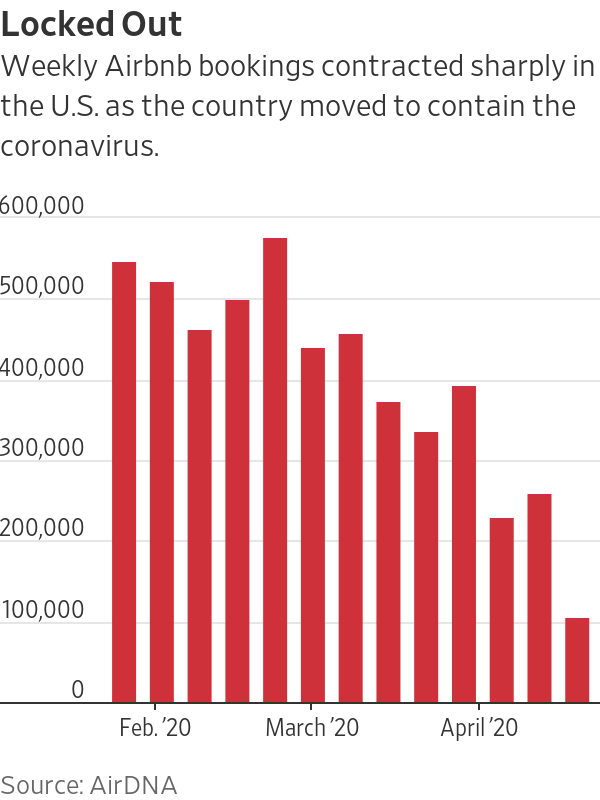

As the coronavirus pandemic continues to ravage economies around the world, some industries are being bit harder than others. One of those hard-hit industries include the travel and hospitality industry, which has seen a sudden and drastic decline in consumerism to the point that many companies are facing significant financial ruin. Airbnb, a popular hospitality provider, has recently run into trouble with its Superhosts whom have suddenly become over-leveraged due to nearly non-existent new bookings amid the coronavirus.

Previously, the financial troubles were merely isolated to Airbnb’s accommodation providers; now however, the entire company has found itself in jeopardy. Airbnb’s CEO, Brian Chesky, has recently issued a harrowing statement, in which the company will lay off 1,900 of its 7,500-strong workforce. Then, the company will also halt all work projects on luxury stays, hotels, as well as its transportation division.

Airbnb’s US-based employees which are getting laid off will be given 14 weeks worth of base pay, with an additional week added on for each year the employee has been with the company. Furthermore, a full-years’ worth of healthcare coverage will be added to the severance package, in addition to increased equity eligibility as well as job searching supports.

Just last month, Airbnb announced to its employees it would discontinue its marketing strategies, impose a hiring freeze, and reduce executive’s salaries as well as suspend bonuses in 2020. However, that was not enough to keep the company from falling into further financial trouble as the coronavirus pandemic rages on.

Information for this briefing was found via CNBC and AirDNA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.