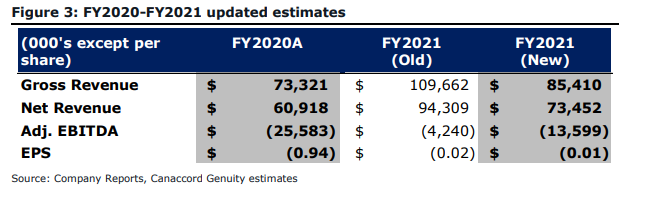

On March 17th, Sundial Growers (NASDAQ: SNDL) reported their fourth quarter and year end financial results. The company announced full year net revenue of $60.9 million or -4% year over year. Gross margins of $9.1 million were reported, a decrease of 46% year over year, and adjusted EBITDA came in at -$25.5 million for the full year, or a 15% increase year over year.

Sundial currently has five analysts covering the company with a weighted 12-month price target of U$0.76. This is up from last month, which was U$0.30. Two analysts have hold ratings, while another two have sell ratings. One analyst has a strong sell rating. The street high comes from Cowen and Company who just raised their 12-month price target to U$1.50 from U$0.30.

Canaccord Genuity’s analyst Shaan Mir downgraded their Sundial rating from hold to sell but increased their 12-month price target to $0.65. Mir defends the ratings move by saying, “given current market conditions, and the opportunity present in the company’s operation today,” and adds that he believes Sundial should be trading at a U$1 billion market cap and not the ~U$2.3 billion it currently stands at.

Onto the price target change, Mir says they have rolled forward their valuation by one year and have added Sundials full year results. They also decreased short-term revenue and gross margin forecasts but increased their market share forecasts in the long run.

Sundial’s quarterly gross revenue, which came in at $16.9 million, beat Canaccord’s $15.6 million estimate. They also reported better than expected net revenue of $13.9 million, with volumes picking up this quarter while Sundial’s average selling price fell $1.30 to $4.14 a gram. Mir believes that the focus should be on Sundial’s very large war chest of over U$700 million now.

Mir outlines three initiatives to right-sizing Sundial’s operations and their push to “re-invigorate Canadian cannabis penetration.” He adds, “We expect the company’s core operation to benefit from these investments, particularly into the second half of FY/21.” The first initiative is the SKU reduction and product optimization Sundial has done throughout this year. Mir says that Sundial has gone from over 100 SKU’s to now just under 40 SKU’s while at the same time, the company has seen its sales mix shift to mainly branded cannabis sales.

The next initiative is the lowering of their cultivation and production costs. The third initiative is the ramping up of their sales and marketing efforts. Mir says that Sundial’s sales and marketing costs have doubled once again in the fourth quarter, which, “is a result of a more focused retail penetration strategy that included targeted holiday campaigns in addition to bringing on new sales representative to support an internal sales force.”

Below you can see Canaccord’s updated full year 2021 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.