As many states across the US began lifting non-essential business restrictions and stay-at-home orders in May, Americans were eager to leave their house and spend what income they had left on the consumption of goods and services.

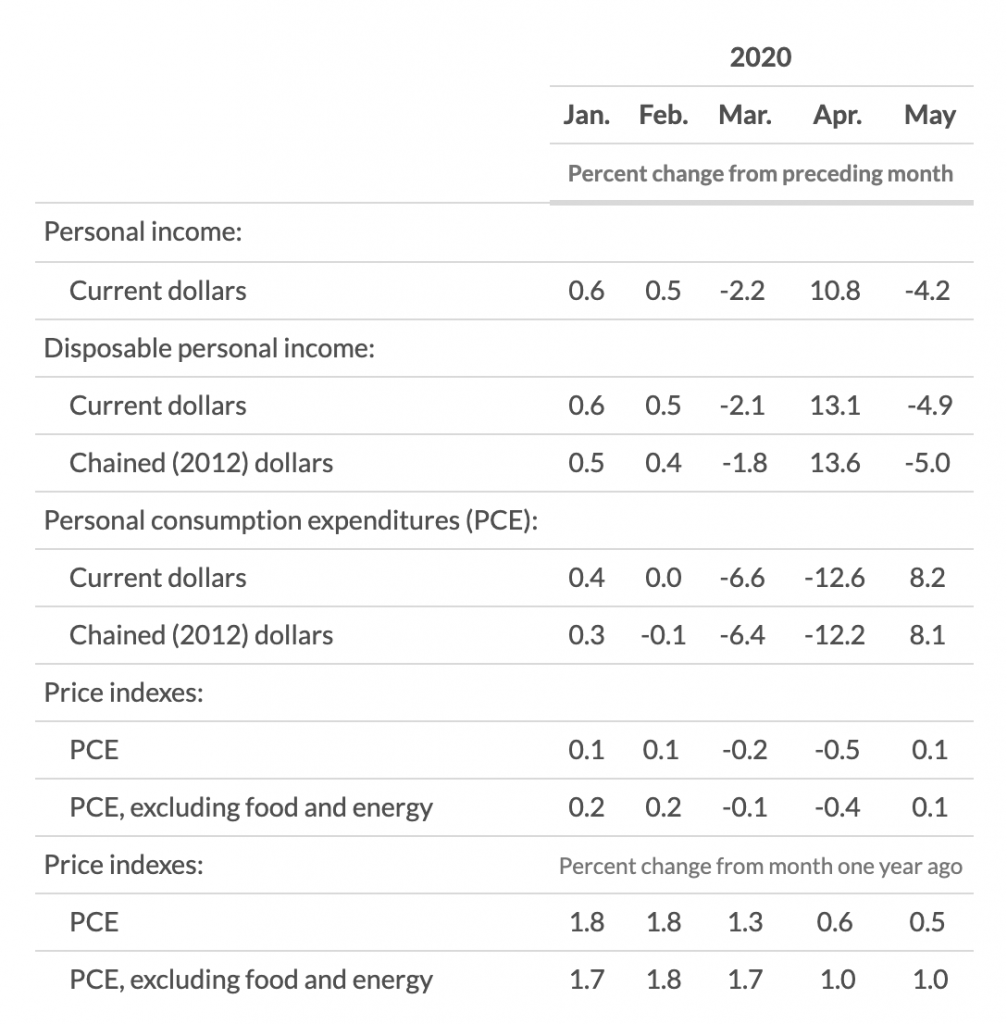

According to a recent report released by the Commerce Department, the month of May saw consumer spending increase by 8.2% – the most on records that date back to 1959. The surge in consumption comes after a 6.6% decline in March, preceded by a 12.6 drop in April, when the recession was set off. As states began reopening their economies, consumers have been mostly indulging on recreational goods and dining out.

On the contrary however, the report also found that simultaneously to the increase in spending, personal incomes have fallen by 4.2% in May. Comparatively, personal incomes surged by 10.5% in April, when many of the government-funded stimulus checks were distributed.

The polarizing results suggest that Americans will soon have their personal incomes dwindle away even more, given that stimulus funding is slated to soon run out. At the end of July, the $600 weekly supplemental unemployment benefits will reach expiry, ultimately leaving millions of Americans in a state of financial difficulty.

Information for this briefing was found via The Washington Post and the Department of Commerce. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.