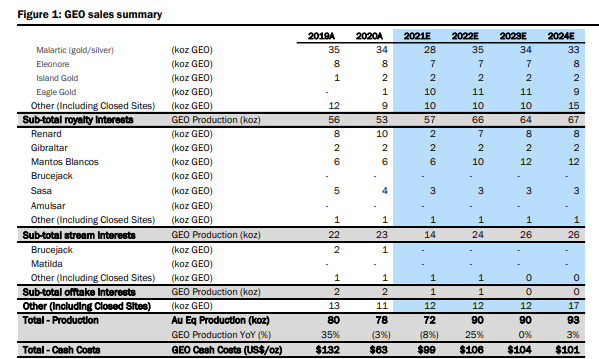

Osisko Gold Royalties (TSX: OR) (NYSE: OR) provided an update on their deliveries received this week, which totaled 12,300 gold equivalent ounces (GEO’s) for the second quarter and released preliminary revenues of C$40.8 million, cost of sales, excluding depletion came in at C$13 million. The result, was $27.8 million in cash operating margin.

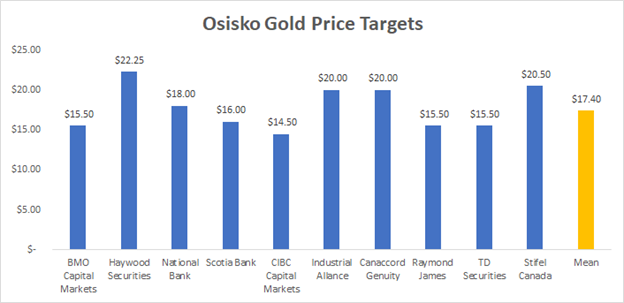

Out of the 14 analysts that cover Osisko, Haywood was the only firm to upgrade its price target from C$19.75 to C$22.25. This is currently the highest price target on this company, giving the stock a ~52% upside while keeping their Buy rating on the stock. The mean price target is C$17.40 or a ~19% upside.

Although gold equivalent ounces were below both Canaccord and Bank of Montreal’s estimates of 14,000 ounces and 13,700 ounces, respectively, they did not change their price targets or ratings on the company. Canaccord did not alter their FY guidance of 78,000 ounces and highlighted the available liquidity, which is around C$550m as a strong point.

On the other hand, Bank of Montreal highlights their royalty portfolio as a technical strength but says the nature of this model makes it longer-dated and that the asset turnaround stories will come. As for estimates and forecasts, BMO noted that due to the miss in terms of ounces, they lowered their FY2020 revenue projection from C$233 million to C$199 million. Still, their EBITDA estimate has gone up because they removed their San Ramon asset from the forecast.

Information for this briefing was found via Sedar, Haywood Research and Osisko Gold Royalties. The author has no affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.