Welcome!

If you are reading this, you have likely decided you would like to go beyond the headlines and learn more about the details of some of your favourite (or hated) Canadian public companies. Whether you own shares, are considering buying shares, or trying to talk your spouse out of buying shares in a public company listed in Canada, the System for Electronic Document Analysis and Retrieval (“SEDAR”) is a tool that can hep you make better informed decisions.

Editor’s Note: This is a re-published version of the four part series released earlier this year, aggregated into one simple, easy to view article. if you would like to view them individually, here are parts one, two, three, and four. If you’re worried about relevance, don’t fear! As you’ll soon find out, Sedar hasn’t changed much over the course of the last two decades.

There are many paths that may have led you to want to discover more about SEDAR.

Maybe you wanted to read one of your holding’s financials for yourself; or maybe you wanted to see how your favourite company’s competition is doing; or maybe you just wondered where all those angry screenshots on Twitter come from that show a company’s executive team just made tens of millions of dollars in annual compensation, while generating almost no sales.

Regardless of what path brought you here, this guide was written to help you better qualify your investing decisions by finding the information that is meaningful to you.

Before we jump in, let’s start off with an imagined conversation you and I might have, if you had just logged on to SEDAR.com and we had previously agreed to a structured Q&A format that flowed somewhat logically toward the conclusion – until a final question was tacked on at the end that seems out of place, but I, as an explainer, felt I needed to address within this article.

Question: Why does this website look like it is from the 90s?

Answer: Because it is! I’ve been told they are planning on updating things, but unfortunately, they haven’t gotten around to it yet. On the plus side, documents aren’t uploaded in WordPerfect anymore and they now require documents to be filed in PDF format (with some exceptions). If you are under 30, feel free to take a break now and Google “WordPerfect”.

Question: So, all the key information I would need to understand a publicly traded company is here?

Answer: You might think that, but no! Many documents that might be useful in assessing the quality of a company are not uploaded to SEDAR. This includes, but isn’t limited to: corporate presentations, transcripts from earnings calls, current share price information, and documents that are only required by certain exchanges. For example, the Canadian Securities Exchange (“CSE”) requires issuers to file monthly progress reports (known as a Form 7) on their website, but you can’t find those here!

Question: Well, what IS here then?!

Answer: Lots! All public companies listed in Canada must file troves of documents on SEDAR as part of their continuous disclosure obligations that contain information you may find useful. These include quarterly financial statements, prospectus filings, business acquisition reports, executive compensation details, material press releases, and more!

Question: Wait, how come there is a press release filed on here telling me an executive at a company just listed his book on Amazon? I thought you said companies only filed ‘material press releases’ on here – how on earth could that be material?

Answer: Well, it’s not! Unfortunately, many companies do tend to publish their immaterial press releases to SEDAR. In fact, the Canadian Securities Administrators (“CSA”) have asked them to literally stop doing this in order to stop annoying and misleading people just like you. Don’t expect the CSA to get the companies to stop this anytime soon though – they aren’t exactly quick to discipline.

Question: Do I even need to use SEDAR, I mean, can’t I just get all this information off a company’s website?

Answer: No! It is true that many companies have an investor relations section on their website, but you’d be surprised how many documents they are legally required to file on SEDAR that don’t end up on their actual website. For some reason, I’ve found that documents detailing how much their executives are being paid are usually missing from their websites… I wonder why….

Question: Alright, it seems some of this information might be useful. So how do I get started?

Answer: Follow me!

Question: Wait! Before we get started… will SEDAR tell me when insiders, like a company’s executives, are dumping their shares? I might want to know that. Answer: Nope. That information can be found on SEDAR’s equally retro and obtuse cousin, SEDI. That of course assumes though that the executive isn’t delinquent and actually filed the proper disclosure in a timely manner… and ideally not one day before the company is about to initiate bankruptcy proceedings. Anyway, off to SEDAR!

The first step to using SEDAR is figuring out how to find the information that will help you in your research, analysis, and/or social media shit posting.

