The coronavirus pandemic has created significant global shortages of numerous commodities, causing spot prices to soar to near-record highs. The latest shortage to grapple the commodities market has been steel, as a number of US manufacturers face struggles to meet new and pent-up demand.

According to a recent report by Reuters, numerous US steel manufacturers have been experiencing difficulties in procuring hot-rolled and cold-rolled steel from mills, sending spot prices surging to new highs. The latest supply disruptions have been significantly impacting vehicle and appliance manufacturers which demand hot-rolled steel, as well as aerospace manufacturers that require cold-roll steel for production.

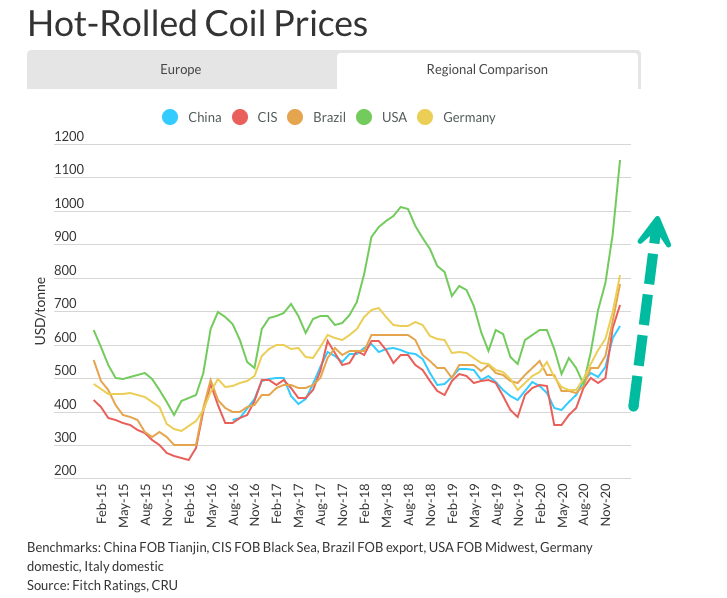

The previous quarter saw unfilled orders for steel soar to the highest level in nearly five years, while inventories sank to a 3-year low. As a result, steel spot prices for hot-rolled steel increased to $1,176 per ton in February— the highest in 13 years. In fact, the demand for hot-rolled steel in the US has been so profound, that steel prices in the US are rising by the most compared to the rest of the world.

One of the main reasons behind the lack of steel supply in the first quarter of 2021 is due to the lingering effects of mill shutdowns at the onset of the pandemic, and their subsequent slow restart once restrictions were lifted. The surging steel prices also pose significant implications for steel-consuming manufacturers, many of which have been suffering from decreasing margins.

Since the beginning of August 2020, US steel prices have risen by 160%, forcing steel consumers to chose between absorbing the massive price hikes or passing them along to secondary consumers via additional costs. As noted by Reuters, Whirlpool last month warned that the rising steel costs will cause the appliance manufacturers’ profit levels to fall by at least 150 basis points in 2021. Similarily, crane maker Terex, and farm equipment manufacturer AGCO have increased their prices to offset the growing price of steel.

The rising steel costs have forced many producers to voice their concerns, after capacity utilization rates at steel mills increased by up to 75%, following a decline of 56% in the second quarter of 2020. “Our members have been reporting that they have never seen such chaos in the steel market,” said Coalition of American Metal Manufacturers and Users executive director Paul Nathanson. As a result, the group, which supports over 30,000 companies across America’s manufacturing sector, in February called on the Biden administration to unwind former President Trump’s steel tariffs in order to increase supply.

Information for this briefing was found via Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

A shortage of steel goes way beyond what you mentioned here. Automobile manufacturers are not the only ones who need high quality steel, we’re talking forest industry need for knives “ lathe and chipper knife etc”, tool manufacturers, building construction and many more.