Over the first two months of 2021, Orezone Gold Corporation (TSXV: ORE), a single-asset gold miner, put together a giant financing package, pegged at US$189 million, that fully funds the construction of its Bomboré gold mine in the West African country of Burkina Faso. Orezone has a 90% stake in the mine and the Burkina Faso government owns the remaining 10% via carried interest.

In an “all eggs in one basket” move, the company sold US$58 million of equity, US$35 million of convertible notes and US$96 million of senior debt, which will ideally allow the mine to enter commercial service in 3Q 2022, without Orezone having to raise any additional capital. Construction activities have already begun.

To underscore the risk-embracing nature of Orezone, no offtake agreements have been signed and none of the projected gold output is hedged. Two clear positives are that Orezone owes no royalties to a third party, leaving all potential upside to shareholders, and that the terms of the debt facilities do not require it to create a construction cost overrun reserve.

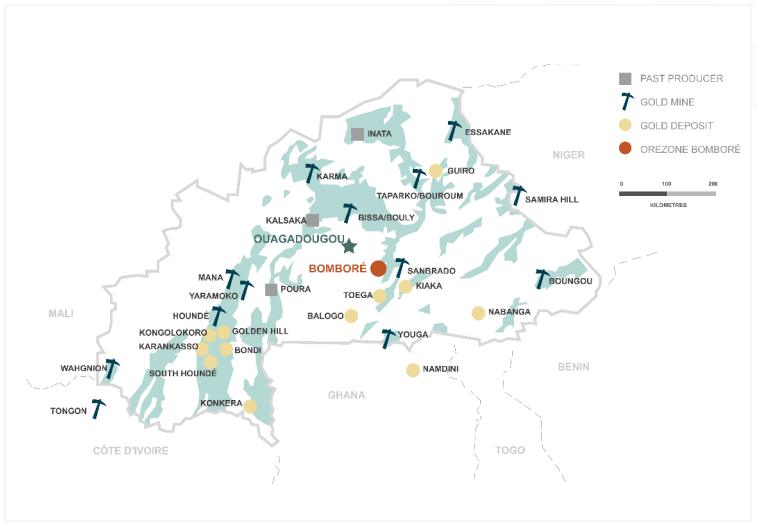

The Bomboré Project is situated in an established gold mining region. A total of 15 mines in Burkina Faso have reached production. In addition, Bomboré’s economics are impressive: a feasibility study released in 2019 estimates the project has an after-tax net present value of US$733 million based on a gold price of US$1,750 per ounce and a 5% discount rate. At that gold price, Bomboré could generate US$140+ million of free cash flow in its first year of production.

A single asset junior miner’s advancing a project to completion in Burkina Faso is not unprecedented. In June 2020, West African Resources’ (ASX: WAF) Sanbrado Gold Project entered commercial production, about 18 months after construction began. Sanbrado, which is about 40 kilometers east of Bomboré (see map above), could produce several hundred thousand ounces of gold in its first year of production.

Financials

As of September 30, 2020, Orezone had US$13.2 million of cash and almost no debt. Both these measures are now significantly larger, given the company’s recent financings. Orezone’s operating cash flow shortfalls have been substantial over the last five reported quarters, averaging around US$5 million per period.

| (in thousands of US $, except for shares outstanding) | 3Q 2020 | 2Q 2020 | 1Q 2020 | 4Q 2019 | 3Q 2019 |

| Operating Income | ($4,293) | ($2,801) | ($6,612) | ($7,128) | ($5,864) |

| Operating Cash Flow | ($4,190) | ($3,097) | ($6,486) | ($5,002) | ($5,849) |

| Cash – Period End | $13,074 | $16,101 | $18,230 | $12,372 | $17,257 |

| Debt – Period End | $177 | $189 | $197 | $231 | $242 |

| Shares Outstanding (Millions) | 252.6 | 251.1 | 251.1 | 213.4 | 213.4 |

If the Bomboré construction process were to encounter challenges or run over budget, Orezone could be forced to access the capital markets for additional funds. If the company were forced to follow this course, market conditions may not be as favorable as they were in early 2021. However, Orezone’s senior debt facility carries an interest rate of 8.66% and has only light covenants.

Orezone is an unhedged play on three key variables: the company’s ability to construct Bomboré at or below budget; the actual gold composition of tonnes mined; and the spot price of the precious metal. If all of these factors were to prove favorable, the shares could perform quite well. If any of the three prove problematic, Orezone’s prospects become more uncertain.

Orezone Gold Corporation’s stock is trading at $0.94 on the TSX Venture Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.