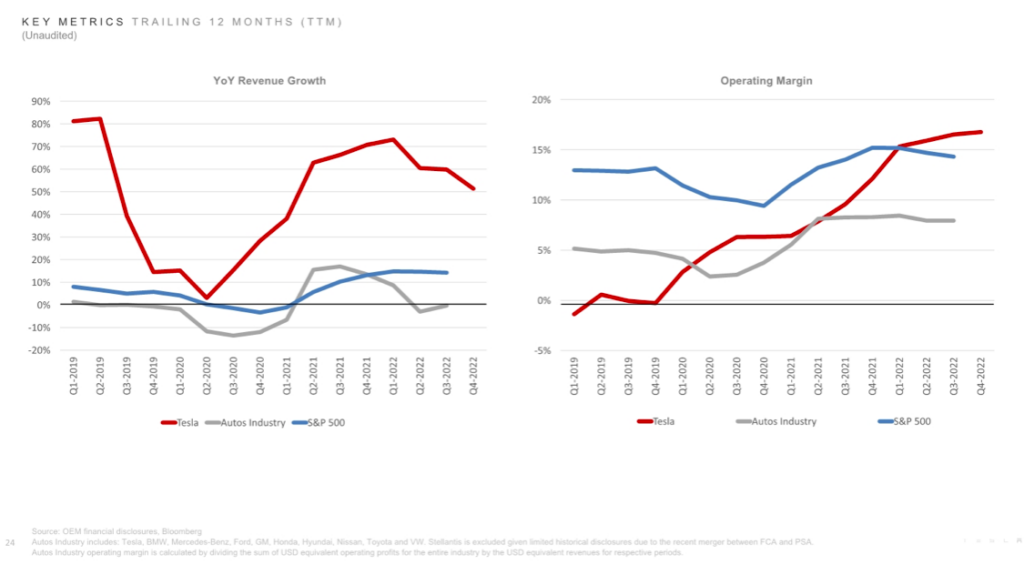

Amid all the controversies its chief executive is embroiled in, Tesla (Nasdaq: TSLA) mustered to announce its Q4 2022 financials yesterday after the close of markets. The quarter notched $24.32 billion in revenue, up from both Q3 2022’s $21.45 billion and Q4 2021’s $17.72 billion.

The company said in its presentation that Q4 2022 was “another record-breaking quarter” and 2022 was “another record-breaking year.”

“For Q4 specifically, sequential and annual margin was impacted by [average selling price] ASP reductions, as we are managing through COVID impacts in China, uncertainty around the consumer tax credit in the US, and a rising interest rate environment. Note that in 2022, rising interest rates alone had effectively increased the price of our cars in the US by nearly 10%,” said CFO Zachary Kirkhorn.

The firm also said that total revenue for 2022 grew by 51% to $81.46 billion and net income grew by more than double to $12.56 billion.

Operating income for the year jumped to $13.66 billion from last year’s $6.52 billion. For Q4 2022, the figure also went up to $3.90 billion from Q4 2021’s $2.61 billion.

Tesla shares jumped 7% after trading hours following the release. The electric vehicle maker’s shares have plummeted by more than 50% year-on-year, with a majority of the steep declines occurring after Musk took over Twitter.

READ: Tesla Wins In 2022, But Not For Its Investors

FSD revenue

However, the quarterly figure also recognized revenue from a full-self driving (FSD) software beta release of around $324 million. The firm also said it expects to recognize “nearly $1 billion of deferred revenue that remains for such customers over time as software updates are delivered.”

Ding Ding Ding. Of course the PDF isn't searchable (sorry, algos!) so you have to go hunting. $324M of FSD revenue recognized. What a low quality "beat" here. @TaylorOgan @BradMunchen @StanphylCap https://t.co/xCgGZMvBHU pic.twitter.com/bTNcRQqgF8

— Keubiko (@Keubiko) January 25, 2023

Total deferred revenue is $1.9 billion, so interested to hear more about this on the earnings call. Perhaps they chose to recognize over a longer period, such as only recognizing once FSD Beta is actually installed.

— Whole Mars Catalog (@WholeMarsBlog) January 25, 2023

That would allow them to spread the margin boost across 2023

Kirkhorn explained that the FSD revenue was structured with two components.