Unfortunately, you can’t just type “Aurora Cash Position” or “Canopy Executive Pay” into the search bar to get the answers you seek. Rather, each company has their own Profile Page, which links you directly to their comprehensive list of documents. The first part of learning how to use SEDAR is figuring out how to arrive on your target company’s profile page – don’t worry, there will be pictures.

Before we get started though, you might want to open a new tab and look up the legal name of the company you are researching. On SEDAR, you can’t search by a company’s stock ticker, and many companies have similar names to one another. For example, looking up just “Aurora” would pull up 9 different companies, while looking up “Pacific” would pull up no less than 38 companies! A big reason to confirm the company’s official name is that several companies with similar names operate in the same industry, and you don’t want to inadvertently research the wrong company.

If looking up the legal name of a public company you are researching sounds difficult, I assure you, it is not. Just punch the ticker of the company you are researching into TMXMoney, Yahoo Finance, or another major finance site, and you’ll notice that the legal name of the issuer is included in the company profile. Once you have your target company’s legal name on hand, you can quickly use one of two methods to pull up a company’s profile page. Let’s check them out.

Method #1: Search Database

If you’ve already looked up the legal name of the company you are looking for, this method is exceptionally quick and easy.

Just click the ‘Search Database’ text at the top of SEDAR, and then punch the legal name into the ‘Company Name’ bar and hit ‘Enter’. If you did everything right, you should find yourself looking at a table with links to documents in blue from your target company that are in alphabetical order.

A very common misconception at this stage is that you have already arrived at the comprehensive list of documents, but that is not the case. To make it to the profile page, which will take you to the actual comprehensive list of documents, you need to click on any of the company name links in blue. If you didn’t have the company’s legal name and just punched in a more generic term such as “Aurora”, you may notice several other companies’ names in blue, so you will need to select the right one.

If you were trying to look up information about a company that is no longer public, (perhaps because it was acquired and you were interested in its historic performance), you may be frustrated to find that the search bar pulls up nothing – even when you punch in the proper legal name. The reason for this is that the default settings on the search function are set to only pull up documents from the past six months. This means if you wanted to pull up details on a company that is no longer public, such as MedReleaf Corp., you would need to adjust the search settings to go back more than six months – or move on to the second method.

Method #2: Issuer Profiles

Once again, if you have already looked up the legal name of the company, this method will also quickly direct you to your target company’s profile page.

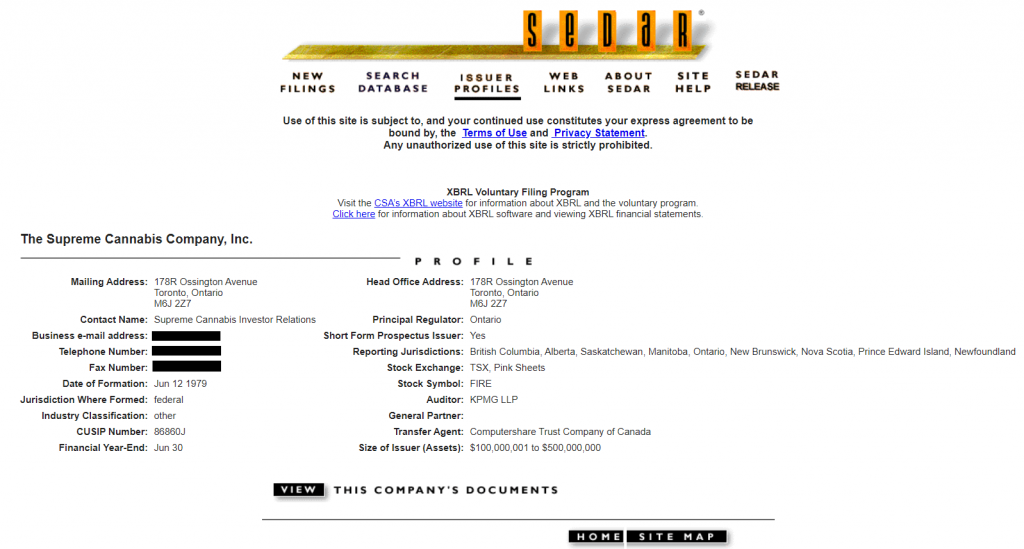

Just click the ‘Issuer Profiles’ text at the top of SEDAR and you’ll come to a page with two sets of large capital letters – one set that links to ‘Companies’ and one set that links to ‘Investment Fund Groups.’ The top set of letters link to the list of companies whose names start with that letter. (Note that if your company’s name starts with “The,” you don’t go to the “T” section, but the first letter of the first word after that. For example, if you were looking up “The Supreme Cannabis Company Inc.” you would search under “S”, not “T”.)

