Following last week’s eye-watering CPI print that even prompted Joe Biden to quell market fears, this week’s producer prices EXPLODED by the most on record, substantially exceeding expectations and further cementing the narrative that inflation is here to stay.

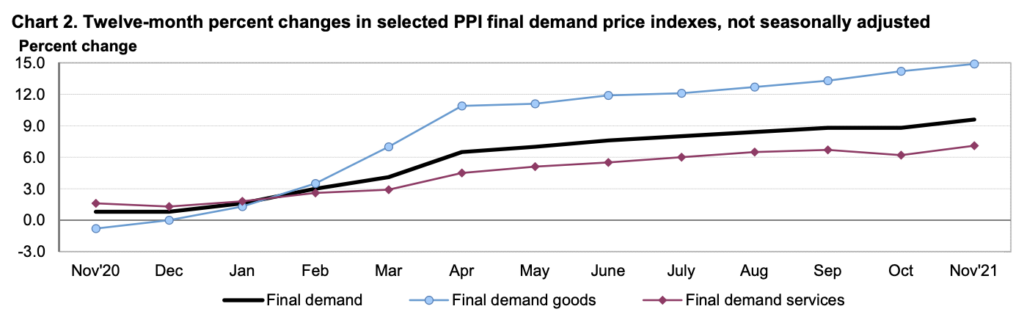

Wholesale prices skyrocketed by the sharpest pace on record in November, signalling that inflationary pressures continue to be persistent throughout the entire economy. According to the Bureau of Labour Statistics, the producer price index jumped another 0.8% last month to an annualized 9.6%, surpassing forecasts calling for a 9.2% increase. Likewise, core PPI, which excludes volatile components such as food and energy increased 0.7% month-over-month, and was up 7.7% from November 2020— also a record-breaking jump.

Both goods and services prices were up last month, with energy and transportation costs leading the increase. Final demand for goods rose 1.2% from October, while services inflation jumped 0.7% last month— substantially higher than the prior month’s increase of 0.2%. Looking under the hood, prices for iron and steel scrap rose 10.7%, while the index for energy prices jumped another 2.6% last month.

Last month’s PPI increase was the largest on records dating back to 2010, and further underscores concerns that inflation is not abating anytime soon. Costs of raw materials, transportation, and labour have been rising significantly, forcing businesses to pass on the higher costs to consumers. The acceleration in prices has also created added pressure on Federal Reserve policy makers to wind down the monthly rate of bond purchases, as well as raise interest rates ahead of previous forecasts.

Information for this briefing was found via the BLS. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.