U.S. natural gas prices have plummeted over the last month. The front-month (in this case, February 2023) futures price at the benchmark Henry Hub in Louisiana is about US$3.48 per thousand cubic feet (Mcf), down by 50% in just a month’s time. What’s more, futures prices are below US$5.00 per Mcf for all months through December 2025.

Extraordinarily warm weather that has blanketed much of the United States since Christmas is the principal reason for the price action. Weather forecasts which do not call for cold weather to return until around the end of January, and then only to seasonal levels, have perhaps played an even more critical role in falling prices.

The extent of this warm weather effect, and the implications for future prices, was underscored last week by remarkable underground natural gas storage data for the Lower 48 states released by the U.S. Energy Information Administration (EIA).

READ: Ohio Legally Reclassifies Natural Gas As “Green Energy”

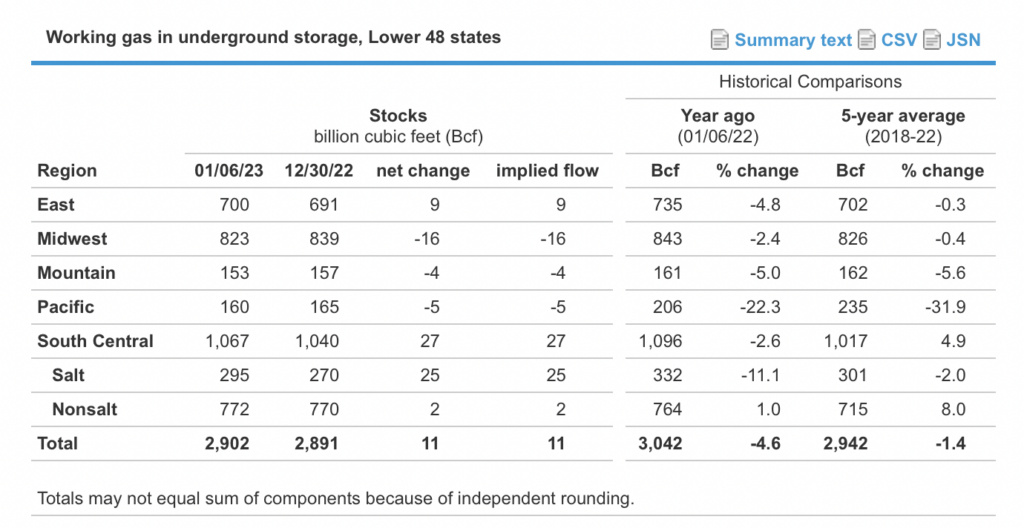

For the week ended January 6, 2023 — the middle of winter — the EIA reported a net 11 billion cubic feet (Bcf) build in the amount of natural gas stored nationwide. Sensibly, the biggest build occurred in the warmest region of the country, the southcentral United States. To demonstrate how unusual such a build at this time of year is: in the week before, the cold seven-day stretch ended December 30, 2022, a total of 221 Bcf of natural gas was drawn out of storage.

The 11 Bcf weekly build for the week ended January 6, 2023 left 2,902 Bcf of working gas in underground storage, 40 Bcf below the 2,942 Bcf average of the last five years at this time of year. Total working gas storage capacity in the U.S. is 4,728 Bcf.

The issue for natural gas prices is that the next few weekly draws are likely to be, at best, modest given the mild weather conditions; and the amount left in storage versus historical norms should grow, which in turn has negative implications for natural gas prices well beyond the short run.

As gas builds in the short run versus historic averages, this feeds into the unfavorable long-term supply/demand statistics of the industry. According to Morgan Stanley, the U.S. now produces about 101 Bcf of natural gas per day, which is 3 Bcf per day (Bcf/d) above total demand, including LNG export demand, of 98 Bcf/d.

All this seems to point to gas-oriented E&P companies’ facing a much more difficult path in 2023 than the favorable one they enjoyed through much of 2022. For example, Comstock Resources, Inc. (NYSE: CRK) and Coterra Energy Inc. (NYSE: CTRA) are still up about 52% and 16%, respectively, since the start of 2022, both far outperforming the overall market.

Information for this story was found via Energy News, Trading Economics, and the sources and companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

Short selling at 18 months high. Squeeeeeze