When you click the letter, you will be taken to what can be an exceptionally long list of companies, with some letters listing over a thousand companies. As long as you have the legal name of your company, scrolling through and clicking the correct link to the profile page should be quick.

I should tell you now that one of the reasons there are so many companies listed under these letters is that SEDAR doesn’t just contain mandatory filings from current and former public companies, but several private ones as well. Speaking of which, if you own a private company that has been raising money from investors and were previously unfamiliar with the notion that some private companies need to file on SEDAR, now would be a REALLY good time to phone your corporate lawyer. I’m actually quite serious; please stop reading this article and phone them now.

The Profile Page

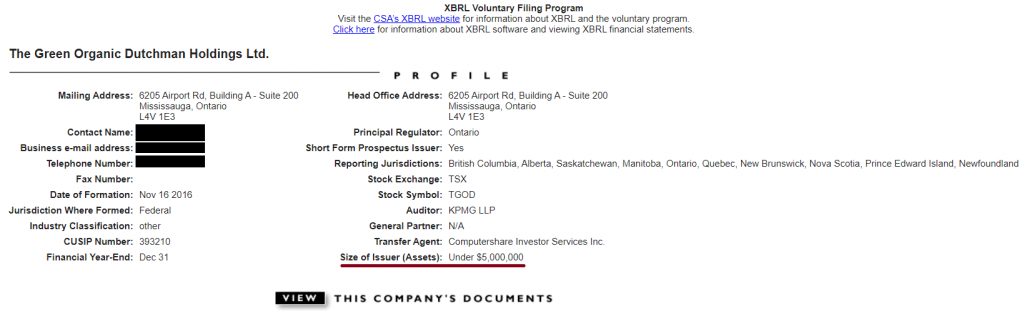

Whether you choose to search the database or scroll through the long list of issuer profiles, your search should land you on your targeted company’s profile page. Here you’ll notice some basic information including who the company’s auditor is, when their fiscal year ends, and a rough range of the company’s total assets. All you need to do now is click the black ‘VIEW’ button at the bottom and you’ll be off to your company’s key documents! Oh, that reminds me, I should probably warn you…

You know all that basic information I just mentioned that you can find on the company’s profile page? Well, it isn’t always that accurate…

