Allocating investment dollars to the EV space looks particularly challenging at this juncture, as investor enthusiasm and momentum are driving favored stocks such as Lucid Group, Inc. (NASDAQ: LCID) and Rivian Automotive, Inc. (NASDAQ: RIVN) to extraordinary levels — US$85 billion and US$99 billion stock market capitalizations, respectively — while stocks of most other EV OEMs have struggled.

A bullish EV investor is then faced with the choice of buying the favored stocks which have been performing well at extended valuations or buying the lower-priced laggards on the assumption that their stock price trends will change.

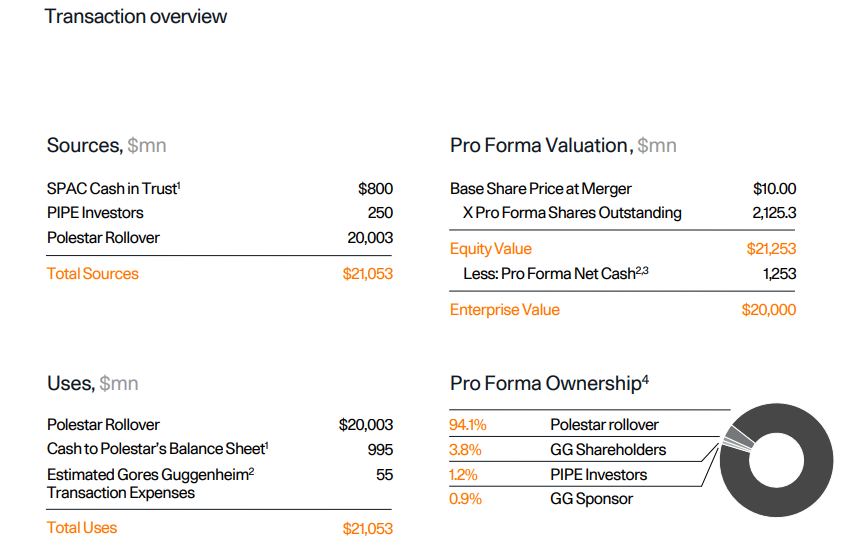

Another possibility that investors may consider is Polestar Performance AB, a premium electric vehicle manufacturer headquartered in Sweden. In late September, Polestar agreed to merge with SPAC sponsor Gores Guggenheim, Inc. (NASDAQ: GGPI). Gores Guggenheim is trading at US$13.54, which equates to a Polestar enterprise value of around US$27.5 billion. The Polestar-Gores Guggenheim merger is expected to close sometime in 1H 2022.

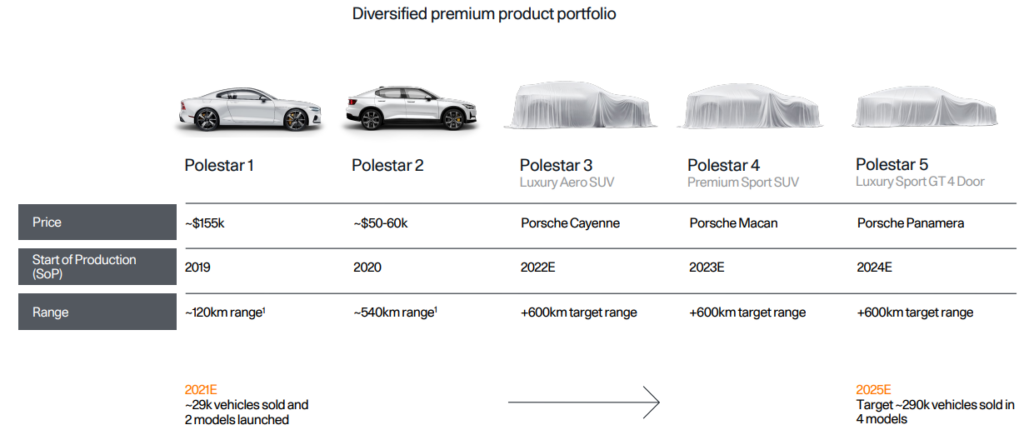

Polestar was founded in 2017 by Volvo and China’s Zhejiang Geely Holding. It currently makes two models – Polestar 1 (a premium performance hybrid vehicle with a price of around US$155,000), and Polestar 2 (an EV sedan with a US$50,000-US$60,000 price tag). The company sold a combined total of 10,000 of these vehicles in 2020.

