names involved 🙂

It’s hard to feel sympathy for people that relish in making money off of pump and dumps up to the point where they inevitably get burned. I would be shocked if Clint or any other investor has any model of a valuation whatsoever beyond the idea that he can sell it to a greater fool than himself.

Once a skunk. Always a skunk ? !!