On January 13th, Yamana Gold Inc. (TSX: YRI) announced its preliminary fourth quarter and full year 2021 operating results. The company reported fourth quarter production of 2240,718 ounces of gold and 3,142,781 ounces of silver. Bringing the total full-year production to 884,793 ounces of gold and 9,169,289 ounces of silver. Full year 2021 guidance was 862,000 ounces of gold and 10,000,000 ounces of silver.

Yamana Gold currently has 17 analysts covering the stock with an average 12-month price target of US$6.41. Out of the 17 analysts, 5 have strong buy ratings, 8 have buy ratings and 4 have hold ratings. The street high sits at US$8.98 while the lowest 12-month price target comes in at US$5.

In BMO Capital Market’s note, they reiterate their $8 12-month price target and outperform rating, saying that the company had strong fourth-quarter production and growth catalysts are ahead.

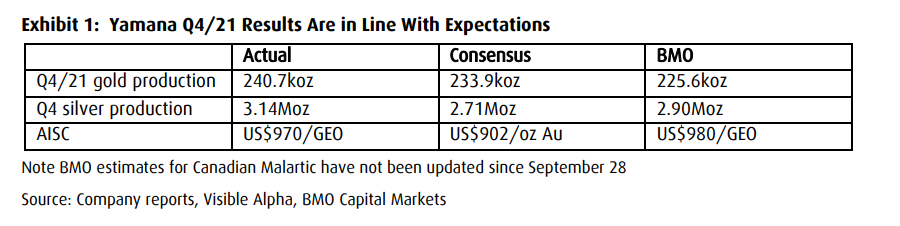

For the production results, Yamana’s gold production came in slightly higher than the 225,600 estimate from BMO, while silver production came in slightly higher than their estimate as well. Costs came in lower than BMO’s estimates with costs of US$970 per GEO compared to the US$980 BMO expected, however consensus was US$902 per ounce.

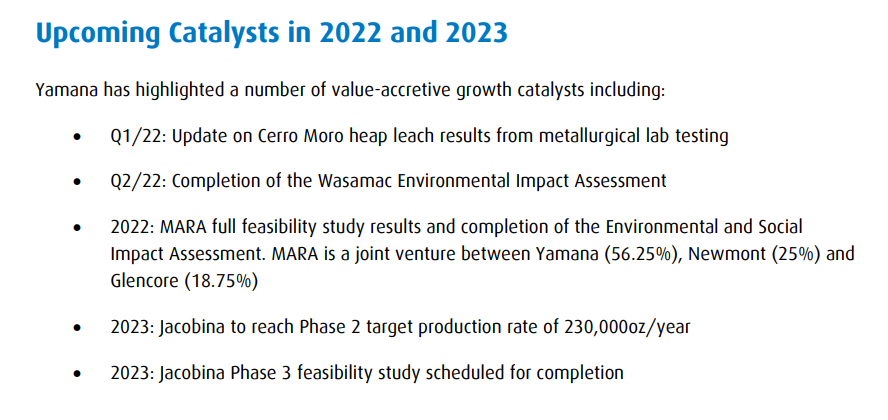

Lastly, BMO says that the company has a strong balance sheet that will support its future growth initiatives, as it has US$305 million in cash and equivalents, which is expected to be reinvested into a number of 2022 and 2023 catalysts which you can see below.

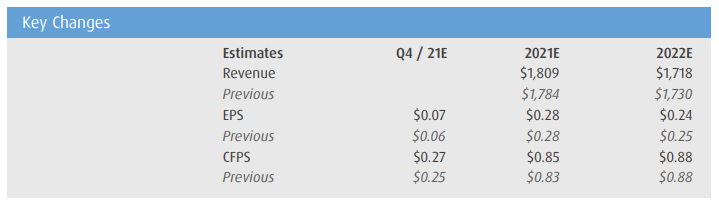

Below you can see BMO’s updated fourth quarter and full year 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.