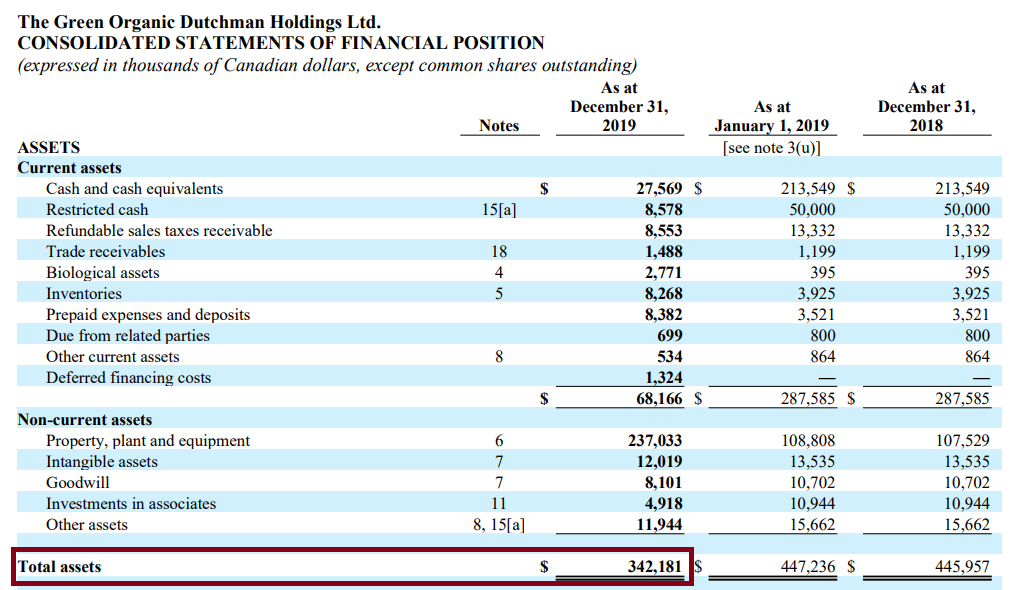

As it turns out, companies are responsible for updating the information on these pages, and many don’t keep their pages up to date (assuming they haven’t forgotten that this profile page exists). For example, The Green Organic Dutchman Holdings Ltd.’s (“TGOD”) profile page shows that the company has “Under $5,000,000” in assets. If you were to go to their most recent financials, however, you’d quickly notice that as of December 31, 2019, they actually have over $342,000,000 in assets. Even if you were to deduct their debt, you’d notice their net assets are still well into the hundreds of millions – a far cry above $5,000,000.

Unfortunately, it isn’t uncommon to find errors on these profile pages. For another example, companies may change their auditor and upload the proper documents, but simply forget to change it on their SEDAR profile page. This can understandably be a little confusing for you as it may lead you to believe you’ve arrived on the wrong profile page, because you know for a fact that your target company has far more in assets or uses a different auditor.

Now that we’ve gotten that cleared up and raised a few doubts about the quality of information here – just click the “VIEW” button and we’ll be off to Part 3.

Congratulations! If you’ve been following along, you’ve now made it to your target company’s document page, which hosts the documents that you can use to conduct your analysis.

What could I possibly have left to explain? Well, as it turns out, there are several oddities to a company’s document page that you’ll probably want to know about.

RTOs

When you arrive on the document page of a company you are researching, one of the first things that might jump out at you as you scroll down is just how many documents there are. Perhaps, too many?

