Early this month, Rivian Automotive, Inc. (NASDAQ), a highly valued start-up electric vehicle (EV) OEM, decided to combat the significant inflationary and supply chain pressures it is facing with an extraordinarily unpopular move among its customers. It imposed 17%-20% price increases on its flagship vehicles, the R1T electric pickup truck and the R1S electric SUV. These increases seem to apply even to loyal and patient customers who made reservations and paid the (refundable) reservation fees 18 months ago or even before that.

Base prices of the R1T and the R1S were set in 2018 at US$67,500 and US$70,000, respectively. Customers do retain the option of maintaining their vehicle reservations at these prices with three catches. First, the customer must accept a design change where motors deliver instant power and adjust torque on just two wheels, as opposed to the originally offered quad motor versions.

Second, a customer must also agree to forgo a long-range 300+ mile battery pack for a standard range 260-mile version. Finally, and maybe the most difficult-to-swallow of the three, R1Ts and R1Ss outfitted with twin wheel motors and a less powerful battery will not be available until 2024.

As one might imagine, customers are none too pleased with the news. On the website www.rivianforums.com, comments on the company’s action span 82 pages at the time of this writing. None of this publicity would seem at the margin to inspire future buyers to choose Rivian.

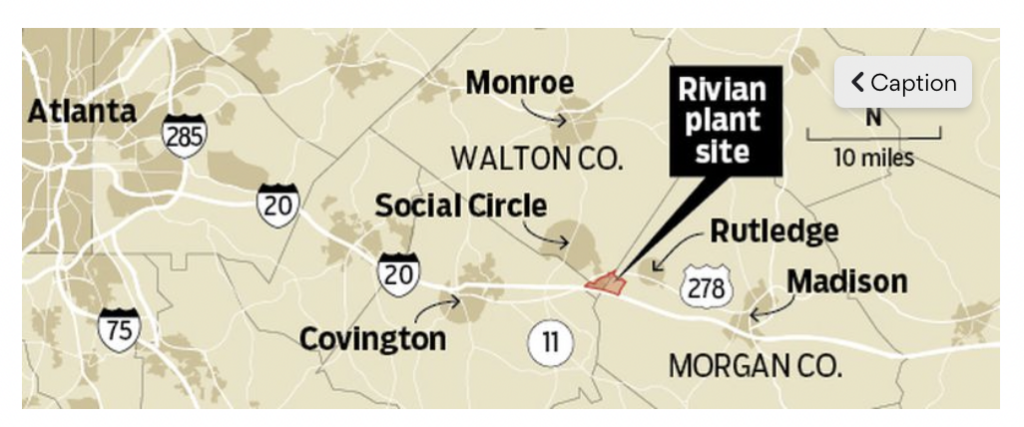

Meanwhile, the company’s proposed US$5 billion electric vehicle manufacturing facility in the U.S. state of Georgia continues to gain unwanted attention as a political issue in that state. Ex-U.S. Senator David Perdue, who is challenging incumbent Brian Kemp in the state’s May 24 gubernatorial primary, consistently campaigns against the project. Mr. Perdue, an ardent supporter of former U.S. President Trump, decries the generous “back-door deal” terms that Governor Kemp granted Rivian in negotiations.

Announced in December 2021, the plant, which will have the capacity to produce up to 400,000 electric vehicles and employ 7,500 people, is considered to be the largest economic development project in Georgia’s history. Construction on the 2,000-acre site is planned to commence this summer and vehicles may begin rolling off the production line in 2024. The Georgia plant would supplement the manufacturing capacity at Rivian’s existing facility in Normal, Illinois, which has annual capacity of 150,000 units (potentially expandable to 200,000).

The issue is that the predominantly staunch Republican residents in the rural area around the proposed plant fear many aspects of its construction (congestion, dirt, etc.). Many want to stop, or at least delay, the project. In turn, pro-Trump politicians are seizing on generous, but not-yet fully released incentives that Governor Kemp bestowed on Rivian to secure the deal.

Rivian Automotive, Inc. last traded at US$35.65 on the NASDAQ.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Views expressed within are solely that of the author. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.