Nobody likes it when the interest rates go up. It raises the cost of capital and makes it more expensive to operate businesses. That drives employment rates down, and puts the housing market in a cold shower… and that’s the whole point.

We’re fighting inflation here. Jack those rates up until buying money costs so much that there’s no money to spend on anything else, like labour, the economy goes into recession, and prices come down in a fit of humility.

Maybe not “nobody.” It’s a raw deal for the people who used to earn with those jobs, and for the small businesses who fold under the enormous costs of capital, and for home owners who were never trying to be real estate moguls, they just wanted to quit feeding that pig of a landlord. They’re likely to end up owing the bank more than the house is worth by the time inflation is at an acceptable level.

But there is NO OTHER KNOWN WAY to bring prices down. What else are they supposed to do? Implement price controls? RENT controls!? The government can’t just implement laws against raising prices! This isn’t communism! It isn’t Nixon!

Ratcheting up the rates is the way to go. Capitalism is about capital and, the higher the rates, the more that capital earns in the fixed income markets, keeping it from piling into the equities markets, where it would be forced to earn based on the success or failure of Canadian businesses, heating the damned economy up as it went. This way, once the capital has been collecting interest at the jacked-up rates for long enough, the businesses and property currently belabouring the balance sheets of the broke suckers who can’t afford its freight will become the property of the rich and deserving interests who can.

It’s the cycle of life.

But try telling any of that to those porkers down in Ottawa! They’re busy wrapping enterprises up so tight in red tape, they can’t afford to be job creators!

Bell Canada (TSX: BCE) Executive VP Robert Malcomson didn’t want to close a bunch of radio stations and lay 1,300 people off… but the CRTC’s “relentless regulatory intervention” practically forced his hand. During his discussion of the layoffs with the Canadian Press, Malcolmson took some time to complain about the commission’s “populist” policies, aimed at reducing the cost of phone and internet for Canadians.

The executive claims that the CRTC’s shackles have hurt his company’s ability to charge enough already, and cites some statistics about the cost of wireless falling and the cost of high-speed internet rising slower than broader inflation, that we can’t check for accuracy. Stats Canada keeps track of the consumer cost of Bell’s services, but has suppressed the data since 2018, so we’ll just have to take Malcolmson’s word that all this red tape is keeping Bell’s prices down.

