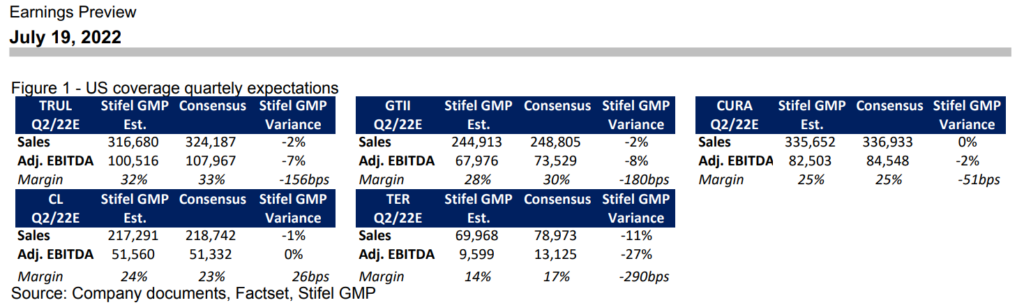

Earlier this month, Stifel-GMP came out with their US cannabis second quarter preview, calling the bottom on the drawdown but resetting their estimates for many cannabis names in their coverage to include “limited to no sales growth across most markets.” The analysts say that an elevated recession risk, challenging macro environment, and price compression/margin erosion are being added to the list of headwinds potentially affecting the sector as the reason for the resetting of expectations.

Though Stifel believes that some of these potential headwinds will be offset by a better geography mix and thinks that the moat is widening for those who, “enjoy greater access to capital, robust cash generation potential, and the ability to capitalize on distressed assets to fill white space.” They reiterate their bullishness on the sector as a whole.

Heading into the second quarter results, Stifel says that Curaleaf Holdings (CSE: CURA) is their favourite and tells investors to be cautious on TerrAscend Corp (CSE: TER) while saying that Trulieve Cannabis (CSE: TRUL), Cresco Labs (CSE: CL), and Green Thumb Industries (CSE: GTII) are all the second half of 2022 stories. They believe that Curaleaf is the company with the highest chance of exceeding expectations for the second quarter. While they comment that Terasecnd is basically too hard to forecast, putting it in the penalty box this quarter as a result.

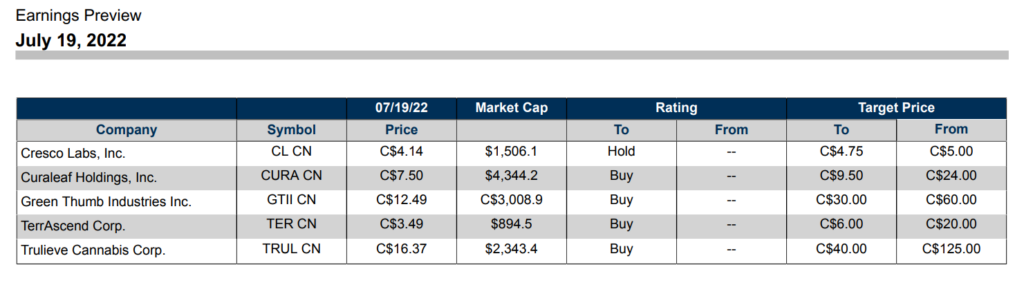

Below you can see Stifel’s updated price targets and ratings; most notably, Trulieve and Green Thumb’s price targets got absolutely pummelled, dropping from $125 and $60 to $40 and $30, respectively.

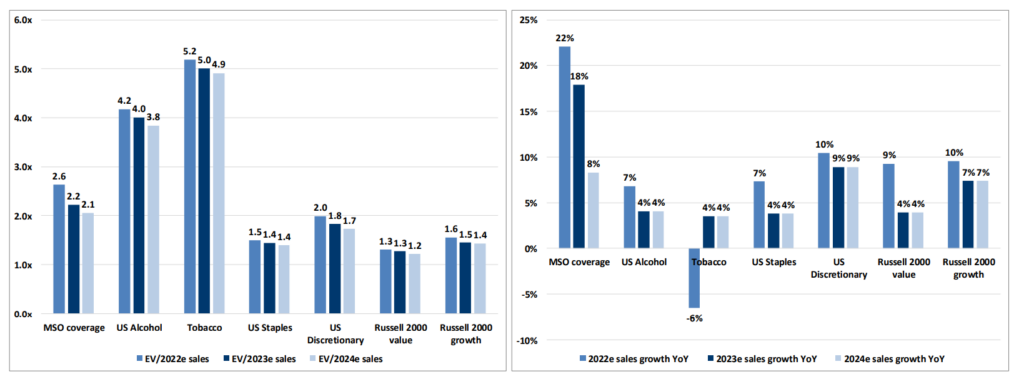

The cuts come after Stifel started to right-size their assumptions while also “considering the rising rate environment and the valuation re-rating of the broader market,” and used the alcohol industry as their guide for multiples.

On the price headwinds potentially facing these companies, Stifel believes it will be the East Coast states that will be hit the hardest when price compression happens due to the delta between legal and illicit pricing. As a result, they are factoring in price compression for all of 2023 and 2024. Though they add that some companies will be able to offset this headwind due to volume growth and continued CAPEX investments in other limited license states. They write, “margin expansion mainly stems from better geography mix with NJ and IL leading the way and rising vertical integration making accretive contributions.”

Stifel believes that the market is currently pricing in 280E and won’t be going away for some time, though they believe that long-term investors should assume that 280E is “eventually addressed.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.