U.S. President Biden continues to be a friend to nuclear power generation and, by implication, the uranium mining industry. On March 2, the Department of Energy (DOE) announced plans to spend US$1.2 billion to extend the lives of nuclear facilities, including at least one that has recently closed. The funding will come from the second award cycle of the Civil Nuclear Credit Program, a US$6 billion pot of money that was part of one of President Biden’s key legislative achievements, the 2021 Bipartisan Infrastructure Law.

In November 2022, the DOE decided to conditionally award US$1.1 billion to PG&E Corporation (NYSE: PCG), the owner of the Diablo Canyon Power Plant in California. The two-unit nuclear plant was scheduled to be decommissioned in 2024 and 2025. The government funding, the final terms of which are still being negotiated, is designed to keep Diablo Canyon open. According to the DOE, Diablo Canyon produces 15% of California’s clean energy.

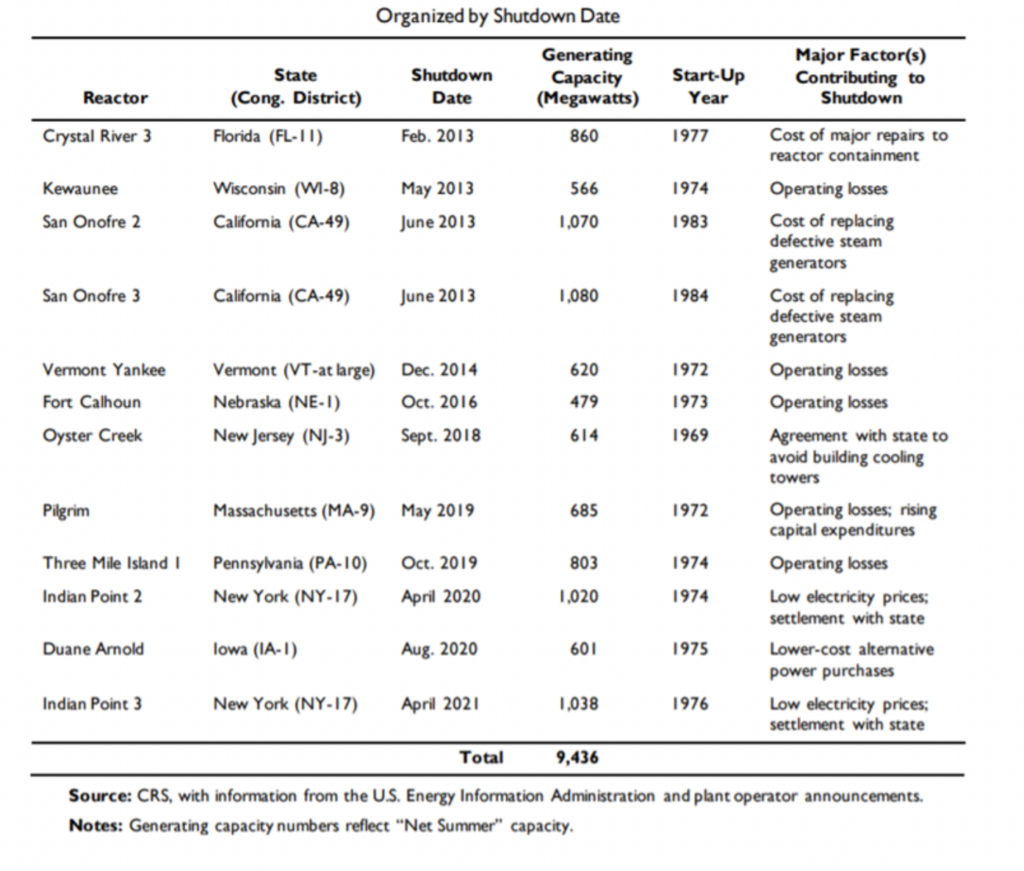

Twelve nuclear reactors in the U.S. representing about ten gigawatts of generating capacity were shuttered over the 2013-2021 period, and others are scheduled to close over the next few years. If the funds in the Civil Nuclear Credit Program can limit the number of future closures and/or potentially reverse the process, the uranium market will benefit.

A less constructive development for long-term uranium pricing has been the inability of European Union (EU) member states to reach an agreement to sanction Russia’s nuclear fuel industry, and in particular Rosatom, Russia’s state-owned nuclear conglomerate. Reaching consensus is proving difficult for several reasons. The most prominent is that five EU countries — Hungary (the most vocal opponent), Slovakia, Bulgaria, Finland, and the Czech Republic — utilize Russian-built nuclear reactors for which alternate sources of nuclear fuel apparently do not work.

To be more specific regarding Russia’s uranium position, the country’s real value in the uranium industry stems from its uranium enrichment capabilities, a process which creates nuclear fuel from mined uranium by increasing the percentage of Uranium-235. Russia has more than half the world’s enrichment capacity. The raw material for most of Russia’s uranium exports comes from Kazakhstan.

Spot uranium prices have been stable at around US$50 per pound over the last nine months. Falling prices of competing fuels, particularly natural gas, as well as higher interest rates which have affected economic activity and in turn electricity demand, have held down uranium prices.

Still, the spot uranium price has performed extremely well versus natural gas and oil over the last nine months. Natural gas is down about 60% since mid-November, and oil prices have been cut nearly in half since June.

Information for this briefing was found via US Department of Energy and the sources mentioned. The author has no securities or affiliations related to this organization. Views expressed within are solely that of the author. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.