“There’s enhanced Autopilot, the price of which is listed on the website. We fully recognize that,” the CFO said. “Then there’s an incremental, which is for the additional features of full self-driving offers and we’ve released a portion of that. And then there’s a minority of the total package that’s remaining that will be released over time as software updates are there.”

Musk said in the earnings call that Tesla has deployed full self-driving Beta “to roughly 400,000 customers in North America” with respect to Autopilot.

“And we’re currently at about 100 million miles of FSD outside of highways. And our published data shows that improvement in safety system — stuttering here, safety statistics, it’s very clear. So we would not have released the FSD Beta if the safety statistics were not excellent,” Musk added.

The electric car maker is facing investigations and criticisms on its self-driving claims, with the Department of Justice investigating the firm since last year after it was discovered that Autopilot was engaged during a number of high-profile fatal crashes involving the automaker’s EVs.

READ: Tesla Under Criminal Investigation Over Bold Self-Driving Claims

READ: Tesla: 2016 Full Self-Driving Video Was Faked, Says Head of Autopilot Engineering

Another math explanation Musk talked about in the earnings call pertains to FSD Hardware 3 and 4, and what the upgrade path looks like for the feature.

“So what we’re aiming for is like how do we get ultimately to, let’s say, for argument’s sake if Hardware 3 can be, say, 200% or 300% safer than human, Hardware 4 might be 500% or 600%,” Musk said. “But it is the cost and difficulty of retrofitting Hardware 3 with Hardware 4 is quite significant. So it would not be, I think, economically feasible to do so.”

The chief executive also said that Cybertruck will have Hardware 4, but the long-delayed vehicle model “will not be a significant contributor to the bottom line but it will be into next year.”

READ: ‘The Boy Who Cried Cybertruck’: Tesla To Mass Produce Cybertruck By End Of 2023… For Real?

Beat estimates?

The quarterly revenue beat the analysts’ average estimate of $24.16 billion. Net income for the quarter came in at $3.69 billion, which led to an adjusted earnings per share of $1.19. This also beat the Wall Street analyst average of $1.13.

However, these “beats” can be taken with a grain of salt after analysts slashed their estimates in recent months, as well as after looking at Musk and the firm’s own projections for the quarter.

As potentially – or at least partly – anticipated by the share price move, Tesla is experiencing severe downgrades in earnings expectations. In 3 months the '23 consensus estimate has fallen by 28%, and brokers are now looking for $TSLA EPS growth in '23 of just 13%. A thread… pic.twitter.com/DtnwdNDyAC

— Drew Dickson (@AlbertBridgeCap) January 19, 2023

TESLA EARNING ESTIMATES ARE DOWN MASSIVELY OVER THE LAST FEW WEEKS

— GURGAVIN (@gurgavin) January 25, 2023

IT IS NOW WAY MORE EASIER FOR TESLA TO "BEAT" EARNINGS $TSLA pic.twitter.com/fJAhD8qWje

– 39% YoY growth, vs 50% projected by Elon

— William LeGate (@williamlegate) January 25, 2023

– $1.19 EPS vs $1.30 projected EoY

– Inventory continues to pile up despite unprecedented global price cuts

…but Elon stans will try to portray this as a win $TSLA https://t.co/PvRiiYRTq7

Ahead of the Q4 results, the firm announced earlier that it delivered a record 405,278 cars, falling short of the consensus estimate of 420,760 vehicles.

50% CAGR?

