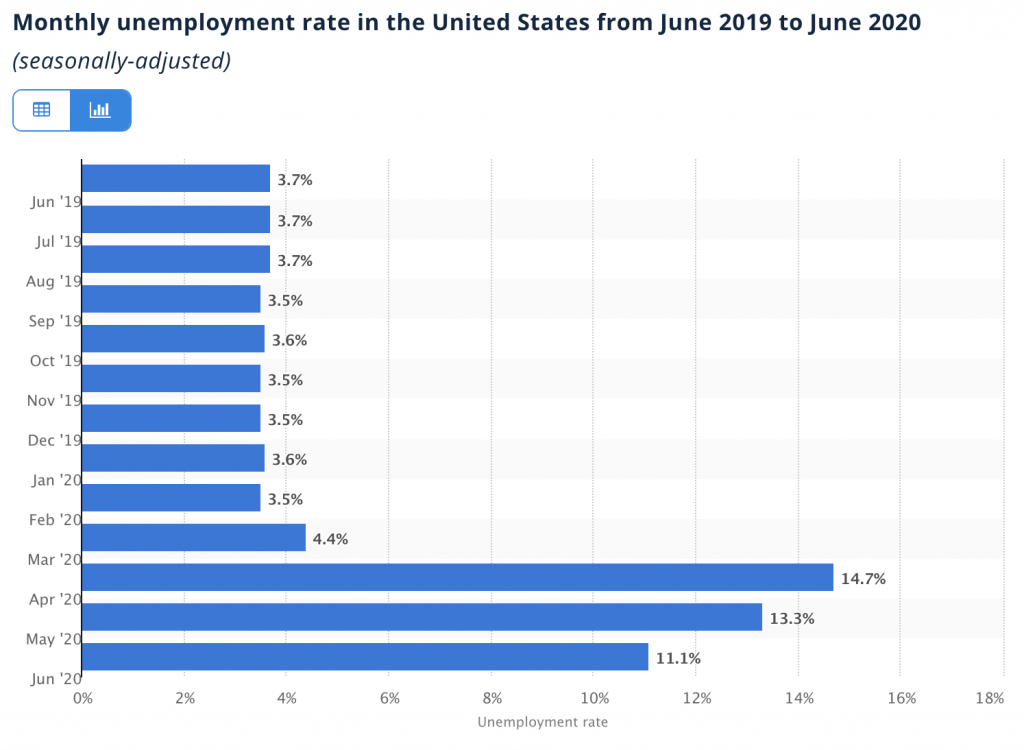

As the US continues to battle soaring coronavirus infections and reductions in unemployment, the White House, along with Senate Republicans, have been drafting a second pandemic bill to address the current economic turmoil.

The new bill is expected to cost approximately $1 trillion – a significant decline compared to the $3 trillion passed by House Democrats back in May. The bill is slated to include another round of direct payments to Americans, with amounts similar to the $1,200 in the Cares Act. In addition, there will also be a payroll tax deferral, which is supposedly aimed at incentivizing companies to keep or rehire their workers.

In the meantime, Mnuchin addressed some of the concerns surrounding the $600-per-week additional employment benefits. Considering that many Republicans have been arguing that some Americans are making more by staying at home in lieu of working, as a result, the employment benefits will be scaled back with the difference replaced by tax credits for businesses as well as tax credits for personal protective equipment.

The new bill is also slated to include liability protection for healthcare providers and businesses in order to prevent lawsuits related to the coronavirus pandemic. In addition, the funding repeatedly requested by the Democrats for states and cities will not be included in the new bill. Instead, local leaders and governors will have the option to tap into a reserved $150 billion to address their shortcomings in much-needed revenue.

Information for this briefing was found via the Washington Post. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.