Nationwide lockdowns have ravaged the US economy, significantly reducing a multitude of industries to bare bones. One of the industries hit the hardest amidst the coronavirus pandemic has been the travel and hospitality industry, of which a significant hit has been laid upon Airbnb superhosts.

Airbnb is an online company which connects homeowners willing to rent their space with consumers in need of accommodations in a certain locale. Since Airbnb provides guests with an alternative to costly hotels, it has become an ideal form of accommodation for those needing short-term rentals or just a place to crash for the night. Simultaneously, homeowners are able to earn additional income via renting out extra rooms in their homes. Airbnb increased in popularity as homeowners realized the potential in earning a significant income if they were to rent out an abundance of properties.

People then began to build large real estate portfolios for the sole purpose of generating revenue via short-term accommodations. Those individuals progressed to Superhost status, providing above and beyond experiences for their guests – including luxuriously-outfitted rooms on premium properties. Many of those Superhosts went into extensive debt, acquiring copious amounts of property all in the name of generating a pretty profit. However, all of that has been turned upside down as travel restrictions and mass panic reduced Airbnb bookings to virtually zero.

Now, those over leveraged Superhosts have found themselves in significant troubles, as many of them are reliant on rent revenue to pay for the extensive mortgages. A large portion of the Superhosts have built up empires revolving around revenue from their rental properties, but are now struggling to meet their debt obligations – including cleaning services, property maintenance workers, and interior designers.

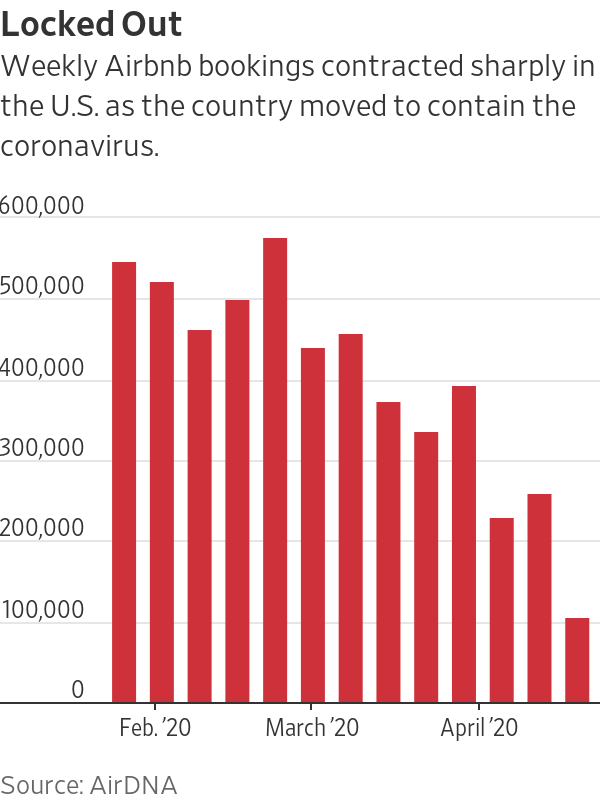

Since mid-March, Airbnb has lost upwards of $1.5 billion in bookings, and had to issue refunds to guests whom were unable to use the accommodations due to implications from the coronavirus pandemic. The company was able to secure a private $1 billion loan from institutional investors, but that does little for hosts who are indebted to numerous properties.

According to AirDNA, a firm focusing on analyzing Airbnb rentals, a third of all Airbnb hosts have more than 25 short-term rental properties – which surely generate a generous profit in times of economic stability. Right now however, those hosts are realizing they had made a deal with the devil, given that pre-pandemic profits are no longer on the five-star menu.

Information for this briefing was found via Wall Street Journal, Zero Hedge, and AirDNA. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

4 Responses

I have only one small cottage on my small property which I rent to supplement my seniors income. I have no sympathy with those who have changed the nature of Airbnb by buying up multiple properties to milk the system . It’s those people who have taken rentable housing to all time lows And pushed up prices for normal people.

This is starting to look like the Great Depression.

You can say that again! This is going to crush the real estate market.

Shocking. All these millennials buying properties without understanding risk.