With half of the world under some some form of quarantine due to the dangerous coronavirus pandemic, the global food supply chain may soon be the subject of substantial disruptions.

The coronavirus lockdowns have led to an escalation in panic buying and stockpiling, which in turn substantially increased the prices on staple foods, such as wheat and rice. With many regions already experiencing food shortages, some of the main grain-producing countries have begun decreasing their exports in order to meet the needs of their domestic consumers. As a result, the prices for rice and wheat have began to skyrocket. India for example, has been experiencing difficulties in honoring its current export contracts due to disruptions in logistics and labor shortages; as a result, the country has not been taking on any new international contracts.

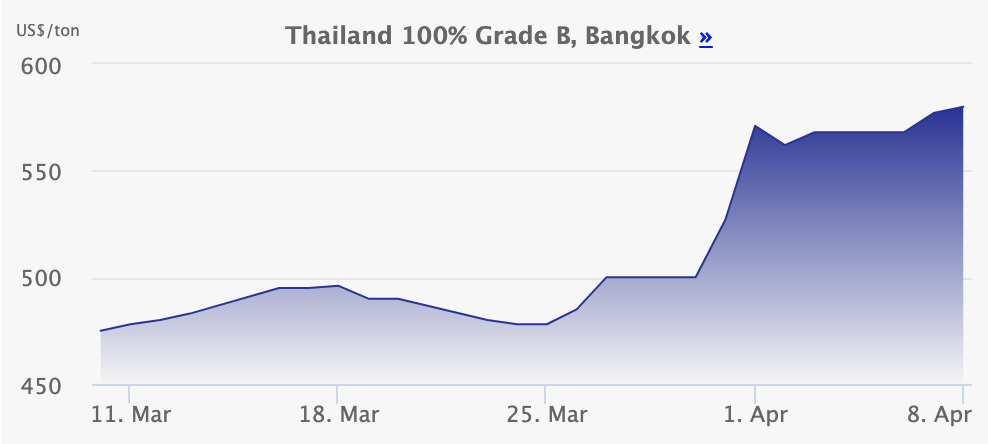

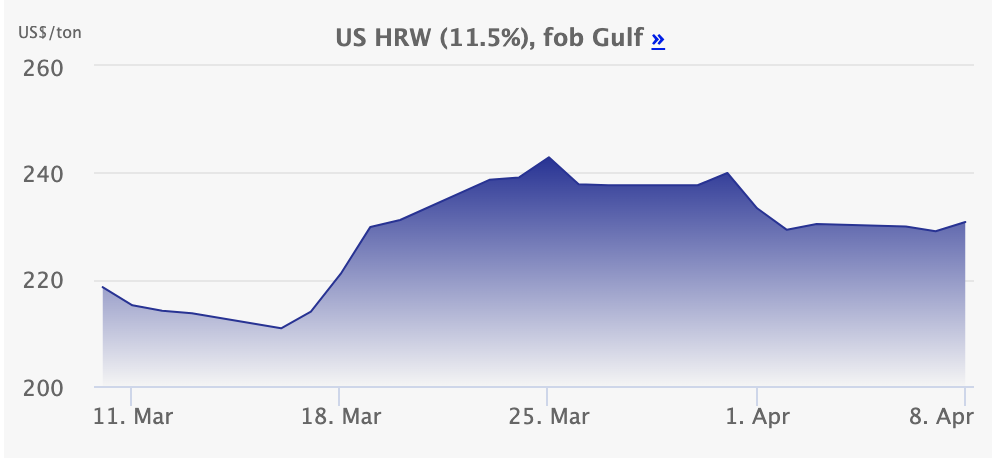

Currently, the price of rice is the highest it has been since 2013, with a 12% increase from the industry benchmark between March 25 and April 1. Meanwhile, wheat prices have increased by approximately 15% since the middle of March.

Even before the onset of the pandemic, many producers were already struggling to meet the world’s demand. Crops in Australia and South East Asia were subject to severe droughts during the growing season, which in turn was the onset of price increases in late 2019. And East Africa has been dealing with the largest locust invasion in 70 years.

Combine that with a pandemic which has not only created significant increases in demand, but also labor shortages and supply input disruptions, global food security may soon become threatened.

The growing season for rice and wheat has strict harvesting and planting schedules, and if there continues to be unforeseen and uncontrollable disruptions, then the forthcoming crop may be significantly reduced- if there is even to be a crop at all.

Information for this briefing was found via Reuters, CNBC, International Grain Council, and RT News. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.