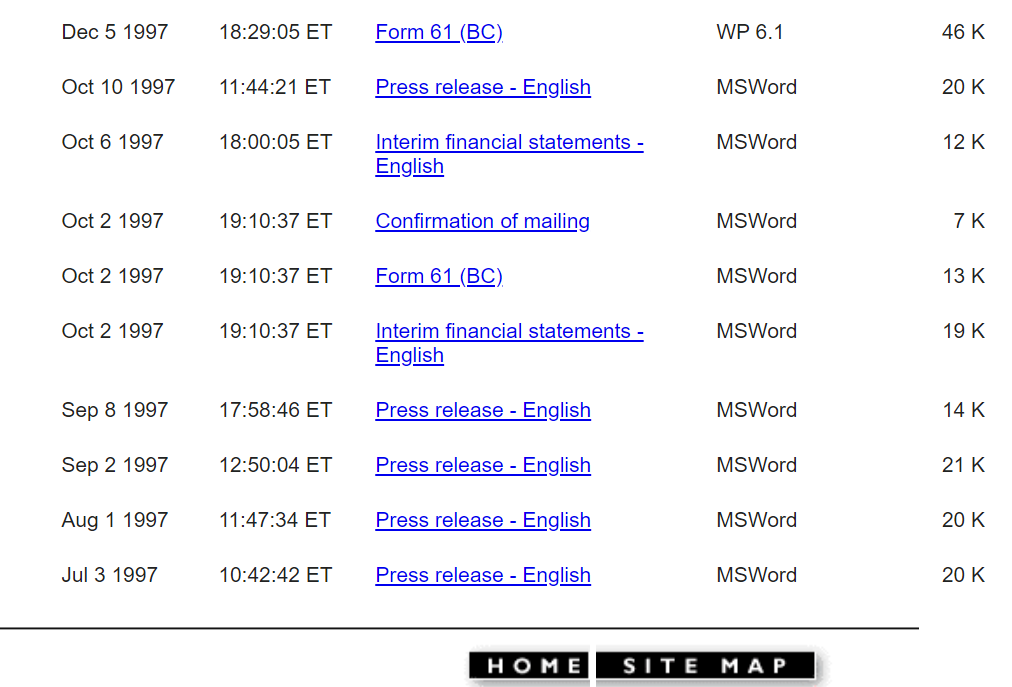

For example, on cannabis retailer MedMen Enterprises Inc.’s (“MedMen”) document page you can find files going as far back as 1997 – decades before MedMen ever went public or even commenced operations. (Hey, some of the documents are even in WordPerfect!)

While you might be tempted to believe this is the result of a gross mislabeling or misfiling, the actual reason for this has to do with the way many companies go public in Canada. It is very common for companies to go public through a reverse takeover (“RTO”) of an existing company that is already public, as opposed to an initial public offering (“IPO”).

When a company goes public via an RTO, all the old filings from the ‘previous’ public company are left up on SEDAR, resulting in ‘new’ companies having files that can stretch back for decades. This explains why many cannabis companies, whose operations were only legalized over the past few years, have public documents stretching back decades. This RTO process can happen multiple times over the life of a public company, so you might even find that a public company you are researching has been engaged in a variety of different businesses over the years.

Year Ends and Filing Dates

If you are trying to compare the results of public companies, you might be frustrated to find that one of the companies you are trying to compare has not yet uploaded their financial documents to SEDAR – even though everyone else in your comparison group has. Before you decide to send an angry letter/tweet to their investor relations department accusing them of being a delinquent filer, there are two important items you should check first.

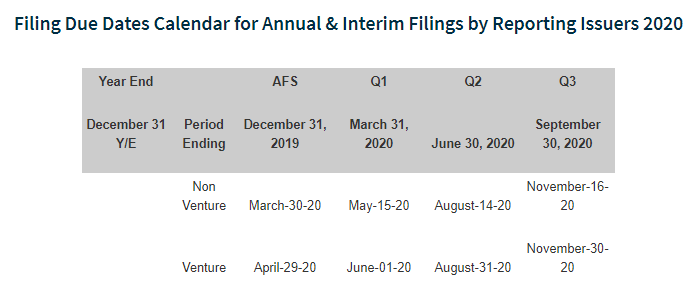

First, while we generally tend to think of December 31 as the end of the year, many public companies have fiscal year ends that end on a different month. For example, cannabis producers Aphria Inc. (“Aphria”) and Hexo Corp. (“Hexo”) have fiscal year ends that end on May 31 and July 31 respectively. This means that the timing and release of their quarterly and annual results will differ considerably from a company whose year end is set for December 31, such as cannabis producer VIVO Cannabis Inc. (“VIVO”). To confirm when a company is required to file their financials, you can check the year-end date on their SEDAR profile page and then cross-reference the deadline schedule on sites that list them, such as the Ontario Securities Commission website.

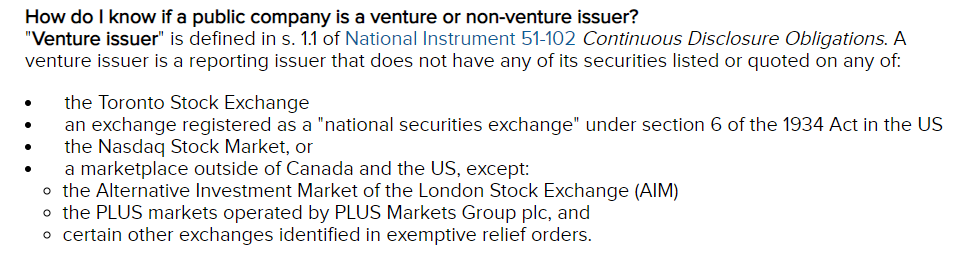

The second consideration is whether the company you are researching is a ‘venture’ or ‘non-venture’ issuer. In a nutshell, companies that are venture issuers are given more time to file their quarterly and annual financial statements and generally have more lax disclosure requirements than non-venture issuers. For example, a public non-venture issuer whose most recent year-end was December 31, 2019 would have had until March 30, 2020 to file their annual financials while a venture issuer would have until April 29, 2020. While you might be tempted to think that the difference between venture and non-venture issuers boils down to size or total assets, there is a specific technical definition that addresses where a company’s securities are listed.

