Are you tired of forever-skyrocketing CPI prints? We are too— but here we are again, with yet another eye-watering inflation increase for the 19th straight month in a row…

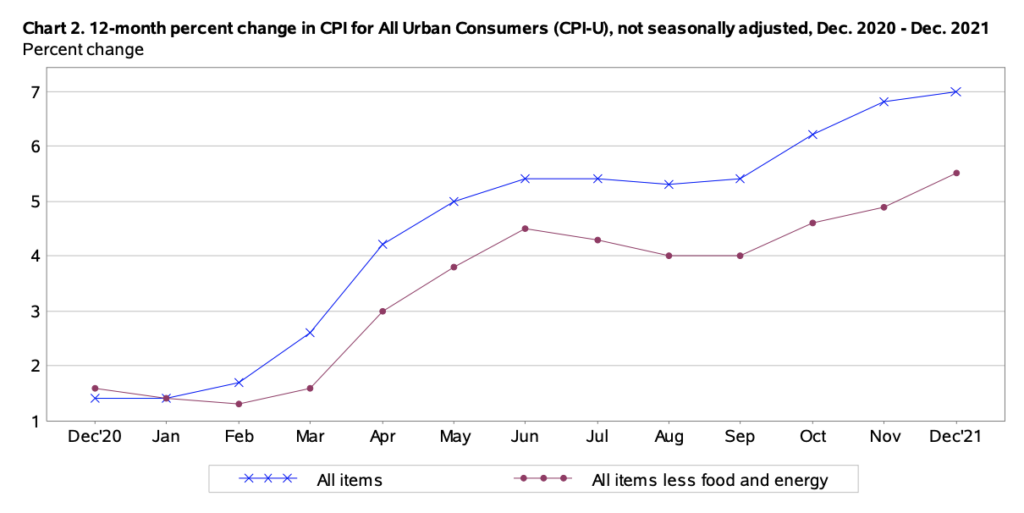

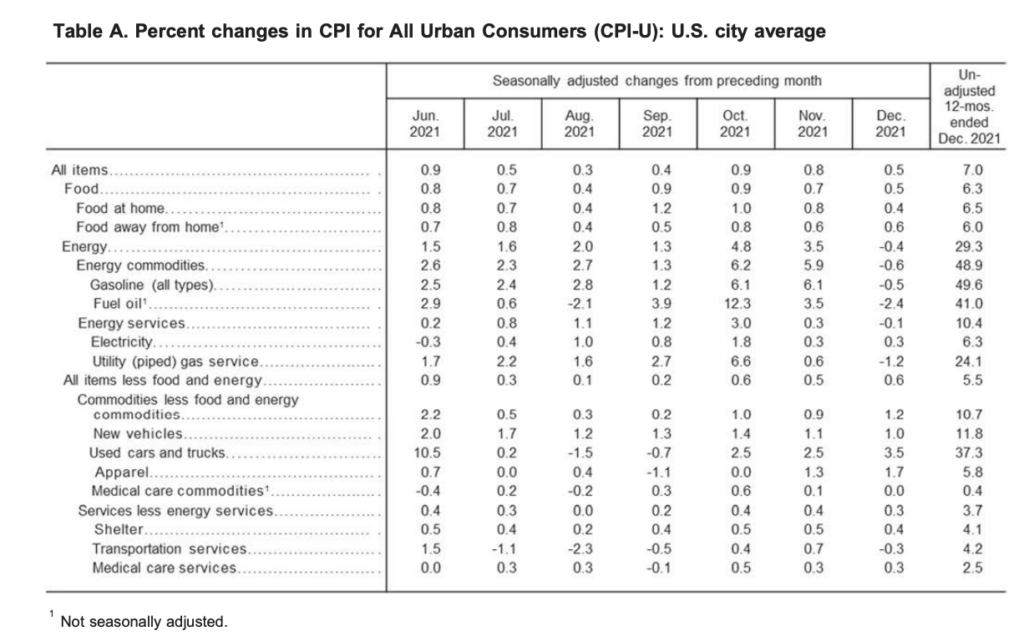

The latest print from the BLS showed consumer prices jumped 0.5% to a whooping annualized 7% from December 2021, which is the fastest pace since June 1982, and exceeds forecasts calling for a monthly gain of 0.4%. Core CPI, which strips out volatile components such as food and energy, rose 5.5% from a year earlier, marking the largest gain since 1991.

Consumer prices across America have now risen for the 19th consecutive month in a row, with commodities, shelter, and both new and used cars soaring by the most. Although energy prices slumped 0.4% from the month before (thanks Joe Biden for the assuring us that energy costs would subside), they were still up over 29% from December of last year.

Meanwhile, Americans continued to see the cost of keeping a roof over their head rise, as shelter inflation increased from 3.84% to 4.13% year-over-year last month— the highest since February 2007. Food inflation was also on the rise, increasing another 0.5% from November to an annualized 6.3%.

Finally, and maybe what is the least reassuring for America, real average hourly earnings slumped 2.4% from December 2021, marking the ninth straight month of declines. So, the next time the Biden administration tries to reassure the public that its $2 trillion spending package will not stoke price pressures, just keep in mind that the soaring cost of living is substantially outpacing wage gains, forcing millions to forego even their basic quality of living.

Information for this briefing was found via the BLS. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.