Following PR crises and production halts, Peloton Interactive (Nasdaq: PTON) announced today that its CEO John Foley will be stepping down but will take an executive chair position. This follows weeks after activist investor Blackwells Capital released a report outlining the firm’s “mismanagement” and called for Foley’s resignation.

Foley, the company’s co-founder, has been leading the firm since its inception. Alongside him, the firm’s president William Lynch is also expected to step down and remain as one of the company’s board members.

Blackwells Capital released a presentation detailing its assessment of Peloton’s performance.

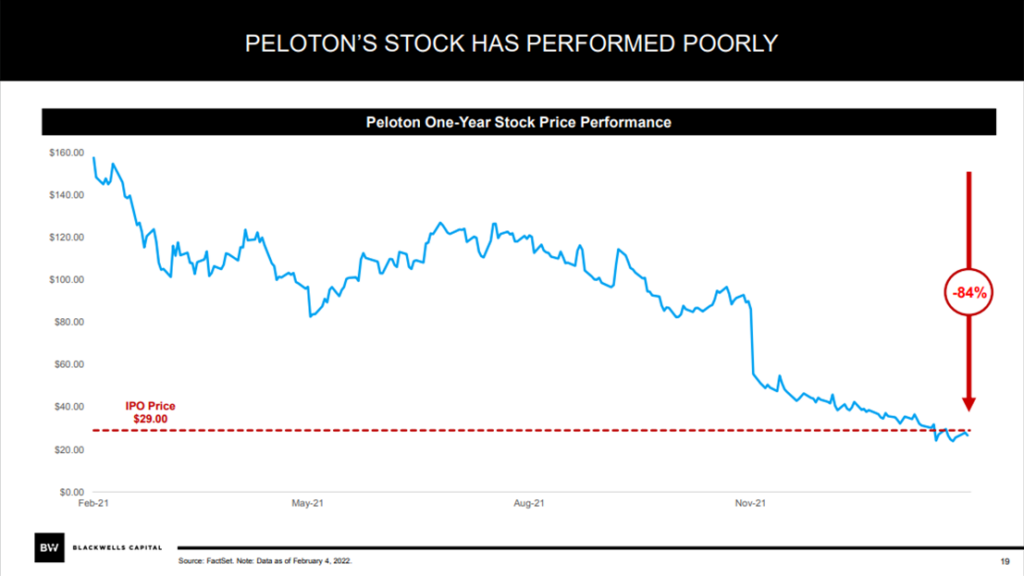

“Peloton’s 2021 total shareholder return of -76% was the worst of any company in the Nasdaq 300 Index,” said the investment firm in its report.

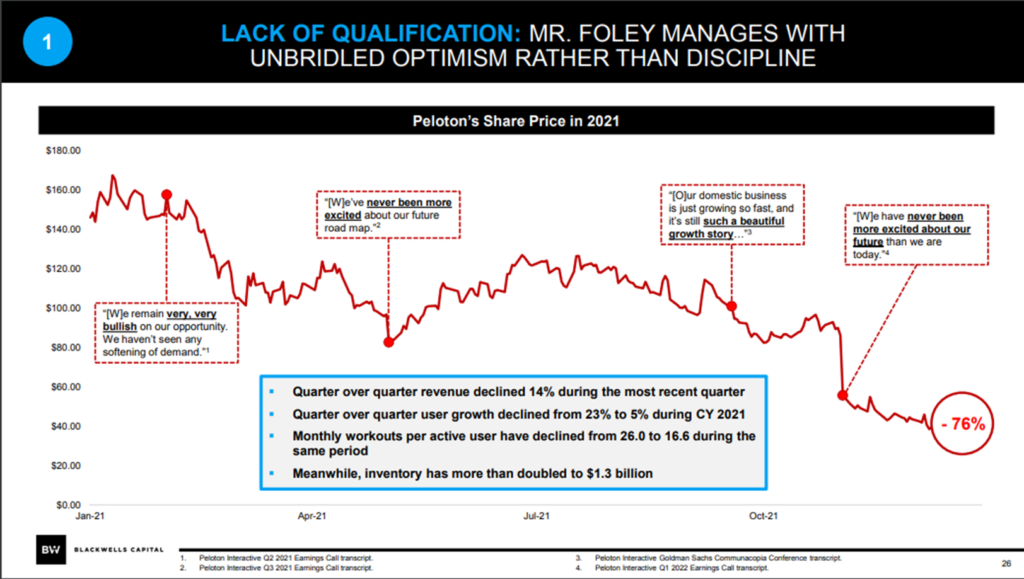

After describing the company’s potential, the investment firm went on enumerating points to support its assessment that the company “has been grossly mismanaged,” mostly centered on criticisms against Foley.

