Last week Take-Two Interactive (NASDAQ: TTWO) announced that they reiterated their 2022 guidance and outlook. They additionally noted that their highly anticipated expanded and enhanced versions of Grand Theft Auto V and Grand Theft Auto Online for PlayStation 5 and Xbox Series X|S, which was originally planned for a November 11th, 2021 release, is being delayed and is planned to launch in March of 2022.

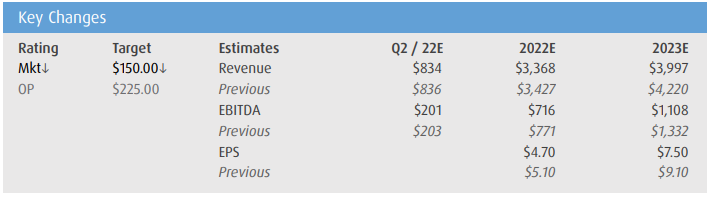

Take-Two Interactive’s 2022 guidance is below:

Take-Two Interactive currently has 27 analysts covering the stock, with an average 12-month price target of $208.92, or a 40% upside. Of the 27 analysts, 6 have strong buy ratings, 12 have buy ratings and the other 9 have hold rating. The street high comes from Elazar Advisors with a $253 price target and the lowest comes in at $150.

On September 17th, BMO Capital Markets lowered their 12-month price target to $150 from $225 and downgraded the name to Market Perform from Outperform, saying that this delay is just a series of delays. Further, they refer to the delays as now becoming more of a “disconcerting trend.”

BMO says that they have “grown less confident” in their higher than street estimates as Take-Two Interactive has slowly pushed back video game releases, and they expect that this will start to hurt the companies multiple. Additionally, they are wary of the new Chinese gaming regulations and heightened scrutiny of video game companies.

The trend of delaying video game releases first started back in the Fall of 2017, where the company delayed Red Dead Redemption 2 several times, then Kerbal Space Program 2 was delayed from 2020 to 2022. And now GTA V expanded and enhanced was delayed from November 2021 to March 2022.

BMO believes that investor sentiment is starting to turn neutral on video game companies as there was a lot of pull-forward of new users and daily consumption because of the COVID-19 pandemic. They believe that engagement might not be as high leaving the pandemic as investors expect.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.