Close to a year after the US Department of Justice opened an investigation into the collapse of hedge fund Archegos Capital Management, a New York court issued an indictment and ordered the arrest of the fund’s owner Bill Hwang and CFO Patrick Halligan among others.

Federal prosecutors filed a complaint against the former top honchos of the failed hedge fund related to the latter’s US$10 billion collapse last year.

According to the authorities, the defendants used the firm as an “instrument of market manipulation and fraud,” as well as inflated its portfolio to US$35 billion from US$1.5 billion in a single year.

Hwang’s lawyer confirmed the arrest but declined to comment when asked while Halligan’s lawyer claimed her client “is innocent and will be exonerated.”

Bill Hwang arrested over allegations of a racketeering conspiracy to boost returns, per @nytimesbusiness, @MattGoldstein26

— Nate Anderson (@ClarityToast) April 27, 2022

Can't wait to read this indictment pic.twitter.com/DwvorDHbun

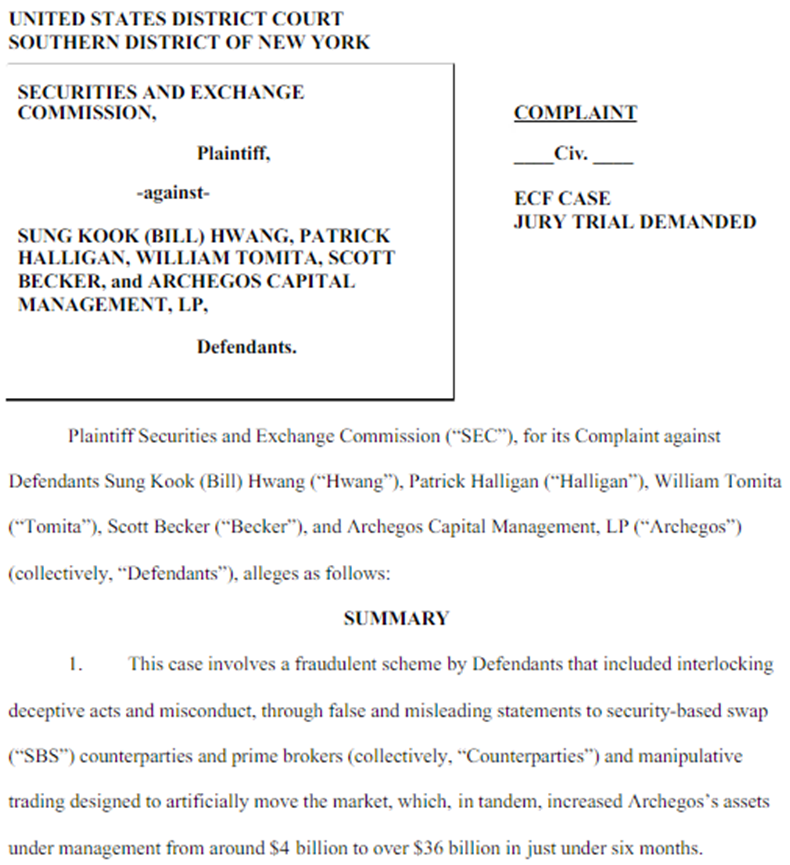

The US Securities and Exchange Commission also filed a separate civil complaint against Hwang, Halligan, and two other executives of the hedge fund. The agency alleges the defendants coopted a “fraudulent scheme” to bloat the firm’s “assets under management from around $4 billion to over $36 billion in just under six months.”

Around March 2021, the fund defaulted on its margin calls causing several major global banks to pull out their investments for a total US$30 billion quick selloff. The event caused a sharp decline in Wall Street’s indices. Soon after, the hedge fund prepared to file for bankruptcy.

Bill Hwang's RIDICULOUS year, as officially documented by the U.S. DOJ:

— Sridhar Natarajan (@sridinats) April 27, 2022

Hwang's personal fortune grew from $1.5 bln to **$35 billion** within a year. The total size of Archegos's market position with the use of leverage increased from $10 billion to **$160 billion** at its PEAK. pic.twitter.com/7jmL51SgjU

Hwang and Halligan are expected to appear before the Manhattan court within the day.

Information for this briefing was found via Bloomberg, The New York Times. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.