Argentina, Chile, Bolivia, and Brazil are considering forming a sort of lithium cartel to enhance South America’s processing capacity, convert more of its mined lithium into batteries, and enter the electric vehicle (EV) manufacturing market.

The group would follow similar schemes as the Organization of the Petroleum Exporting Countries (OPEC) in terms of coordinating production flows, pricing and good practices, leaders of the Argentinean delegation said at the annual Prospectors & Developers Association of Canada Convention, held this week in Toronto, Canada.

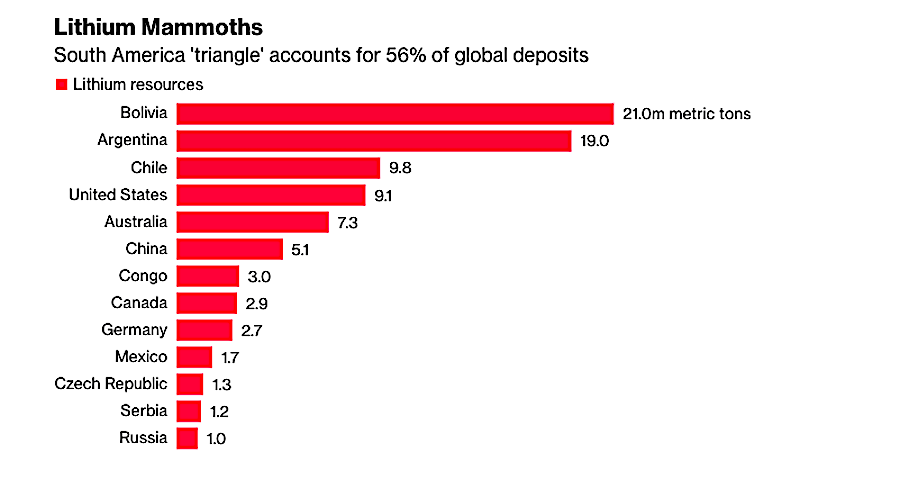

Argentina, Chile, and Bolivia have been talking since July of last year, when their foreign ministers met in Buenos Aires at the Community of Latin American and Caribbean States summit. The three countries comprise the so-called lithium triangle, which contains approximately 65% of the world’s known lithium resources and accounted for 29.5% of global production in 2020.

While Brazil’s lithium sector is only now waking up to global demand, the country has auto-making history and is now a global case study in low-carbon transportation, using ethanol, biofuels, and natural gas to power automobiles.

A shared desire to maximize the benefits of rising battery demand and rising pricing has rekindled regional cooperation talks.

Even Mexico, which traditionally has partnered with the USA and Canada, has made attempts to engage with its southern neighbours. While almost a dozen international businesses have active mining concessions aimed at developing potential reserves, President Andres Manuel López Obrador has stated that all of them will be “reviewed” in light of the resource’s recent nationalization.

Since the 1990s, Argentina has welcomed global investment, whereas Chile and Bolivia have been reticent to allow foreign corporations to utilize their assets.

For the last two years, the country has attracted significant miners such as Rio Tinto, the world’s second largest miner, and Posco, a South Korean steelmaker.

Any move to consolidate power among lithium producers would have to consider the other non-South American countries that are part of the world’s largest lithium producers: Australia and China.

This is not the first OPEC-like proposal floated for a battery mineral resource. Indonesia, in November, floated the notion of an alliance of nickel exporting countries at the Group of 20 Summit in Bali. The idea was discussed by the Indonesian investment minister with his counterparts in Australia and Canada–two of the world’s top nickel producers. Both hinted at not supporting the formation of the organization.

Meanwhile, China’s lithium industry is in disarray as its biggest production hub, which accounts for roughly a tenth of global supply, is threatened by sweeping shutdowns due to a government investigation into environmental violations.

The crackdown in Yichun, Jiangxi province, comes after a year of local lithium frenzy as miners rushed to meet soaring demand for the battery element – and profit from record global prices. They are currently dealing with close scrutiny by Beijing-sent environmental officials.

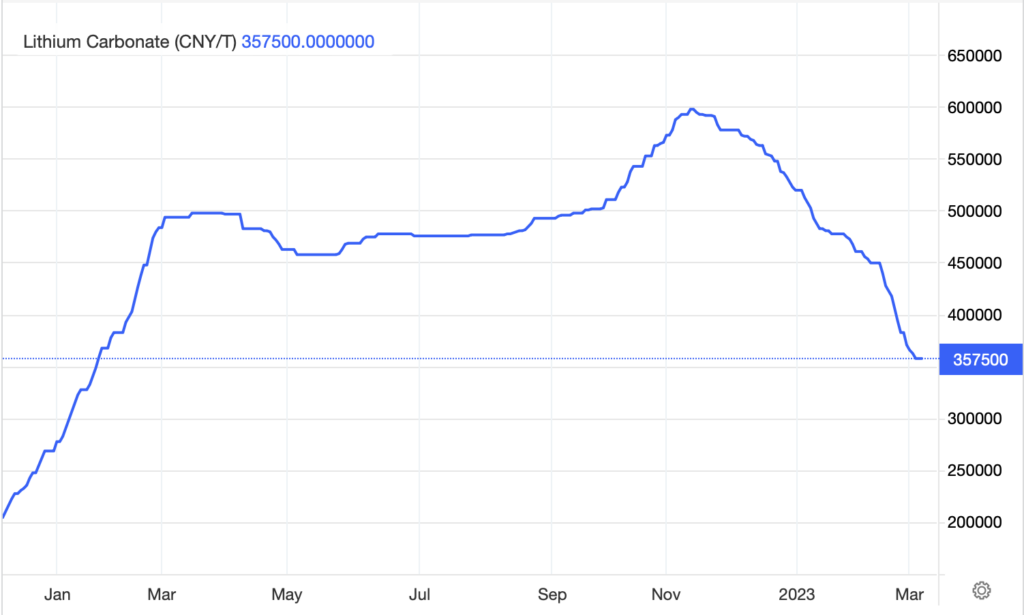

Lithium carbonate prices in China have plunged to a 13-month low of CNY 357,500 per tonne in early March, shedding 40% of its value in the last three months. After subsidizing battery manufacturers and offering monetary incentives for new electric vehicle purchases, the Chinese government ended incentives for the new energy auto sector in January, causing automakers’ demand for battery supplies to fall.

This was compounded by the overproduction of batteries towards the end of 2022 to capitalize on subsidies, which prompted top battery producer CATL to offer products at a significant discount this year, with the company expecting carbonate costs to halve in the coming months.

According to China-based analysts, lithium prices are anticipated to fall to 300,000 yuan by the end of this year, around half the level they peaked at in November 2022.

Information for this briefing was found via Mining.com and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.