If you spend enough time on SEDAR, you will soon notice a variety of behaviours from companies when it comes to filing deadlines. Some companies will diligently put out an early press release informing you of the exact time they plan on uploading their documents. Some, however, will just quietly submit their financials 15 minutes before deadline like a kid sliding their homework under the door.

Special Filings

As you familiarize yourself with SEDAR, you will pick up on the usual rhythm of quarterly financial statements, management discussion & analysis reports, management information circulars, and the occasional, (or very VERY frequent) press release. You’ll also likely notice that some companies seem to upload uniquely detailed documents, while other companies may not upload them at all. Examples of these documents include business acquisition reports, credit agreements, and material contracts.

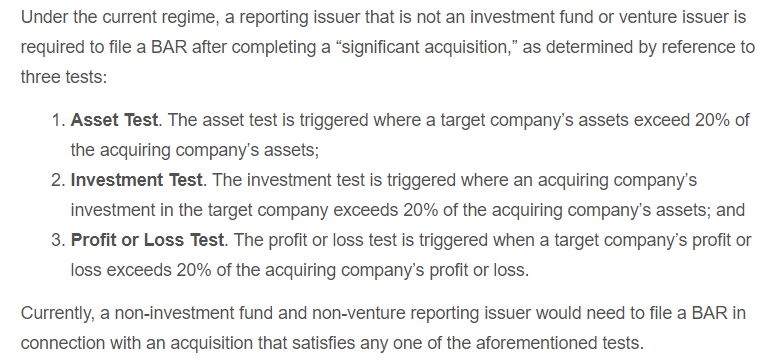

One such example of these unique filings is a business acquisition report, which provides granular details about a specific acquisition a company has made. You’ll find that some companies may file these for certain acquisitions, but not for others, while other companies who have made extensive acquisitions don’t file them at all. The reason for this is that there are specific thresholds that must be met before a company has to make a special filing, like a business acquisition report, making them something of a sporadic occurrence.

Even when companies are required to file these documents, you might find yourself frustrated at the level of detail they provide. It is not uncommon for companies to redact substantial sections of these documents, such as the debt covenants in a credit agreement or the key economic terms of a material contract the company has executed. For example, below is an excerpt of the economic terms from Beleave Inc.’s note purchase agreement with Auxly Cannabis Group Inc.

As you can see, these aren’t always swimming with detail.

A Few Thoughts

Despite its somewhat archaic design, the ability to navigate SEDAR and access the key documents a public company is required to file can be an exceptionally empowering tool. This skill is not just beneficial to the investors and analysts who own and trade public securities; but can also be tremendously valuable to private companies who want to better understand their customers or competition. For example, if you owned a construction company and were offered a contract to work with a public company, you might find it beneficial to know how much cash they have, what their sales are like, and whether or not they are struggling to pay their bills.

If you are new to public company research, think of this guide as a first step on a long path that will be frustrating at times – but can begin to pay considerable dividends over time.

Best of luck.

Question: Where can I find a company’s cash position?

Answer: You can find how much cash a company has on hand on their statements of financial position (more colloquially referred to as a balance sheet), which is located near the beginning of a company’s financial statements. If you want to review a company’s cash position for their fiscal year-end, you should open their audited annual financial statements. If you are checking for an interim period, such as the end of their third quarter, you would open one of their interim financial statements/report that corresponds to the period you are searching.

