Robinhood (NASDAQ: HOOD) was sent plummeting on Thursday, after the retail trading app warned of an impending decline in quarterly revenue going forward.

Shares of Robinhood have significantly receded since reaching a high of $85 on August 4; as of Thursday, the commission-free trading app was down more than 45%, after its second quarter earnings showed some surprising results.

Recall, Robinhood’s daily bread and the majority of its revenue source— Payment for Orderflow (PFOF)— already slumped 34.4% in the second quarter, as the retail trading boom cooled off. But, armed with the full second quarter earnings results, we see that there were a lot more surprises under the hood. Although the retail trading app’s revenue doubled from last year’s $244 million and landed at a whooping $565 million, the majority of the growth was attributed to dogecoin.

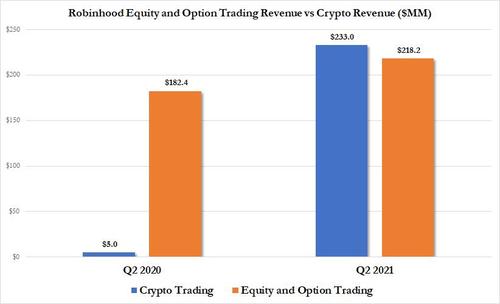

Revenue from cryptocurrencies rose from $5 million in the second quarter of 2020 to $233 million last quarter, accounting for 52% of its total transaction-related revenue. In fact, the discount brokerage earned more money from virtual currency trading than it did from equities and options trading combined! Diving deeper into Robinhood’s crypto business, we see that 62% of the revenue was derived from the trading of Elon Musk’s darling, dogecoin. This means that dogecoin, which has soared by more than 400% last quarter, was responsible for nearly one-third of Robinhood’s transaction revenue.

On that note, with revenues linked to equities quickly fading as Citadel reverts to other sources for its frontrunning, it appears that Robinhood is now left walking on eggshells of uncertainty. Indeed, the company delivered some rather dismal news via its press release, admitting that the problem will likely create headwinds in predicting financial results in the short term. “For the three months ended September 30, 2021, we expect seasonal headwinds and lower trading activity across the industry to result in lower revenues and considerably fewer new funded accounts than in the prior quarter.“

Although it remains unclear what exactly, the seasonal factors in the third quarter are that may inhibit trading activity, the memo is certainly evident: the foundation of Robinhood’s business has hit its peak, and the only forthcoming growth going forward will be centered around crypto—which too, may have hit its peak euphoria.

Information for this briefing was found via Robinhood. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.