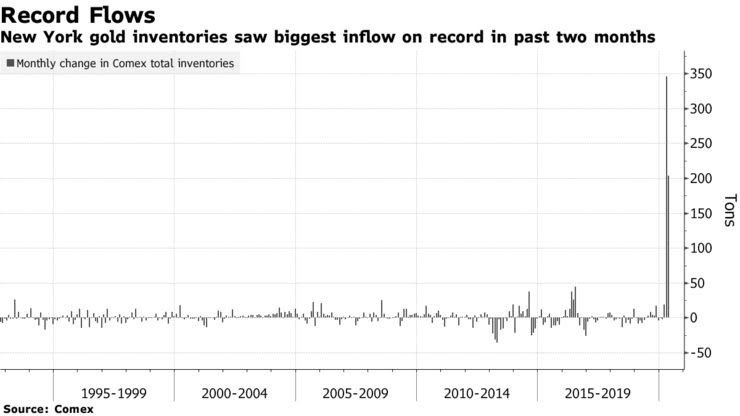

The coronavirus pandemic triggered extensive economic volatility across the US, resulting in the mis-pricing of assets. Traders were quick to notice the arbitrage in the market, and jumped on the opportunity to make substantial profits. Now as a result of frenzy, the US is about to be flooded with physical gold.

Since the end of March, $30 billion worth of physical gold has been stockpiled in Comex warehouses. When the coronavirus pandemic hit, many traders became worried that gold destined for New York would not arrive in time for futures contracts, given the sudden shut-down of air travel and Swiss gold refineries.

As a result, futures that would normally mimic the London spot price began to suddenly increase to premiums in excess of $70 per ounce. Many enterprising traders saw the window of opportunity, and bought gold from other parts of the world at the spot price; they then turned around and sold the futures in New York and the premium price.

Last week, the traders that took part in this arbitrage opportunity have declared their intent to deliver 2.8 million ounces of gold in time for the June Comex contract – such an extensive delivery has not been noted since 1994. Analyzing Swiss export data, the US has imported approximately 111.7 tons of gold in April, which is the largest volume on record. Furthermore, according to data compiled by the US Census Bureau, gold imports in March were in excess of $3 billion- the highest in over ten years.

Although there has been some delays in logistics and transport as a result of the coronavirus pandemic, a significant portion of the sudden futures premiums is the result of speculation, according to Allan Finn, who is the global commodities director for Malca-Amit. Nonetheless. the window of opportunity is being picked up by even more investors, causing the futures for other precious metals such as silver to trade at premiums as well.

Information for this briefing was found via Bloomberg, Comex, and the US Census Bureau. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.