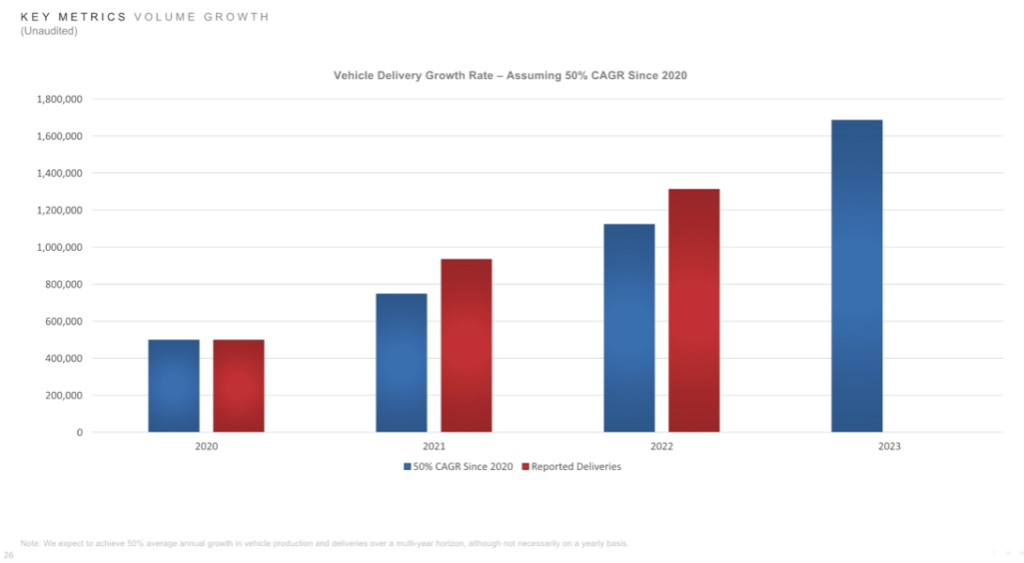

Tesla also said in its release that it expects to “remain ahead of the long-term 50% [compound annual growth rate] CAGR.” For the firm, this means 1.8 million cars in 2023.

The carmaker delivered over 1.3 million cars in 2022, which Musk touts “the highest among any volume carmaker.” With the 1.8 million volume target, the firm is aiming for a 37% increase for this year.

This begs the question on what the 50% CAGR target should be based upon.

Tesla's math is astoundingly bad here – 50% growth in deliveries would be 1.97M cars.

— Jeremy C. Owens (@jowens510) January 25, 2023

If they are suggesting that we need to use old numbers to account for 50% CAGR, that's just silly and $TSLA needs to provide actual number targets instead of this mess. https://t.co/JZFte0cAvP

From Tesla’s presentation, it seems that the calculation of the 50% CAGR doesn’t consider the actual deliveries for the year. Starting with a 500,000-volume target in 2020, the growth rate of 50% is merely based on the target: 750,000 cars in 2021 and 1,125,000 cars in 2022.

This then puts the 50% CAGR target for 2023 at around 1,687,500 vehicle deliveries, which would be met should Tesla achieve its 1.8 million volume target.

Price war

Musk touted that Tesla has seen “the strongest orders year-to-date than ever in [its] history,” almost twice the rate of production. Following this, the chief executive said the firm actually raised the Model Y price “a little bit.”

With rising inflation and supply constraints arising from geopolitical events and strict COVID-19 measures in China last year, Tesla implemented price increases to ride with the economic windfall.

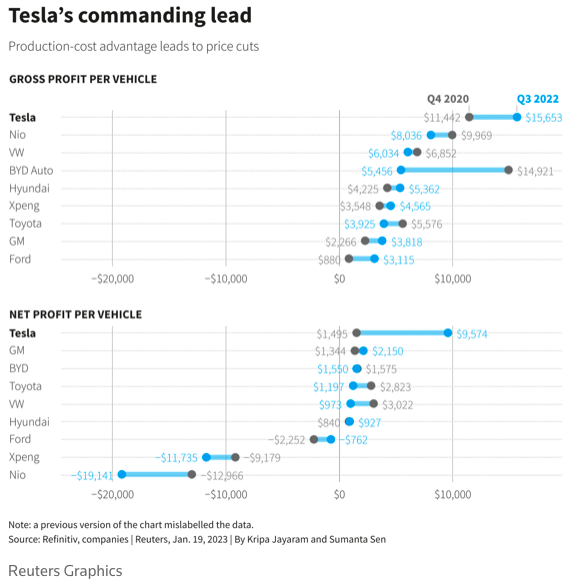

But recently, Tesla made global price reductions at the turn of the year, with analysts predicting that the firm’s reported profitability would allow it to cut prices and put pressure on competitors. The company’s $9,000 net profit per vehicle in the most recent quarter was more than seven times that of Toyota Motor’s in the third quarter. However, it was down from nearly $9,700 in the third quarter.

“As the world transitions from an inflationary to deflationary environment, we expect a strong partnership with our suppliers on this journey as well. In that, we’ve priced our products with a view towards a longer-term cost structure,” Kirkhorn commented on the prices.

When asked specifically on the math of automotive gross margin and ASP, Kirkhorn said the firm believes it will land “above… 20% automotive gross margin, excluding leases and rent credits and then $47,000 ASP across all models.”

