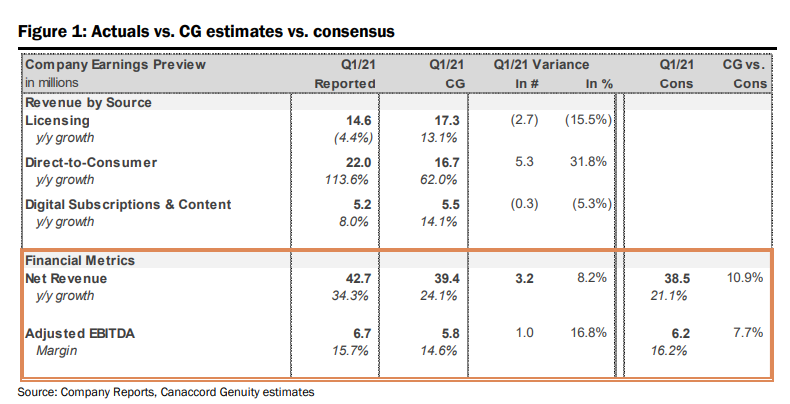

PLBY Group (NASDAQ: PLBY) reported their first quarter financial results earlier this week. The company reported revenues of $42.68 million, an increase of 34% year over year, as direct to consumer revenue led the growth with a 114% increase. EBITDA came in at $6.7 million.

PLBY has only three analysts covering the company with a weighted 12-month price target of $38, with the street high sitting at $52 while the lowest is $30. One analyst has a strong buy rating, while the other two have buy ratings.

In Canaccord’s note, their analyst Austin Moldow reitereated their buy rating and raised their 12-month price target to $52, up from $28, writing, “We think the company is demonstrating its ability to build lucrative growth businesses atop its flagship Playboy brand and though visibility is limited into yet-to-be-launched endeavors, we think it’s likely that our estimates are proved conservative, warranting a premium valuation.”

Below you can see how PLBY quarter came in versus Canaccord’s estimates, with revenue beating consensus by 11%, driven by DTC growth as licensing revenue came in slightly lower. EBITDA also beat consensus estimates by 8%.

Modlow believes that 85% of the 114% DTC growth came organically which came from, “improvements to the e-commerce platform and data science practices,” which helped generate a 60% month over month conversion to their website and new products. Modlow says that is very encouraging to see that company-wide gross margins grew by 3.5% year over year, even after the product mix shifts to primarily DTC offerings.

Although the company does not break down its segments granularly, Modlow believes that Yandy was most likely the key driver in the DTC growth, pegging it at around 60% of growth. He touches on PLBY’s first NFT drop, which made the company about $1 million in 24 hours. He believes that the company will have a “never-ending supply of items” to NFT as they can build off their own IP.

Below you can see Canaccord’s updated 2021-2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.