We begin our extended metaphor in August of 2017, when first mover potcos were the masters of the legal marijuana universe. As the holders of ultra-scarce cannabis licenses (only 55 licenses had been issued in Canada at the time), the big licensed producers were de-facto apex predators.

Competition for capital – the life blood of any venture organism – might as well not even exist. Through a symbiosis with the banking and brokerage sharks in the ecosystem, the licensed producers raised and feasted on billions of dollars of invested capital, and gained enormous valuations as prospective future controllers of a multi-billion dollar per year legal vice business.

A thriving, capital-rich ecosystem develops a variety and multitude of second tier life, able to survive and thrive selling the opportunities that are too small to be classified as large predators, but still have plenty of growth potential in an environment set to expand and change rapidly.

We’re talking about a capital ecosystem here, which is a different thing altogether from a notional, functional business ecosystem, making the ocean an imperfect metaphor. In such an ecosystem, these companies would be buying and selling goods and services to each other and to the consumer to generate income inputs sufficient for it to sustain itself. It would go through seasons, have transient occupants, become more diverse as it developed, etc.

It would also have grown from the bottom up, with the top predators only having developed when there was enough below them to feed on. The capital ecosystem is more like a fish tank. It needs the artificial input of outside capital to keep going. When it doesn’t get any, it slows down and starts dying, and we’ll get to that eventually. For now, the apex “predators” of the 2017 fish tank began stashing some of the capital they’d grabbed up at the surface in the second tier enterprises that form the middle of the food chain.

A brisk trade existed in the middle, so private cannabis enterprises were being created at pace. One such enterprise, HydRX Farms LTD, managed to get backed by Aphria Inc. (TSX: APHA) (NASDAQ: APHA) with $11.5 million in operating and development capital in the form of secured convertible debentures. HydRX Farms presented itself as a cannabis-flavored medical research venture. It was licensed soon after being financed by Aphria in September of 2017, and began operating a Whitby, ON research and extraction facility.

HydRX’s web presence indicates that it banked on creating cannabis-pharma products in a lab that was “GMP compliant” (but not GMP certified). Whether the plan was to license their created elixirs out to larger entities, or to sell the products under their own brand, or to jump through the certification hoops and sell the facility is unclear.

HydRX never went public, and never filed any documents that articulated a plan or outlook. There survives a website for “Scientus Pharma,” an apparent trade brand, and one for “Medisenol,” a brand of oils dressed up to look like pharma drugs. The aforementioned lack of filings makes it impossible to know if the company ever sold any Medisenol, but the fact that the note had its maturity date extended, and was then defaulted on without the debtor having made a single payment, is an indication that it did not.

Presumably, the default gives Aphria a call on HydRX’s Whitby, ON extraction facility and the licenses that go with it, but Aphria isn’t interested. HydRX couldn’t make itself into anything attractive to investors in 3 years, and there’s no reason to believe it will start any time soon. Investors sophisticated enough to understand Aphria can see HydRX for what it is: a money-losing business that amounts to an un-funded turnaround cost and increased risk. Aphria is a predator, and this lifeless carcass is dead weight, ready to float downwards where the scavengers and fungus can further break it down.