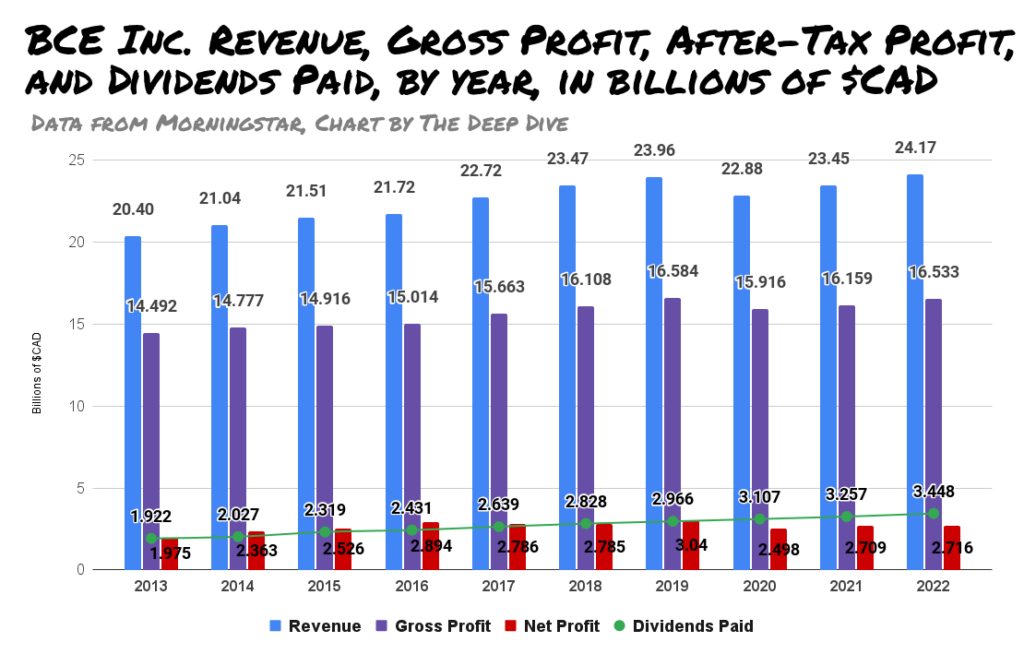

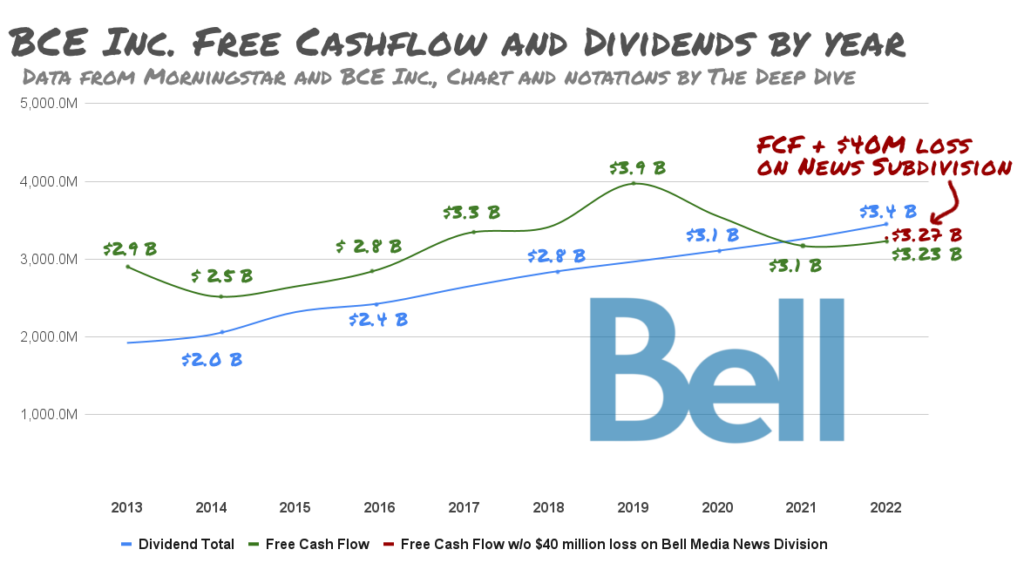

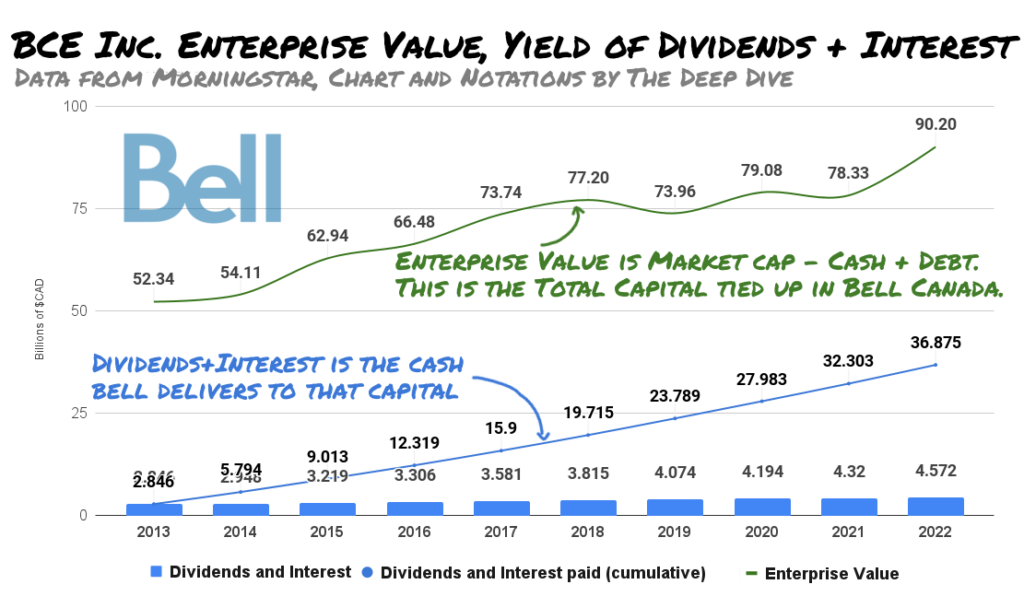

The allegedly falling consumer costs haven’t yet made a dent in Bell’s earnings or revenue. It pulled down $24 billion in revenue in 2022, a new record. That take generated $3.8 billion in pre-tax earnings, and Bell passed pretty much all of it to the shareholders as dividends. Bell is very proud of its dividends, and has pledged to keep them at at least 65% of free cash flow.

In a sense, Malcolmson is right about the CRTC circle jerk that resulted in these phantom price drops. Beating back the cost of Bell’s services to subscribers with any policy other than a price cap seems like wasted energy. It’s committed to those divvies, and will adjust to any mandate that increases its costs by cutting down its consumer offerings, laying off the people who used to make them, and blaming the government.

Investing in (cash) generational breakthroughs

This is a company named after the Canadian who invented the telephone (in the United States), so it takes its reputation as an innovator pretty seriously, and it should. Innovation is what capitalism is all about. Without it, we’re no better than those filthy commies.

Something called Re$earch Infosource puts Bell at #6 in corporate R&D spending in fiscal 2021. The outfit counts Bell’s R&D spend at a very generous $618 million, apparently by including the portion of its capex determined to be R&D. Bell itself counts its opex-based R&D at $57 million in 2021, and another $57 million in 2022. The all-in $618 million figure is about 2.6% of Bell’s total revenue.

We took a walk through Bell’s Canadian patent portfolio to get a sense of what it’s been up to in the lab.