The firm hit Foley on his “lack of qualification and financial discipline,” citing interview snippets that showed his aversion to handling the financial aspect of the business and highlighting the rising selling, general, and administrative expenses which tripled in 2021 vis-a-vis 2020.

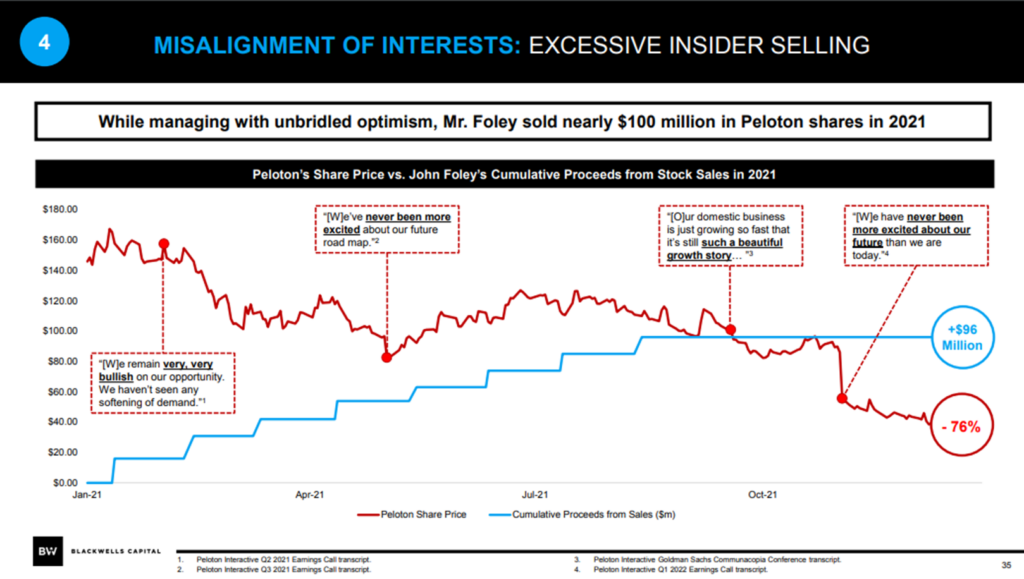

Blackwells also highlighted Foley’s “poor decision-making skills” related to his handling of treadmill safety issues and the US$450 million lease he signed for a 300,000-square feet office space in Manhattan. It also accused the former CEO of a “misalignment of interests” when the latter put his wife in charge of Peloton’s apparel business and his gain from selling his own Peloton stocks when share prices would go down.

On top of firing Foley, the investment firm also recommended the board to “immediately examine a sale of the company to the highest bidder.” On February 4, The Wall Street Journal reported that Amazon.com, Inc. (Nasdaq: AMZN), among others, is considering acquiring the company. Afterward, Peloton shares shot up 26%.

So someone leaked a fake takeover $PTON story to sell shares ahead of CEO departure and job cuts? https://t.co/0uTqWDMcE4

— ForexLive (@ForexLive) February 8, 2022

Foley and Lynch are set to be replaced by Barry McCarthy, a former CFO of Spotify Technology and Netflix Inc. McCarthy will take on both the CEO and president positions and will get a seat on the Peloton board.

The company also announced that it will be cutting 2,800 jobs, impacting 20% of its corporate positions, to cope with the declining demand and increasing losses. Peloton reported its preliminary results for its fiscal Q2 2022 toplined by a quarterly revenue of US$1.14 billion. But this also includes an expected quarterly net loss between US$423 – US$481 million, compared to last quarter’s net loss of US$376 million.

“As we discussed last quarter, we are taking significant corrective actions to improve our profitability outlook and optimize our costs across the company,” said Foley when the firm released the preliminary results.

The fitness firm is expected to release its detailed Q2 2022 results on February 8, 2022.

Peloton Interactive last traded at US$29.75 on the Nasdaq, up 20.9% on the day.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.