Following through its previously announced plan to introduce a lower-priced, ad-based subscription tier, Netflix (Nasdaq: NFLX) announced on Wednesday that it has chosen Microsoft (Nasdaq: MSFT) as its partner to run the ads.

“Microsoft has the proven ability to support all our needs as we together build a new ad supported offering. More importantly, Microsoft offered the flexibility to innovate over time on both the technology and sales side, as well as strong privacy protections for our members,” said COO Greg Peters in a statement.

While Co-CEO Reed Hastings has initially opposed introducing ads to the platform, the chief executive indicated the plan for an ad-supported service earlier in April.

“We’re trying to figure out over the next year or two. But think of us as quite open to offering even lower prices with advertising as a consumer choice,” Hastings said.

Since announcing the plan, the company has been interviewing companies to partner with to run the ads, including Google and Comcast. But compared to these two giants, who own streaming platforms Youtube and Peacock, respectively, Microsoft doesn’t own any similar or competing service.

The partnership is also expected to boost Microsoft’s ad revenue, which accounts for around 6% of its total revenue.

Netflix reported in its Q1 2022 results its first quarter-on-quarter decline in its membership base in 10 years. It also forecasted a further decline of 2.0 million users for Q2 2022.

During the quarter reported, it also recorded losing around 200,000 users during the quarter, far from its guidance of 2.5 million net membership additions.

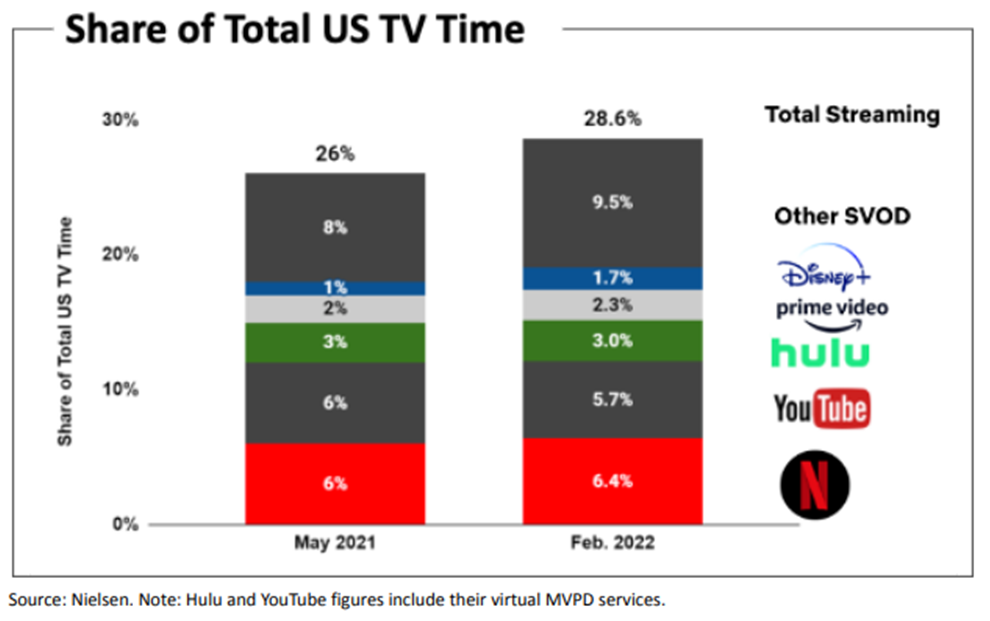

The streaming platform, while it saw an increase in watching hours, is also facing fierce competition from other alternatives.

In late June, the company laid off around 300 employees, following the 150 job cuts it made the previous month.

Netflix last traded at US$176.56 on the Nasdaq.

Information for this briefing was found via CNBC and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.