On April 8th, Verano Holdings (CSE: VRNO) announced their full year 2020 and fourth quarter results, with the results being their first quarterly report as a public company and they did not disappoint. The company reported full year pro-forma revenue of $355 million, a ~200% increase year over year. They had a 63% gross profit and a 48% EBITDA margin, while operational cash flow was $151 million and free cash flow was $53 million for the year.

Verano currently has five analysts covering the company with a weighted 12-month price target of C$36.60. This is up slightly from the average before the results, which was C$34.25. One analyst has a strong buy rating, while the other four have buy ratings. The street high comes from ATB Capital Markets with a C$42 price target, while Echelon Wealth has the lowest at C$33.

In Canaccord’s note, Matt Bottomley, their cannabis analyst, reiterates their C$35 price target and speculative buy rating saying that Verano issued solid results after a bunch of M&A. Bottomley says that the results basically came in line with their estimates.

Canaccord says that, based on their calculations, they believe fourth quarter revenues were $113 million, which is a run rate of $452 million, before factoring in its recent M&A activity in Arizona, Pennsylvania, Illinois, and Ohio. Bottomley says that the majority of their revenue came from Illinois and Florida, which are regarded as some of the highest margin states. He writes, “Verano achieved one of the highest gross margin profiles among MSOs in 2020.” They also calculate that EBITDA for this quarter came in at $40 million, which he writes, “places the company with a top-five EBITDA line among its MSO peers as at the end of 2020 and one of the highest-margin profiles in the sector to date.”

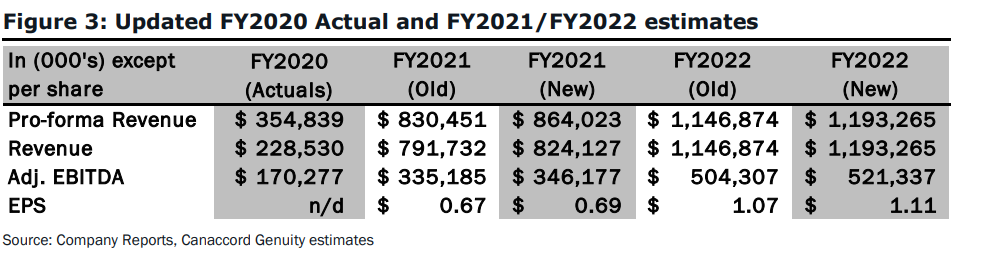

Canaccord additionally makes note that Verano has come out swinging, with the firm being one of the most acquisitive companies that just came public. Bottomley has upgraded their forward estimates which you can see below.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.