Russian state atomic energy corporation Rosatom is denying rumors that it has halted the export of uranium to the US, labeling such information as entirely untrue.

UPDATE – Forbes just updated the headline and article text: Rosatom denies stopping the export of Russian uranium to the United States. https://t.co/cHZNXsGCCJ

— Disclose.tv (@disclosetv) September 28, 2023

This response followed initial reports from the corporation’s publication on its Telegram channel, stating that the export of nuclear fuel from the ports of St. Petersburg to America had been stopped due to a lack of insurance coverage. However, this post was swiftly deleted, and clarifications were issued by Rosatom, emphasizing their commitment to completing “accepted obligations under concluded contracts to foreign customers in full.”

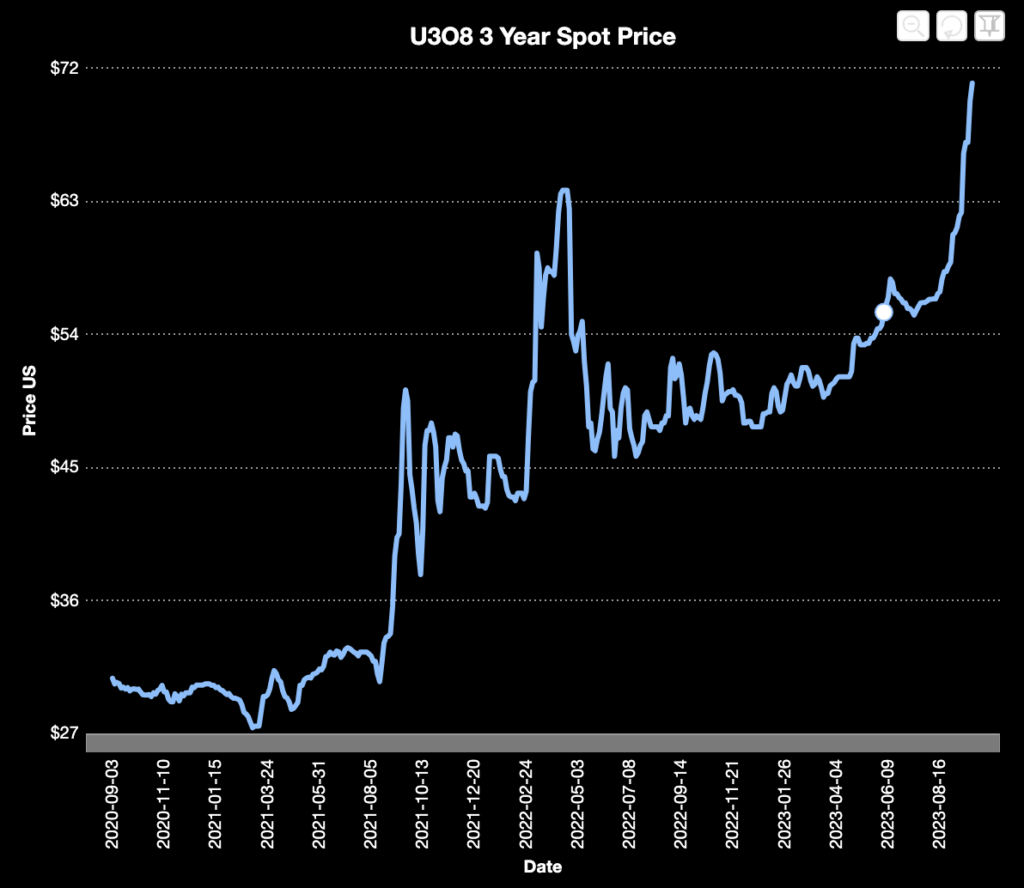

The initial reports suggested a forthcoming interruption in the uranium supply, linking it to a heightened price of uranium, which had risen to $70 per pound for the first time since the accident at the Fukushima-1 nuclear power plant in 2011. it turned out, though, that the rise in uranium prices was largely attributed to prevailing concerns about global uranium supplies, as Canadian-based Cameco Corp. (TSX: CCO) revised its production outlook downwards for 2023.

A closer look at trade statistics reveals the critical position of Russian uranium in the US market. Over seven months in 2022, the US purchased goods worth about $3 billion from Russia, with $2.5 billion attributed to nuclear fuel, fertilizers, and platinum group metals. Notably, these items were exempt from Washington’s sanctions following Moscow’s military operation in Ukraine. In terms of uranium supply, US nuclear power plants received around 12% of its uranium from Russia last year, making the post-soviet nation the biggest supplier of enriched uranium to the country, preceded by Canada and Kazakhstan in market share.

Information for this story was found via the sources mentioned within the article. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.