“Sometimes for those — for people who are well — who have a lot of money, they sort of forget about how important affordability is. And it’s always been our goal at Tesla to make cars that are affordable to as many people as possible, so I’m glad that we’re able to do so,” Musk said.

Tesla this month decided to slash prices in the United States and Europe by up to 20% on some of its vehicles, including the best-selling Model 3 and Model Y, suggesting the path for EV players may become even more difficult. This follows days after similar price cuts were implemented in China.

For prospective buyers, this comes as welcome news. Not only will the amount of cash necessary to buy a popular Tesla model be reduced, but the price reduction may also allow U.S. buyers to qualify for enhanced federal tax credits of up to $7,500.

READ: Will Tesla Price Cuts Lead To An EV Pricing War?

For Musk, however, the firm can afford the price cuts because there’s “a tremendous upside potential” in most Tesla models that don’t have the FSD Hardware yet.

“Something that I think some of these smart retail investors understand, but I think a lot of others maybe don’t is that the — every time we sell a car, it has the ability, just from uploading software to have full self-driving enabled and full self-driving is obviously getting better very rapidly,” Musk explained.

In another math narrative, the Tesla CEO said there’s “only a small percentage of cars don’t have Hardware 3,” which essentially means “there’s millions of cars where full self-driving can be sold at essentially 100% gross margin.”

Tesla insurance

Kirkhorn commented that a stride the firm is making in improving “the total cost of ownership of our cars” is the Tesla insurance. The CFO said that “it’s probably going to take some time before this business is large enough for specific financial disclosures,” but revenue from the division was at a $300 million annual premium run rate as of the end of last year, and growing 20% a quarter.

Musk took the discussion further and surmised that the effect of Tesla providing its own insurance for its cars is that it makes “the other car insurance companies offer better rates for Teslas.”

“So it has a bigger effect than you think because it improves total cost of insurance costs even when they don’t use Tesla Insurance,” Musk claimed.

The Tesla insurance also aids the firm in “minimizing the cost of repair of Teslas,” Musk added, as it provides feedback on after-sales repair costs that the EV maker previously “didn’t actually have good insight into that” since other insurance providers covered the cost.

“So it’s giving us this really good feedback before, again, reducing cost — total cost of ownership and also just figuring out how to get — if somebody’s cars in an accident, most accidents are actually small,” Musk explained, noting that the feedback informs future designs. “We’re actually solving how to get somebody’s car repaired very quickly and efficiently and back in their hands.”

Recently, Tesla drivers are discovering that late-night driving has been dinging their safety scores–after the firm updated the Safety Score feature to version 1.2 in November 2022. These incidents are poised to potentially raise the premiums for Tesla insurance holders.

The electric carmaker justifies that the new Safety Factor, called Late Night Driving, factors in the assumption that driving at night can be more dangerous because of other considerations such as reduced visibility, tiredness, as well distractions.

READ: Tesla Insurance Dings You For Driving After 10 PM

$4 billion investment?

Tesla ended the Q4 2022 with a $16.92 billion cash balance, down from a beginning balance of $20.15 billion. While the firm generated an operating cash flow of $3.28 billion during the quarter, a lot of the cash burn was driven by a $4.37 billion expenses labeled as purchases of investments.

In the past three quarters, the firm recorded a total of $1.47 billion in purchases of marketable securities. However, cash, cash equivalents and investments at the end of Q4 2022 came in at $22.19 billion, up from Q3 2022’s $21.11 billion. Given that the firm ended with $16.92 billion in cash, this might be explained by the $4.4-billion investment purchase. But of what nature, that’s for the official 10Q filing to explain.

So, $TSLA has an "investment" of $4B+ show up in its abbreviated financials. Neither Musk nor Zach says a word about it on the call, & no analysts evinces the slightest curiosity about it.

— Montana Skeptic (@montana_skeptic) January 25, 2023

Did I miss something?

Recently, Tesla indicated it will “be investing over $3.6 billion more to continue growing Gigafactory Nevada,” including its first high-volume Semi factory. However, this wouldn’t likely be attributed to the investment purchase increase since it would most likely fall under capital expenditures.

READ: Tesla Semi: What We Know So Far Of The Expansion In Nevada

Tesla last traded at $157.48 on the Nasdaq.

Information for this briefing was found via Reuters, Seeking Alpha, and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses