The Bank of Canada maintained its overnight target rate of 0.25% this morning in its market update, refusing to go near negative interest rates for the time being and meeting many analyst expectations. However, surprising many, Canada’s central bank announced that they would be conducting quantitative easing by purchasing both corporate and provincial bonds.

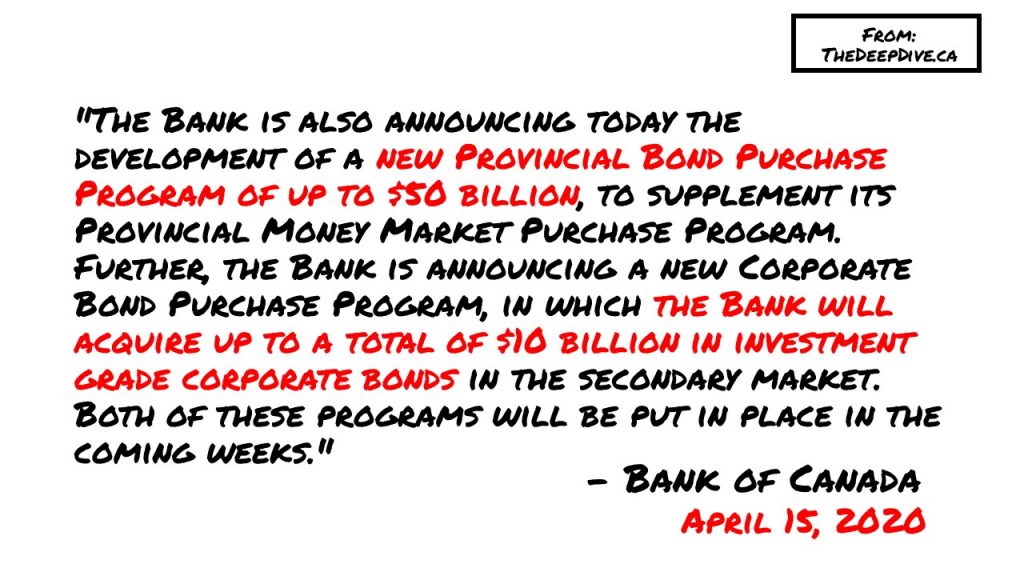

With respect to provincial bonds, the program has been labelled as the Provincial Bond Purchase Program. The BoC intends to purchase up to $50 billion in provincial bonds under the program, supplementing its already active provincial money market purchase program.

The corporate bond purchase program is similar while mirroring actions taken by the US Federal Reserve. The Bank of Canada will be purchasing up to $10 billion in corporate bonds under the new program. However, unlike our neighbours to the South, the program is currently only purchasing investment grade bonds and not junk-rate bonds.

Additionally, the bank will continue to purchase at least $5 billion of Government of Canada securities in the secondary market per week, increasing purchase levels as needed to maintain the market.

Additionally, the Bank of Canada has indicated that the outlook is to uncertain currently to provide a full forecast for the state of the economy. However, the BoC indicated that real activity was done 1-3 percent in the first quarter of 2020, while its estimating that real activity will be down 15-30 percent in the second quarter of 2020 when compared to the fourth quarter of 2019. CPI inflation is expected to be close to 0% as a result of lower gas prices.

Information for this briefing was found The Bank of Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.