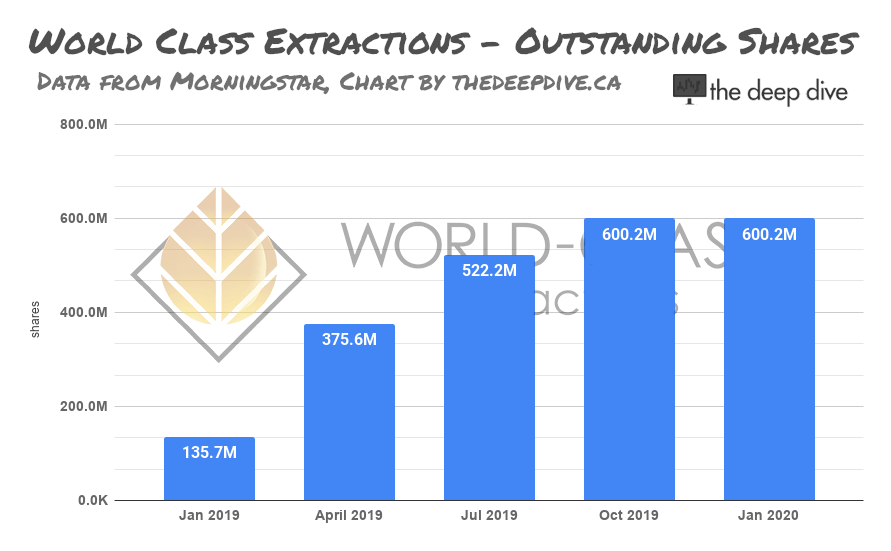

World Class Extractions (CSE: PUMP) is a $18 million company that bills itself as an extraction services provider and equipment maker, despite no evidence of it conducting any significant activity in those sectors. Last quarter, it booked $75,000 in revenue to create a net loss of $3.5 million. It is the successor to Quadron Cannatech (formerly, CSE: QCC), absorbed into PUMP in 2019, along with CEO Rosy Mondin. Mondin has had more time to focus on PUMP since leaving the former Pasha Brands (Now BC Craft Supply Co. (CSE: CRFT)) in a mass exodus that preceded the company’s halting, roll back and further fall to irrelevance. We used the company as an example of an obvious paper mill in our Biotech Boom Playbook Pt.2 post.

World Class Extractions informed the market via a July 29th press release that it has come to an agreement to purchase HydRX’s secured debt off of Aphria for $5 million. Where PUMP would come up with that kind of cash is unclear. Its most recent financial statements showed $7 million cash, but that was back in January, and PUMP burns $1.8 million – $3.5 million a quarter. Raising $5 million at its current 3 cent share price would print 166 million shares to go with the 620 million outstanding (PUMP is due to file its year end financials by August 28th, but if there’s a COVID extension available, bet on a delay).

The proposed purchase of the HydRX debenture would happen at a 43% discount to its face value and a 10% discount to its book value, and occur in a PUMP subsidiary called “Cobra” that does not appear as a PUMP asset in the January financials. The press release describes Cobra as a 50/50 joint venture between PUMP and First Republic Holdings Corp., “the investment holdings company of Richard Goldstein and his family,” and goes out of its way to draw a distinction between FRHC and First Republic Capital Corp., a Toronto exempt market dealer owned by FRHC, and make it clear that FRCC has no intent to own any part of this rotting carcass of a note.

The market didn’t think much of this World Class bottom feeder’s apparent score. PUMP traded around 207,000 CSE shares on the day the news dropped to close at 0.035, well below its daily average of 1.9 million shares, and fell to $0.03 the next day on 900,000 shares.

The abject lack of interest is an indication of just how stale and lifeless the cannabis capital tank is at the bottom. The bumbling, fat, financially illiterate fish that were once fooled by these types of beat up carcasses enough to take a bite, get poisoned, and be picked apart by these scavengers as they die have long been eaten. The notion that HydRX, who couldn’t pay Aphria a dime of what they owed, are somehow going to fork out $11.5 million to PUMP over any period of time isn’t believable, and the notion that World Class Extractions could make anything at all out of its assets is even more far fetched. It can’t even make the assets it has work or grow.

But, as the saying goes, a fish has to swim. We expect to see a push from PUMP in the dismal smallcap media parasites still shameless enough to be associated with this bottom feeder. At $0.03 (or perhaps a rolled-back equivalent), it will make a pitch about having bought the potential ownership of a lab with plenty of upside, and test its luck with the sunlight-starved long-shot-junkie crowd who would be feeding money into slot machines right now if it wasn’t for the COVID shut-down. The bait will present better if it RTOs Cobra into its own shell to make it look fresh, but it won’t make the business case any less foolish. If such an entity does show life at the bottom of the tank, don’t confuse it for strength in the ecosystem. It’s just the food chain settling downwards, metabolizing the waste into mud.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to these organizations. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

3 Responses

LMFAO been googling for any kind of information about this one and I can relate to almost being the one feeding coins into slot machines if it was not for covid. I am not gambling but on stocks lately I found myself sniffing at the very worst of the market to hopefully find something with a fragrance. Thanks for sharing the information that gave me (a swede) insights of the market. Some stuff I already knew and of course PUMP was not really looking bright but still perhaps good enough to put some money in. I take your word for it. They will hardly get their products on the market and become profitable anytime soon. Good luck to anyone making the bet, I keep looking for my graphite and other minerals and will place some bets there. Probably not getting lucky there either but the chances seem bigger in that area early aug 2020..

Thanks for reading!

ouch