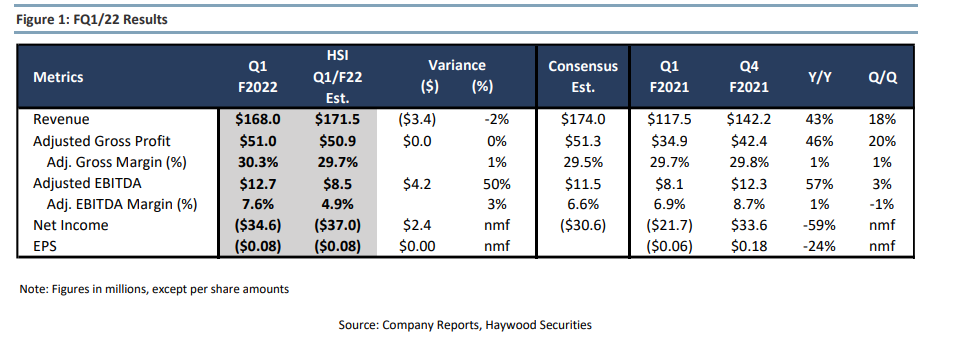

On October 7, Tilray Inc (TSX: TLRY) reported their first quarter financial results for the period ending August 31, 2021. The company reported revenues of $168.02 million for the first quarter, up 43% year over year.

Gross profits for the quarter came in at $50.9 million, up 46% year over year, but general and administrative costs grew 91% over the same period to $49.5 million. Cannabis revenue dropped from 44% of the total revenue to 42% of the total revenue, equaling $70.45 million. As expected, the company reported a net loss for the quarter of $34.6 million or earnings per share of negative $0.08.

A number of analysts lowered their 12-month price target on Tilray after the results, bringing the average 12-month price target to $14.25, down from $17.45 prior to the results. Tilray currently has 20 analysts covering the stock with 2 analysts having strong buy ratings, 3 have buys, 13 analysts have holds and 2 have sells on the stock. The street high sits at $27 while the lowest comes in at $1.27.

Haywood Capital Markets was one of the firms to lower their 12-month price target, dropping it to $12.50 from $13.50, while reiterating their hold rating on the company, saying that the quarter generally came in-line “but [they are] taking a cautious look on growth.”

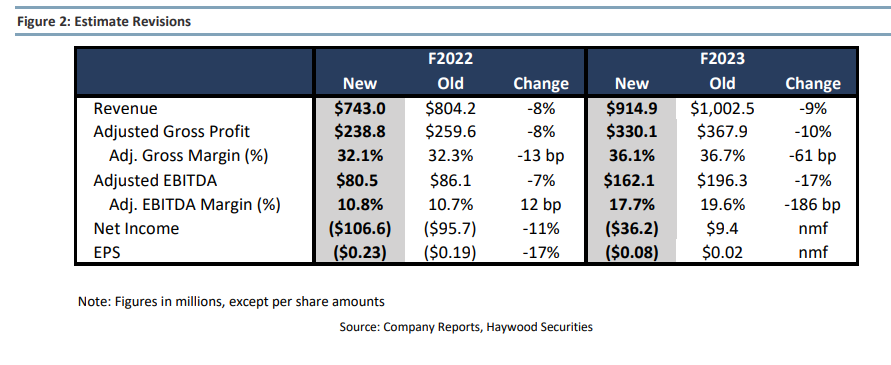

Haywood revised their fiscal 2022 and 2023 estimates lower “to reflect a more conservative top-line growth profile.” They believe that Tilray’s market share of the Canadian adult-use market will grow slower due to increased competition, while the rise of COVID-19 variants “has slowed the global re-opening which has also impacted the cannabis segment but also Tilray’s SweetWater and Wellness operations.”

Below you can see Haywood’s estimates for the quarter. Tilray’s revenue came slightly below their $171.5 million estimate while beating all other estimates, saying that the 18% quarter-over-quarter growth primarily came from a 31% increase in their cannabis segment. They note that with Tilray reporting another quarter of positive adjusted EBITDA, it marks their 10th consecutive quarter. They additionally highlight that management noted that distribution revenue was impacted by roughly $5 million due to facility closures by flooding in Germany.

Below you can see Haywood Capital Markets updated estimates for FY2022 and FY2023.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.