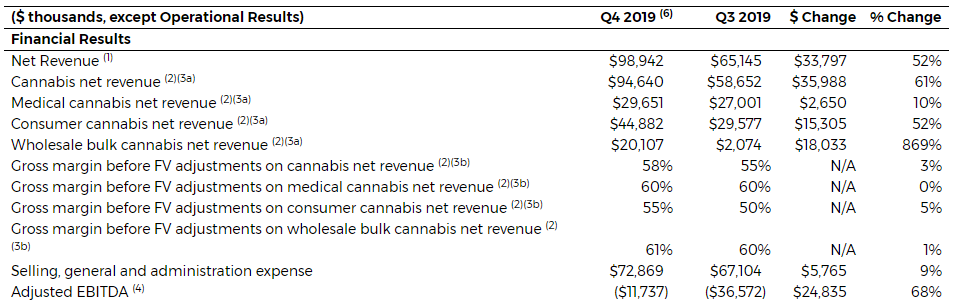

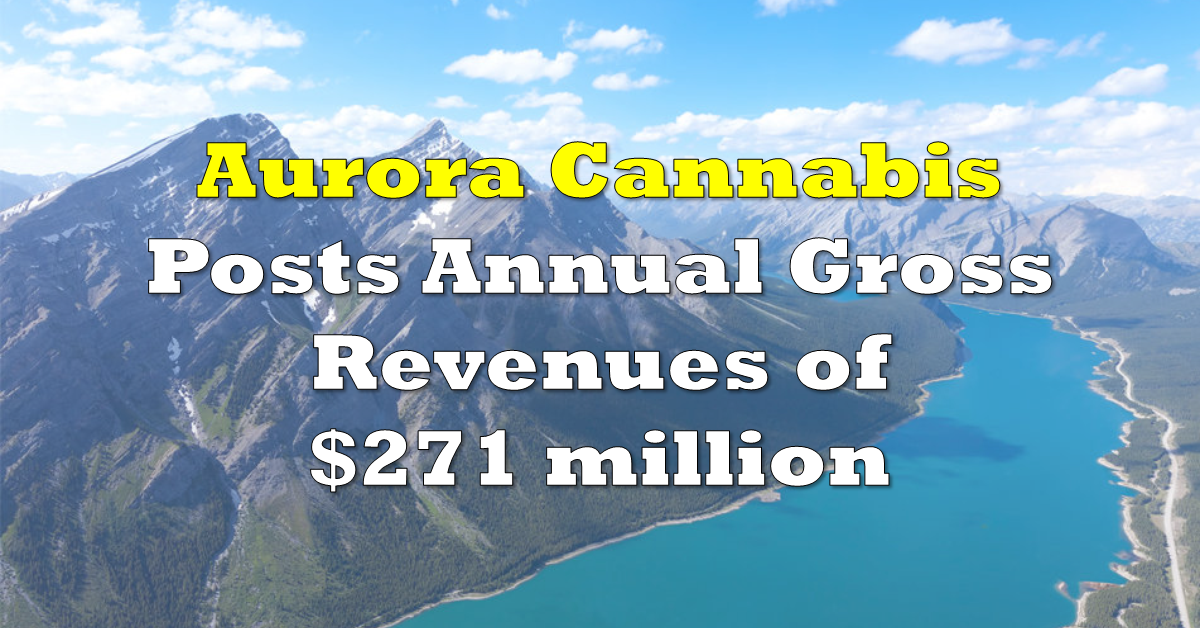

Aurora Cannabis (TSX: ACB) (NYSE: ACB) posted its fourth quarter financials after the bell today, recognizing $98.94 million in net revenue, $94.64 million of which is attributable to the sale of cannabis. Total revenues saw a 52% increase over the prior quarter.

On a per gram basis, Aurora’s cost of production fell 20% to $1.14 per gram during the period, down from $1.42 seen in the third quarter. However, the average selling price per gram decreased 16% during the same period, from $6.40 to $5.32. The decrease is largely attributable to wholesale sales during the quarter which consist of lower margin due to bulk quantities. Total kilograms produced during the quarter increased to 57,442 kg, while the firm sold 36,628 kg during the period.

Despite the increase in revenue, Aurora Cannabis posted an adjusted EBITDA loss of $11.7 million for the quarter, despite previous claims of a potentially profitable quarter. The firm had changed guidance slightly in August that suggested they may not post a EBITDA positive quarter. Overall loss. The company did not provide a net loss figure for the quarter.

On an annual basis, Aurora Cannabis posted $247.93 million in net revenues, compared to FY2018’s revenues of $55.19 million. Expenses were also significant however, with Aurora spending $474.05 million in FY2019 to generate revenues, with an overall net loss of $297.92 million, or -$0.29 per share. The previous year had seen a net income of $69.22 million, or $0.16 per share.

It should also be noted however that the total shares outstanding increased significantly over the same time period, with the end of 2018 having 568.11 million shares outstanding, compared to a current outstanding share count of 1,017.43 million.

Looking towards the balance sheet, Aurora Cannabis currently has a war chest of $172.72 million in cash, and an additional $46.06 million in restricted cash. This figure is down from $346.66 million and $43.55 million at the end of the third quarter. Meanwhile, accounts receivable increased from $71.26 million to that of $103.49 million, while inventory increased from $82.70 million to $113.64 million.

Comparatively, accounts payable increased from $90.14 million to $152.88 on a quarter over quarter basis. Notably, the firm also increased its convertible debenture liability to $235.90 million as the March 2018 debentures near their due date on March 9, 2020 due date. A total of $229.80 million remains due on the debt which converts at a price of $13.05 per share.

Aurora Cannabis closed at a price of $5.88 in after hours trading on the New York Stock Exchange.

Information for this briefing was found via Sedar and Aurora Cannabis. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Galaxy Brain: Aurora Charting a Course through the Cannabis Supply Glut

For this weekend’s special piece, Deep Dive author Matthew Cox breaks down the Health Canada...