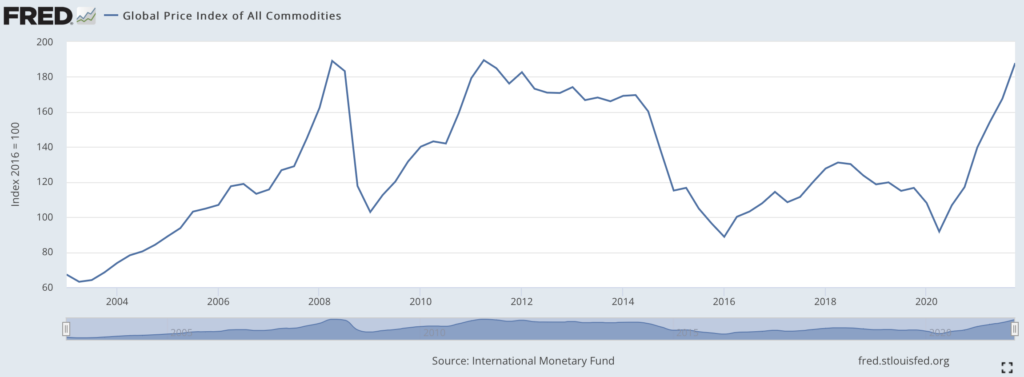

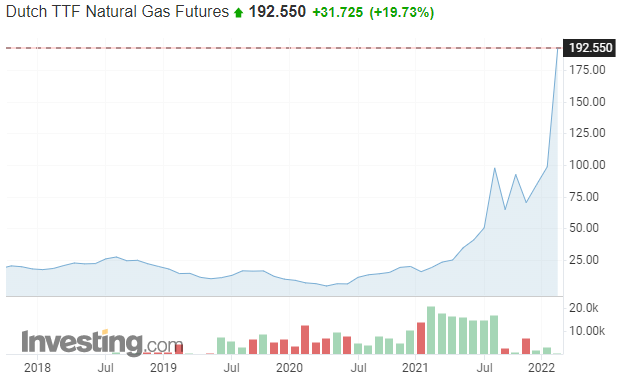

Commodities of all kinds are soaring at some of the fastest rates in history as a result of the stringent sanctions that have been applied to Russia’s economy. The prices of oil, European natural gas, wheat, and, to a lesser degree, copper are rising at video game-like speeds. Perhaps even more frightening, for prices to normalize to lower levels, additional commodity supply from “friendly” countries must be established to compensate for shunned Russian materials and such supply is unlikely to be available for quite some time.

Eventually of course, high commodity price levels will choke off demand, causing the prices of these materials to retreat, perhaps significantly. In other words the old axiom, “the solution to high prices is high prices,” will in time prevail in the markets.

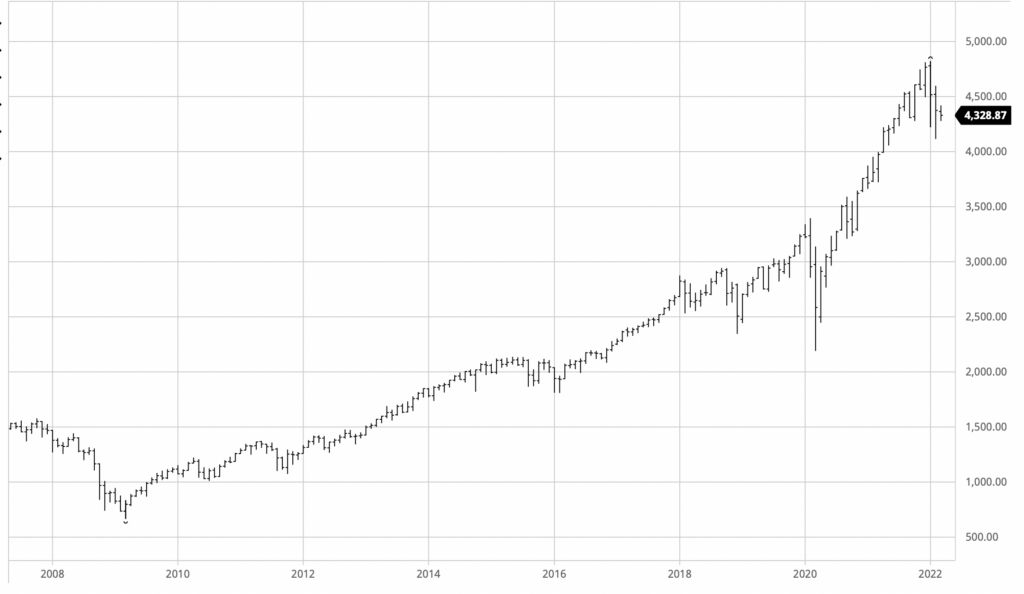

Stock market investors are gradually — and grudgingly — factoring in the enormous inflationary effects of commodity price trends. But if history is any guide, the U.S. stock market could correct quite dramatically when commodity prices begin to plummet. One has followed the other in the past.

In the meantime, it would seem prudent for investors to shift more of their portfolios into commodity producers which benefit from this tailwind and away from other types of discretionary stocks.

The commodity environment which seems to parallel most closely the current environment is the 2008 period when a commodity “supercycle” period was in the process of ending. In particular, the prices of oil, iron ore and fertilizers were soaring. When those prices peaked and then rolled over, stocks cratered. Clearly other factors were at work, such as the bursting of the housing bubble and investors’ realization that large sums of mortgage securities had little value, but the pace of commodity price gains then and now seems eerily familiar.

WTI crude has recently hit as high as US$129 a barrel, the highest level since 2008. Its last leg higher appears related to fears that the West will stop accepting Russian oil.

Dutch natural gas futures, the European benchmark — much like Henry Hub futures is the U.S. natural gas price standard — reached 193 euros per Megawatt-hour (Mwh) on March 4. This price equates to a staggering US$61 per thousand cubic feet of gas (Mcf). By comparison, March Henry Hub gas futures closed at US$5.05 per Mcf on the same day.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Views expressed within are solely that of the author. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.