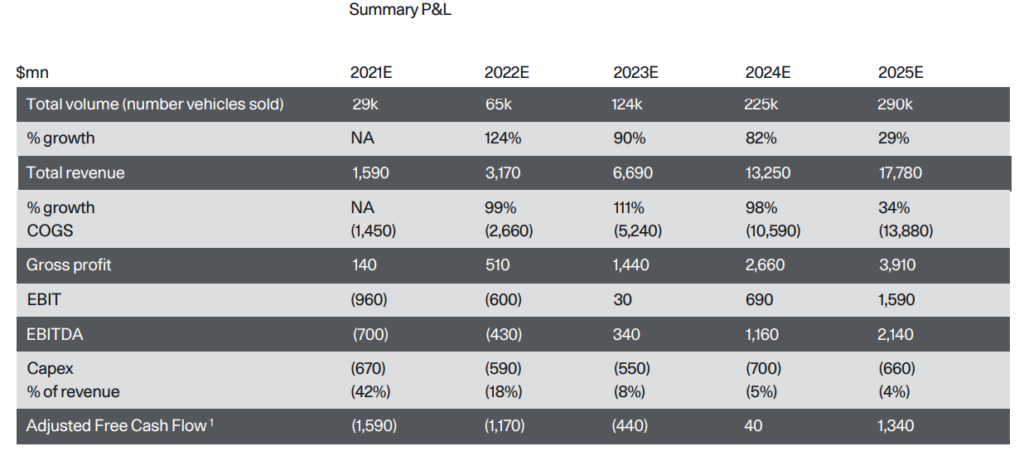

Polestar plans to produce and sell 29,000 aggregate units in 2021, a far higher total than either Lucid (which is producing a handful of Lucid Air models before year-end) or Rivian (which delivered 145 R1T electric pickup trucks in October 2021 but has reportedly pushed back future deliveries to 2022).

As a consequence, Polestar trades at a significantly lower enterprise value and is producing substantially more premium vehicles than either Lucid or Rivian.

By 2023, Polestar hopes to sell its vehicles in more than 30 countries in North America, Europe, the Middle East, and in Asia Pacific regions. Currently, Polestar is selling its vehicles in ten countries throughout North America and Europe.

As is the case with virtually all EV SPAC transactions in the last year, Polestar expects “hockey stick”-type growth in vehicle sales, revenue, and EBITDA over the next handful of years. In 2025, Polestar projects to record US$17.8 billion of revenue and US$2.14 billion of EBITDA.

This implies that Polestar trades at an enterprise value-to-2025E revenue ratio of 1.5x (US$27.5 billion divided by US$17.8 billion), and enterprise value-to-2025E EBITDA ratio of 12.9x. These ratios compare favorably with Lucid’s valuation. Lucid currently trades at enterprise value/revenue and enterprise value/EBITDA ratios of 5.8x and 48x, respectively, based on Lucid’s 2025E projections.

Polestar could be a cheaper (and less overdone?) way to gain exposure to the premium EV OEM segment than investing in Lucid or Rivian. In addition, Polestar has already produced and sold many more vehicles than those companies. Furthermore, the stock of Polestar’s SPAC sponsor Gores Guggenheim has significantly underperformed Lucid over the past two months, rising about 35% while Lucid has approximately doubled.

Gores Guggenheim, Inc. last traded at US$13.54 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.