If you are reviewing a company’s cash position, there are a couple things you should keep in mind. First, financial statements take time to prepare, and the cash position stated in a company’s most recent financials may be up to four months old (or longer if they are a delinquent filer). Many things can happen in this interim period, such as a company generating more sales, incurring additional expenditures, or raising more funds from investors. Second, most sophisticated companies will not just leave significant amounts of cash in their chequing account not earning any interest. Many will purchase short-term interest-bearing instruments (such as GICs) where they can put that cash to work. As a result, many companies may have a substantial amount of ‘marketable securities’ or ‘short-term investments,’ which should always be considered if you are assessing how much runway a company has left.

Question: Where can I find a company’s revenue?

Answer: You can find how much revenue a company has earned for a period on their statements of (loss) income and comprehensive (loss) income (casually referred to as an income statement), which is located near the beginning of a company’s financial statements. If you want to see a company’s revenue for the entire fiscal year, you should open their audited annual financial statements. If you are checking for an interim period, such as their second quarter revenues, you would open one of their interim financial statements/report that corresponds to the period you are searching. Note that if you were interested in a company’s fourth quarter revenue, you will find that the audited annual financial statements will not typically break this figure out separately. To see a company’s fourth quarter revenue, you may need to review the Management Discussion & Analysis (“MD&A”) that accompanies a company’s year-end results – as it often provides a breakdown for the fourth quarter. Unfortunately, if a company does not provide the breakdown in their MD&A, you just might be stuck doing the calculation yourself.

Question: Where can I find a company’s EBITDA/Adjusted EBITDA?

Answer: While you might reflexively believe you can find a company’s EBITDA in their financial statements – this is not the case. EBITDA/Adjusted EBITDA are non-IFRS measures, and while you might see the term EBITDA referenced in a set of financial statements (perhaps in reference to a debt covenant), you won’t find the actual EBITDA figure there. Assuming a company calculates and provides an EBITDA figure (many do), you can typically find this figure in their Management’s Discussion & Analysis (“MD&A”) that accompanies their financial statements, or in the accompanying press release. If you are trying to compare the Adjusted EBITDA of two companies, keep in mind that not all companies calculate this figure the same way – so you’ll want to review how the company defines the term which can be found in the MD&A.

Question: Where can I find how much management is being paid?

Answer: Details about management compensation can be found in a company’s annual Management Information Circular. It will include details about how much a company’s named executive officers and directors are being paid both in cash and securities for their services. Note that companies occasionally file special management information circulars in addition to their annual ones, typically for unique events such as a major transaction that may require shareholder approval. If you can’t find the ‘executive compensation’ section in a management information circular, you have likely clicked on one of these unique circulars and you should just move on to the next one. Also, companies can periodically see officers and directors replaced throughout the year, but their compensation packages may not be evident right away. Some companies will file supplemental compensation details about these new hires shortly after they are made, but many wait until their next management information circular has been filed to disclose all the details.

Question: Where can I find how much a company paid for an acquisition?

Answer: It is fairly common for companies to put out a press release when they have entered into a definitive agreement, or even just a letter of intent, to purchase another company. This release will often include the company’s rationale for the deal, a self-congratulatory quote from management, and the high-level economic terms. Despite the fact an acquisition price may be mentioned in this initial press release, by absolutely no means should you rely on that initial press release for the ultimate acquisition price.

The reality is that deals can change and evolve from the issuance of the initial press release to the definitive closing of the transaction. To give you a particular example of just how disparate this gulf can be, when Canopy Growth Corporation (“Canopy”) announced they would be purchasing HIKU Brands Company Ltd. (“HIKU”) on July 10, 2018, it was widely reported based on the deal economics mentioned in the initial press release that the acquisition price would be approximately $250 million. By the time the deal has closed on September 5, 2018, the acquisition price was revised upward to just over $600 million – a difference of ~$350M from initial reporting to close.

To determine the ultimate acquisition price, you’ll want to go to a company’s audited annual financial statements or interim financial statements/reports which reflect a period following the closing of the acquisition. In the accounting notes, companies will often have a section entitled Acquisitions or Business Acquisitions which provides granular details about how much they paid for their acquisitions and how the purchase price was allocated. (i.e. How much was allocated toward inventory, goodwill, etc.). Note that as time passes, granular details of historic acquisitions will be removed from a company’s financial statements. For example, the aforementioned acquisition of HIKU by Canopy was mentioned in Canopy’s 2019-Q2 interim financials, 2019-Q3 interim financials, and 2019 full year audited financials – but had been removed by the time Canopy reported their interim Q1 results for fiscal 2020. It should also be noted that when an acquisition is exceptionally small, it may not be given any granular disclosure at all – and instead find itself lumped into an ‘other’ column.

