The US Justice Department has opened a far-reaching criminal probe into short-selling activity by hedge funds and research companies, in an effort to determine whether they unlawfully coordinated trades or broke rules for profit.

According to Bloomberg which cited people familiar with the matter, the DOJ’s fraud division in Los Angeles has begun to investigate how hedge funds access research and exercise their bets, especially ahead of short-selling reports that have the potential to move stocks. In particular, the DOJ is exploring the relationships between hedge funds and researchers, in an effort to uncover potential signs of money managers collectively engineering to ignite stock drops or insider trading.

The inquiry is said to be wide-ranging, and will examine trading across multiple short-selling targets, including Luckin Coffee Inc., Banc of California Inc., Mallinckrodt Plc., and GSX Techedu Inc. Likewise, the DOJ will also be looking into the practices of money-managing funds, including Toronto-based Anson Funds, Andrew Left’s Citron Research, and Carson Block’s Muddy Waters Capital.

Hedge funds typically initiate deals with researchers in an effort to gain new insights into potential corporate dilemmas, often times paying sizeable money just to become the researchers’ main source of funding. Attorneys leading the probe are attempting to determine whether or not short-sellers deceived markets by disregarding author confidentiality agreements to coordinate stock declines and spark investor panic to intensify stock selling.

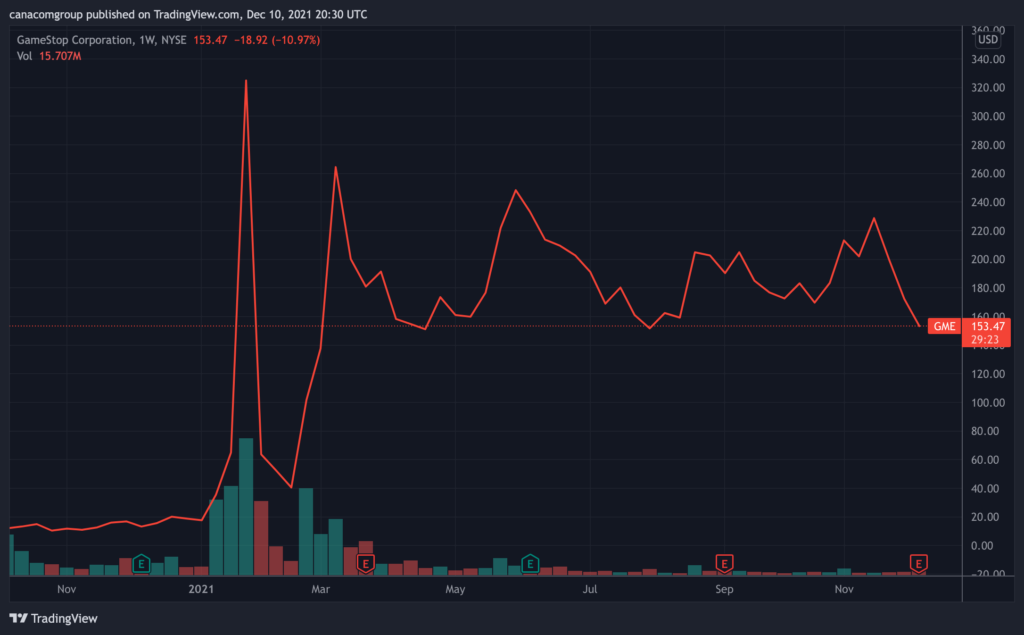

The DOJ’s latest probe follows a bout of heavy scrutiny from lawmakers, who called for a deeper insight into short-selling after January’s unprecedented meme stock frenzy. Within one week, retail investors drove up the price of heavily-shorted stocks including GameStop and AMC Entertainment, before brokerages embarked on taming bets. Some retail investors argued that hedge funds were illegally using asymmetric information to push stocks lower.

Information for this briefing was found via Bloomberg. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.