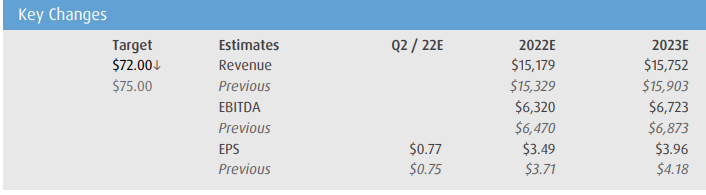

As most Canadians already know, on Friday, July 8, Rogers Communications (TSX: RCI.B) had a nationwide outage that affected internet, television, debit cards, and ATMs across the country. This outage lasted over 15 hours and upset a number of people, some of which seem to be at BMO Capital Markets, whom lowered their price target from C$75 to C$72 and reiterated their outperform rating on the stock.

Roger Communications currently has 16 analysts covering the stock with an average 12-month price target of C$77.62, or an upside of about 27%. Out of the 16 analysts, 3 have strong buy ratings, 9 analysts have buy ratings, 3 have hold ratings and a single analyst has a sell rating on the stock. The street high price target sits at C$90, which represents an upside of about 46%.

In the note, BMO says that this incident will “likely introduce incremental regulatory risk to the Shaw transaction, heightens investor concerns regarding Rogers’ ability to execute on deal synergies, and counters a constructive industry narrative on network performance.”

Over the weekend, after Rogers was able to get customer services back online, they said that the root cause was a “network system failure following a maintenance update in our core network.”

BMO expects that Rogers will go and credit customers for 2 days of lost services and expects that it cost the company $70 million in hits to their revenues and EBITDA. BMO also expects to see Rogers customer acquisition and retention costs to likely increase for the second half of the year, “to placate understandably wary and frustrated customers.”

Lastly, BMO expects to see incremental regulatory risk in the Shaw Communications (TSX: SJR.B) transaction, for they believe that the widespread outages will add concerns regarding “industry concentration,” while they also expect investors to have doubts related to the $1.0 billion synergy target.

BMO closes out the note by commenting, “the outage weighs against an otherwise constructive narrative with regulators coming out of the pandemic where Canada’s telecommunications infrastructure performed admirably during a period of rapid and systemic changes in broadband consumption.”

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.