China’s central bank bought even more gold last month, as it looks to strengthen the yuan and ditch the US dollar.

The People’s Bank of China allegedly purchased an additional 15 tonnes of gold in January, after already buying 32 tonnes and 30 tonnes of the precious metal in December and November, respectively. “This takes its total gold reserves to 2,025 tonnes,” wrote World Gold Council senior analyst Krishan Gopaul on Twitter, citing data from the central bank.

Data from The People's Bank of China shows that its #gold reserves rose by 15 tonnes in January – the third consecutive month of additions. This takes its total gold reserves to 2,025 tonnes. pic.twitter.com/l9EGzfj24y

— Krishan Gopaul (@KrishanGopaul) February 7, 2023

China hasn’t unveiled details of its gold purchases since 2019, with the exception of the last three months. During the time it did report figures, though, the PBOC amassed 1,448 tonnes since 2002. It’s expected the communist country will continue its gold-buying spree throughout 2023, in an effort to bolster the yuan’s international strength and challenge the US dollar’s dominance. In fact, the Chinese regime last year even went as far as to convince Middle Eastern nations to accept its currency in lieu of the greenback for crude imports.

READ: Pegging Oil To Gold Begins In Ghana: What Does This Mean For The Petrodollar?

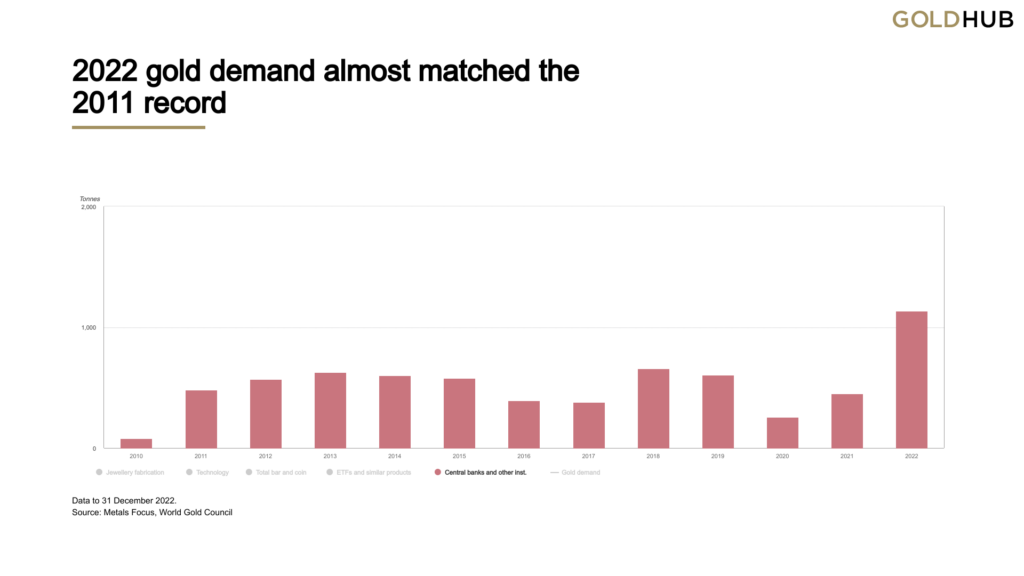

The de-dollarization trend, which gained momentum in wake of Russia’s invasion of Ukraine, is expected to continue as major central banks increase their gold reserves. Data from the World Gold Council showed that central banks purchased a combined 1,136 tonnes of the precious metal last year— the largest amount since 1967.

Information for this briefing was found via the World Gold Council and Twitter. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.