The Green Organic Dutchman (TSX: TGOD) last night filed its statement of executive compensation for 2019, and it has brought us to a question. How much should executives really be paid, especially when a company is operating entirely as a loss leader?

If you recall, TGOD last year managed to produce net revenues of $10.957 million through the sale of cannabis and hemp products, while generating a loss of $198.5 million for the fiscal year. Much of that loss was attributable to operating expenses of $78.2 million, but even more significant were the goodwill and intangible write downs of $123.4 million.

Lets keep those numbers in mind as we look at the executive compensation for the year. Meaning, lets look at just how much executives of the company were paid to incinerate nearly $200 million worth of capital in the company.

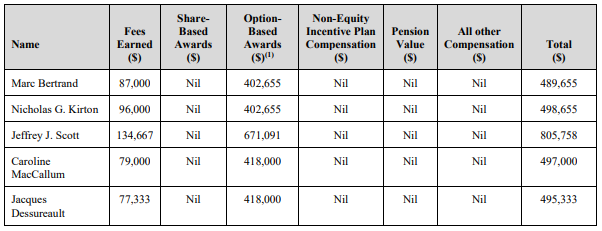

If you were CEO Brian Athaide, on a combined basis, you were paid $0.132 for every dollar of net revenue earned throughout the fiscal year. Rearranged to focus on the loss, you were paid roughly $0.007 for every dollar lost throughout the fiscal year. Athaide collected $341,250 in base salary and $1,073,745 in option-based awards, for total compensation of $1,445,486 for the fiscal year, as compared to $3.75 million the year before.

Comparatively, if you were CFO Sean Bovingdon, you were paid $0.111 for every dollar of net revenue earned during the fiscal year, or alternatively, $0.006 for every dollar lost. Bovingdon managed to collect $276,250 in base salary and $939,527 in option based awards for the year, resulting in total compensation of $1,215,777. In 2018, he made slightly more, at $1.51 million.

Looking at the named executive officers as a whole, which includes the CEO, CFO, former President, CSO, and the VP of Supply Chain, and on a combined basis, TGOD management was paid approximately $0.498 for every dollar earned in net revenue for the fiscal year. Collectively, management was paid $5,461,144 for the fiscal year, or approximately half of the $10,957,000 earned in net revenue during the year.

That’s right – roughly half of every dollar earned on a net revenue basis went to TGOD’s management for compensation. If we’re looking at things on a gross profit basis, both before and after “fair value biological adjustments,” the figure is far, far worse.

Notably, this does not include compensation paid to the board of directors, which was $2.77 million in and of itself. Combined between the board of directors and managements compensation, roughly $0.752 was paid for every dollar in net revenue earned during the fiscal year.

To be fair, TGOD’s management actually took a pay cut in 2019 relatively to that of 2018, at least in terms of bonuses from option-based awards. And in April 2020, all of the named members of management took a significant pay cut. The base salary cut for all members was 20% relative to their annualized base salary, with CEO Brian Athaide taking a 30% cut overall, while Chief Science Officer Ravinder Kumar took what amounts to an 80% cut – he resigned as CSO entirely, and now is the science advisor to TGOD, with a base salary of $50,000 per year, compared to the $250,000 annualized salary he had last year.

Cash compensation was also reduced for directors by 20% as of April 1, 2020.

And if we’re really being fair here, while those option-based awards were worth something at the time of issuance (and for income tax purposes), they’re effectively worthless right now if the insiders did not exercise and sell the shares. Throughout 2019, options were awarded to members of management with strike prices ranging from $0.83 to $5.13 – all of which are now far underwater. The bright side for management, is that the options don’t expire until 2024 at the earliest.

The Green Organic Dutchman last traded at $0.28 on the TSX.

Information for this briefing was found via Sedar and The Green Organic Dutchman. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

6 Responses

This stupid count ceo

Lowest of the low. LOL @Steve

So you are good at math ,what’s the point of your article?? We are all aware that executive’s are over paid and have been for a 100 years ,this is nothing new . OPG ,TTC ,Black berry etc … If your not a stock holder ,who cares this is a practice that will continue.

Clown,you are constant Tgod hater. All your research is just picking your nose

Can see TGOD management is working hard on a Saturday!

Tgod is a scam. Whoever is defending this is grasping to the delusion that they will earn lots of money. Just take the L boys, we got fooled good.