While other multi-state operators are looking to get in to the Oregon market, it appears that Acreage Holdings (CSE: ACRG) wants out. The firm last night filed an 8-K, indicating it had sold off the last of its assets within the state.

The company has sold the last four of its Oregon retail dispensaries, with Chalice Brands (CSE: CHAL) picking up the assets off the firm for a total figure of $6.5 million. The retail locations, branded as Cannabliss & Co, will immediately be placed under a management services arrangement with Chalice, until regulatory approvals enable the formal transfer of ownership of the locations.

Consideration for the four dispensaries takes the form of cash and a promissory note. $250,000 is to be paid at the time of signing in cash, while the remaining $6.25 million is to be paid via a 10-month promissory note.

Interestingly, the note extended to Chalice is on better terms than most of the debt currently held by Acreage. The note is to bear interest at a rate of 5% per annum for the first five months of the note, with the note then increasing to 10% interest for the final five months.

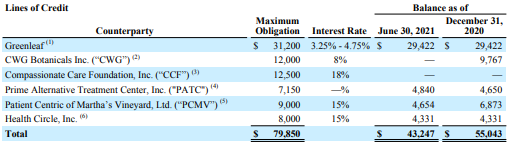

Recent filings by Acreage meanwhile indicate that it typically pays between 15% and 18% on its own debt, with just one line of credit, owed to Greenleaf, currently being under that mark. In terms of hard debt, the company currently has outstanding debt at 6.1% and 7.5%, however both of those loans are classified as being related parties.

With the closing of the arrangement, Acreage no longer has operations within the state of Oregon.

Acreage Holdings last traded at US$2.35 on the CSE.

Information for this briefing was found via Sedar and Acreage Holdings. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.