A week after Aurora Cannabis (TSX: ACB) (NYSE: ACB) closed their U$40 million all-share deal for U.S. hemp operator Reliva, LLC, we thought it would be beneficial to peer into what analysts on the street have to say about the transaction. We consulted a number or reports issued by analysts, including Canaccord Genuity, Cowen & Co, and Cantor Fitzgerald

First up is Canaccord Genuity’s Matt Bottomley, although he doesn’t say much about the deal in the 1-page primer, he makes note that Reliva has >20,000 mass retail stores including 8 out of the top 20 national convenience store chains in the U.S. and is the market leader in hemp-derived CBD topicals while being second to Charlotte’s Web (TSX: CWEB) for overall market share. Bottomley says that this acquisition would dilute shareholders by ~2.8% or ~3.1m shares with the potential to be more as there are U$45m worth of potential earn-outs, which are based on financial targets that would be issued either in cash or shares. With this deal, the management team Aurora is receiving has 40+ years of experience navigating big tobacco and tobacco accessories, which are very strict regulatory sectors.

Next is Cowen and Co, where analyst Vivien Azer says that this deal “represents ACB’s long-awaited entry into the U.S.” They note that Aurora can now build out its infrastructure in the U.S. as FDA starts to reclassify CBD and THC legislation. They believe the deal was reasonable considering Reliva’s C$14m in revenues over the last twelve months, which implies a 4x multiple, sequential growths and the outlook for the total addressable market.

Cantor Fitzgerald came out with a longer note for this acquisition, which talks the deal up saying that it should be EBITDA accretive with about C$3-C$4m for FY21. They also believe the deal is quite reasonable comparbly when assuming that they generate C$5m a quarter, making the enterprise value to sale ratio 2x. This compares to the Charlotte’s Web and Abacus Health deal, where CWEB paid 3x EV/sales.

Cantor is also of the belief that there is a lot of intangibles that this purchase brings, such as the management team is experienced, that it could possibly accelerate the agreement with the UFC, and growing their USA footprint which will be massive if there is cannabis legalization that happens in the U.S. Although they talk this deal up, they also ask “Why now?, stating that they question the timing of this deal as there is still no permanent CEO, and given the current CBD industry challenges.

The last analyst, Owen Bennett from Jefferies, has a lot more questions and issues with this deal than any other analyst mentioned above. They, like Cantor, suggests that the timing of this deal is odd, as Aurora is entering a sector where “many of the main players [are] facing headwinds and seeing financials going backward.”

Jefferies also identifies that there are a number of obstacles and concerns relating to Aurora focusing on the acquisition, including:

- Limited barriers to entry and lack of regulatory oversight from the FDA.

- Management situation.

- Aurora’s financial strength.

- Reliva’s almost absent online presence and the ability to create premium products.

- Implications for covenants.

- Dilution.

- Questions about the purchase price.

Let’s start on this laundry list of issues Jefferies gives, the first being a move into the U.S. markets is potentially the most significant decision for the company. Conducting this move without a permanent CEO makes it seem like they are not close to hiring anyone for the position and in their view makes the role less attractive as any new CEO will be tied to this deal, rather than having their own strategy for entering the U.S. markets.

Secondly, they mention that the balance sheet is in a “delicate position” and that they are still not sure if Aurora will meet its renegotiated covenant in the first quarter. They also say that the balance sheet does not have the capital required to make a crucial move into the U.S., where investment is necessary to succeed.

Next, they have questions: due to the value positioning of the Reliva brand, there could be issues in creating substantial brand equity and a premium brand because the main distribution is Circle K. The firm states that a genuine national brand needs to expanded beyond convenience stores, which does not seem like Reliva’s focus.

Next, Owen says the optics on this deal are odd as it looks like history is repeating itself as their strongest bear point was “Aurora’s continual dilution of shareholders.” Conducting an all-share transaction just after doing a 12:1 split “really does seem like a case of history repeating itself” and makes the note that the institutional shareholders they have spoken to are less impressed than the retail investors.

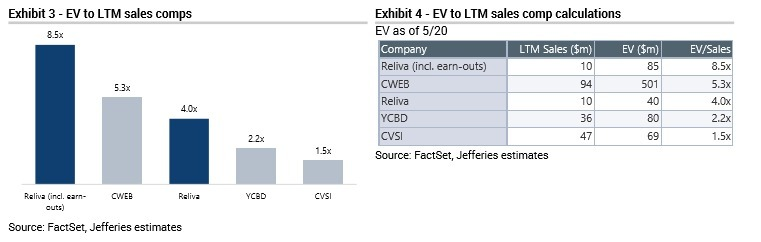

The last issue they bring up is the total purchase price when factoring in the C$45m worth of earn-outs. Below is their breakdown of the E.V. to last twelve months (LTM) sales comp and calculations showing that Reliva plus its earnouts make it 8.5x, which is ~40% higher than CWEB’s 5.3x.

Information for this briefing was found via Sedar, Jefferies, Canaccord Genuity, Cantor Fitzgerald, Cowen & Co, and Aurora Cannabis. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

they have to earn it to get the earn out. that doesn’t bother me because it would be good news. Circle K is Couche Tard which has equity and options on Fire & Flower, kind of makes you wonder how all this fits together.