It isn’t clear if this method of content delivery is a patented process.

Predictably, Bell is working on ways to improve the networks that it uses to pull in $20 billion + / year, and ways to more efficiently monetize its media properties, without having to generate any compelling original content.

True to its brand, Bell is only willing to tolerate a certain amount of risk in its media division. It produces very little original content for its subscribers, preferring instead to license the dreck produced by Warner Brothers, and why not?

Spending the time and money to build a serious studio could only yield higher quality content that the 30 million consumer Canadian market might watch, eventually. It makes more sense for Bell to buy the Canadian streaming rights to whatever gets so popular in the States that Canadian viewers are clamoring for it on social media, over the bandwidth that Bell is already charging them for.

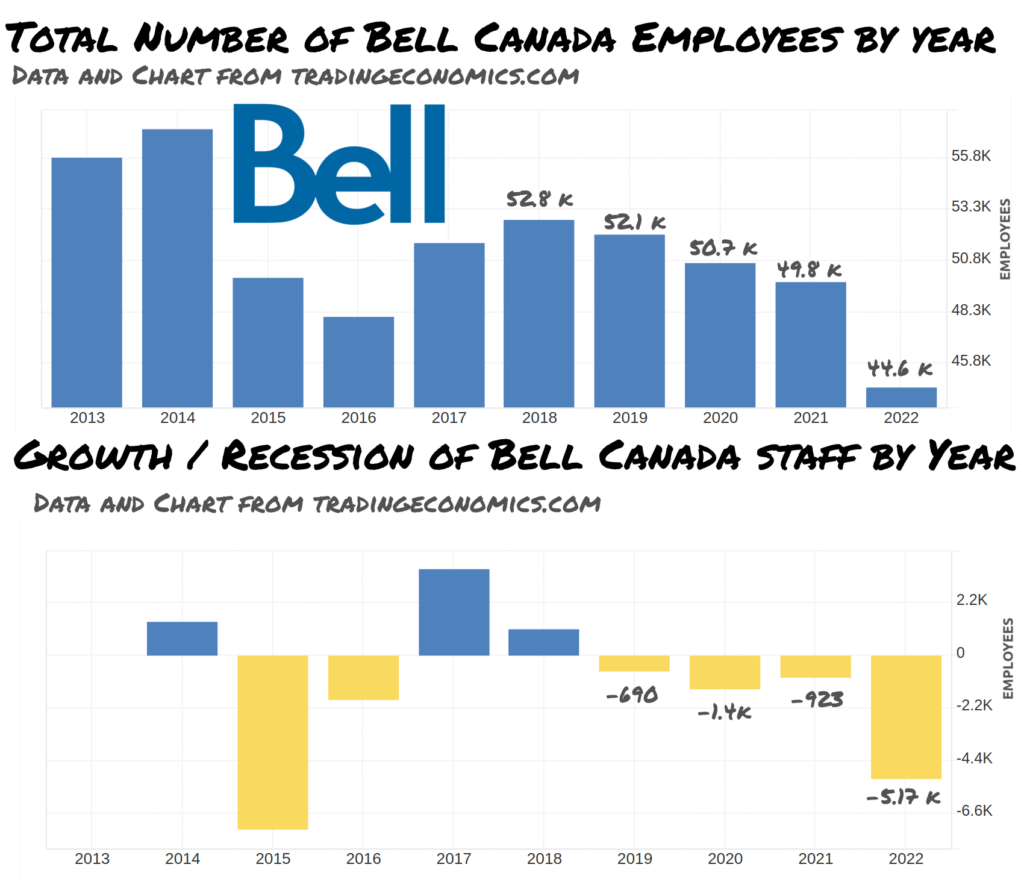

Bell does not innovate anything other than the entrenchment and monetization of its own interests and, contrary to what it might claim, it does not “create” any jobs that it doesn’t have to.

Bell exists to find and stabilize the path that delivers the highest possible volume of its subscribers’ money to its shareholders in the most efficient way possible. Accordingly, anyone who really believes that capitalism fosters strong, innovative economies should be demanding that Bell be nationalized.

Bell Canada is a $90 billion dollar chunk of capital whose sole purpose is to leech $4.5 billion per year out of the Canadian economy, to be re-deployed into further rent-seeking. Allowing that much capital to sit on a sure thing while (relatively) high interest rates starve the venture markets of growth-focused capital is economic malpractice.

A government serious about a strong economy and serious about fostering innovation would buy Bell from its shareholders, and sell the media division to investors interested in its development and growth.

A government-owned network could lower the cost of cell and internet services to subscribers by at least an amount equal to the dividends (probably about 20%), and create an economic tailwind by sending $60 billion in equity investment up the risk curve in search of yield.

This concludes part 2 of Nationalize the Telcos for the sake of Capitalism. Part 1: Rogers can be found here, and its companion post about the ministry of Innovation and Industry is here. If you’d like to read Pt. 3, Telus, sound off in the comments.

Information for this briefing was found via Bell Media, Sedar, TradingEconomics, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.