Once again, Hertz has taken the spotlight in the investing scene. Shortly after the infamous car rental company filed for bankruptcy after it got crushed by the weight of the coronavirus pandemic, retail investors, for some unexplainable reason, rushed to purchase the bankrupt stock, causing it to increase by nearly 168%! All meanwhile billionaire investor Carl Icahn, was at the same time dumping his 55.3 million Hertz shares faster than you can say bankruptcy.

But the madness continues! It appears that investors are pushing their optimism about the distraught rental company to new levels. Right after regular trading commenced on Friday, Hertz’s stock was trading as high as $3.7 – which amounts to a 353% increase since close on Wednesday. Now either there is looming optimism about a rebound in the air travel industry, or the coronavirus pandemic has given rise to a swarm of extreme risk-seeking investors.

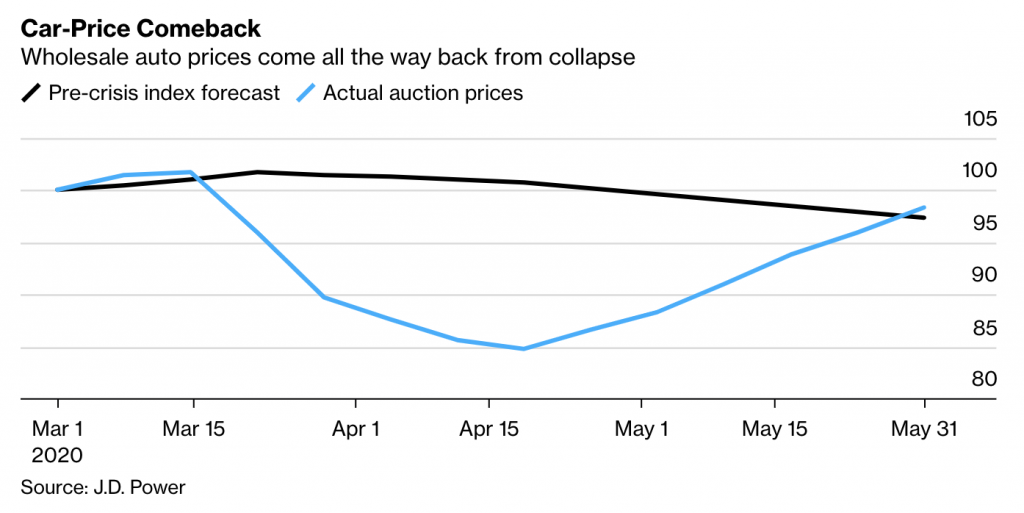

The new post-pandemic Hertz equity holders are exposing themselves to a significant risk, because once a company files for a Chapter 11 bankruptcy as per the US Bankruptcy Code, the said company has to repay all debts in full before payments to stockholders are made. However, some of that investor optimism may stem from the rebound of prices in the used car market. According to market researcher JD Power, used vehicle prices have increased to to the pre-virus forecast since suffering a historic decline in April. This may be good news for Hertz, which has a fleet of nearly 500,000 rental vehicles slated for used vehicle auctions in the next short while.

According to Jefferies analyst Hamzah Mazari, there is a very high probability that Hertz stock will not come out with a positive rebound. Optimistic equity holders are most likely going to be met with disappointment, because Mazari is anticipating a 90% chance that the stock will once again trade below $0.50 once the dust settles.

Information for this briefing was found via Bloomberg and JD Power. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.