Question: Where can I find information about a company’s outstanding warrants/options?

Answer: Many investors have found themselves particularly frustrated when a company that appears to be performing well, fails to get the same recognition and share appreciation as its peer group. A potential cause of this phenomenon is that a company’s capital structure has been stuffed with warrants and stock options with low exercise prices. Whether this is the result of generous warrant terms demanded by early investors or management issuing an abundance of cheap options to their employees (or themselves) – the effect can be an anchor on a company’s stock price. For this reason, many investors who don’t want to be blindsided may seek out the key details of a company’s outstanding warrants and options.

You can find these key details within a company’s audited annual financial statements and interim financial statements/reports in a section of the accounting notes labeled Share Capital. Within the Share Capital section is a description of a company’s securities, including key information about a company’s warrants and options – such as their exercise price and remaining life before they expire. You may also find additional details that may be relevant, such as the terms by which options that are vesting over time may have their vesting period accelerated.

Question: Where can I find who a company’s auditor is?

Answer: You can find out who a company’s auditor is on their SEDAR Profile Page. Unfortunately, as mentioned in Part 2 of this series, it is possible for this information on the profile page to be out of date – most often because a company has made a recent auditor change and has failed to update the page.

If you think a company might have changed their auditor and the SEDAR profile page may be out of a date, there is an alternative path to verification. First, you can go to the most recent audited annual financial statements and find, at the beginning of the document, the name of the auditor accompanied by their opinion of the financial statements. Next, you’ll want to verify that the company has not changed auditors since their last set of audited statements. To do this, you’ll want to see if they have filed a Notice of a change of auditors which will be accompanied by both a Letter from former auditor and a letter from successor auditor. I would note that it is possible that, for at least a brief period, a company can have no auditor whatsoever. It isn’t unheard of for a public company’s auditor to quit outright and refuse to wait for a replacement. In that case you may find that a company has filed both a notice that they are changing auditors and a letter from their former auditor, but no letter from the successor auditor stating they will be taking over. An example of this occurred when Namaste Technologies Inc.’s auditor resigned outright on February 15, 2019, and the company had not engaged a replacement until March 15, 2019.

Question: What accounting notes should I be on the lookout for?

Answer: At the bottom of every set of filed financial statements is a series of accounting notes that provide additional insight and detail into the numbers that are captured above. While it can be reasonably argued that all the notes are important to fully understanding a company’s financial statements, what notes you choose to prioritize will depend on the focus of your analysis. If you are concerned about a company’s debt obligations, you may want to prioritize the note on Loans and Borrowings that discusses the terms of their debt obligations, and, occasionally, what covenants they must maintain to stay compliant with their lenders. Alternatively, if you are concerned about litigation that has been initiated against a company, you may want to review their note on Commitments & Contingencies.

If you are new to financial analysis, I recommend that you start with the Subsequent Events note, which, if included, is typically listed at the very bottom of a company’s financial statements. Given the length of time it can take to prepare financial statements, it is not uncommon for major corporate events to occur between the end of a reporting period and the publication of a company’s results that may dramatically impact how you interpret their numbers. This section may reveal information key to your analysis of a company, such as the closing of a major capital raise which has shored up their cash position, the laying off of a considerable amount of their workforce, or an amendment to their debt facilities which may limit their ability to borrow.

(Note that the bolded note titles used above may vary slightly from company to company, so it is always best to scroll through the note titles yourself as opposed to punching these into a search bar. Many companies provide a table of contents listing their accounting notes which can save you some time, but this isn’t universally practiced – so you might be stuck scrolling.)

Information for this commentary was found via Sedar. The author has no securities or affiliations related to this organization or any organization mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

thanks boss