Last week Echelon Wealth Partners and Beacon Securities both initiated coverage on Skylight Health Group (CSE: SHG). Echelon initiated with a speculative buy rating and a 12-month price target of C$1.35, while Beacon initiated coverage with a speculative buy rating and a C$1.40 12-month price target.

Skylight Health Group is a US multistate health network comprised of physical multi-disciplinary medical clinics providing primary care, subspecialty, allied health, and laboratory/diagnostic testing. They also own and operate a proprietary electronic health record system that supports care delivery to patients via telemedicine and other remote monitoring systems integrations.

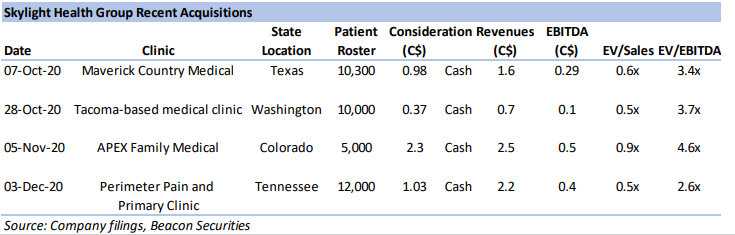

Beacon Securities writes that the company has grown aggressively during 2020, mainly due to acquiring many companies. They have announced four acquisitions in the fourth quarter alone. The company currently has a $20 million run rate and has roughly another $50 million in revenue coming via acquisitions. They are also cash flow positive with approximately $7 million in cash, says Beacon.

Beacon Securities states that three key initiatives will drive growth for Skylight. The first initiative they identify is expanding its services to its already existing customer base.

Gabriel Leung, their analyst, says that they currently earn $150 per patient per year, and with the expansion of their insurable primary care services, Skylight expects to increase that number to between $500-$1000 per patient per year. He adds that they should be focused on “completing credentialing and contracting with public and private payors in the states that it plans to provide primary care services (~3 – 6 month process per state).”

The second initiative is that they are getting into the subscription to uninsured patients market. He says that this market is a massive 40 million person market, and the company plans to offer a $199/year subscription program to new patients and $150/year to its legacy patients.

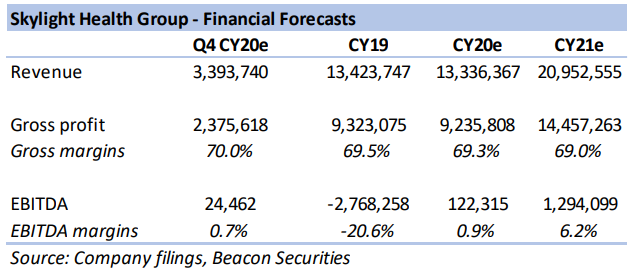

The last initiative that Skylight is doing to drive growth would be buying growth via acquisitions. Below is the four most recent acquisitions that Skylight has made, along with Beacon’s forecasted earnings for the firm.

Echelon starts their initiation note by saying, “We believe current healthcare needs together with provider challenges in a fragmented industry present the opportunity for significant and sustained shareholder value creation.” They make it clear that their bullish outlook reflects their confidence in the management team and board of directors’ ability to execute successfully.

They say, “We look for the Company to successfully execute on a number of secondary market clinic acquisitions,” as they draw parallels to newspaper publishers, stating that management was “exceptionally successful in building media leaders pursuing strategies based on consolidating small market regional publishers.”

Echelon writes that early in December, a bipartisan group of 49 US Congress members urged House and Senate leaders to leverage end-of-year legislation and permanently expand coverage of telehealth services under Medicare. They say that “the move reflects positive political support for the improved care and ecosystem efficiencies of telehealth.”

Found below is Echelon’s forecast for Skylight’s patient count, as well as revenue forecasts, with Echelon stating that their 2022 organic revenues are conservative in nature.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.