The Bank of Japan (BOJ) is hinting at a more aggressive quantitative tightening plan for July, potentially coupled with an interest rate hike. This move marks a significant step back from the central bank’s longstanding monetary stimulus policy.

Recent hawkish signals from the BOJ reflect growing pressure to address renewed yen weakness, which could push inflation above the 2% target by increasing import costs. Sources familiar with the bank’s thinking told Reuters that, barring severe economic downturns or market shocks, a rate hike could be considered at each policy meeting, including July’s.

Despite maintaining near-zero interest rates this month, the BOJ board discussed the need for a timely hike. One member even suggested the possibility of raising rates to prevent excessive inflation due to cost pressures. Governor Kazuo Ueda has not ruled out a rate increase in July.

The potential July 30-31 meeting decision could significantly impact markets, as the BOJ also plans to announce details on reducing its massive bond-buying program and trimming its $5 trillion balance sheet. Ueda has indicated that the cut to bond buying could be substantial, aiming to free markets from the constraints of yield curve control, a policy abandoned in March.

"It's very dangerous to be holding any type of short yen position at these levels…"@kathylienfx of BK Asset Management offers insight on how to trade the yen ahead of a potential intervention from the Bank of Japan. pic.twitter.com/CwUQCEVsvd

— CNBC's Fast Money (@CNBCFastMoney) June 24, 2024

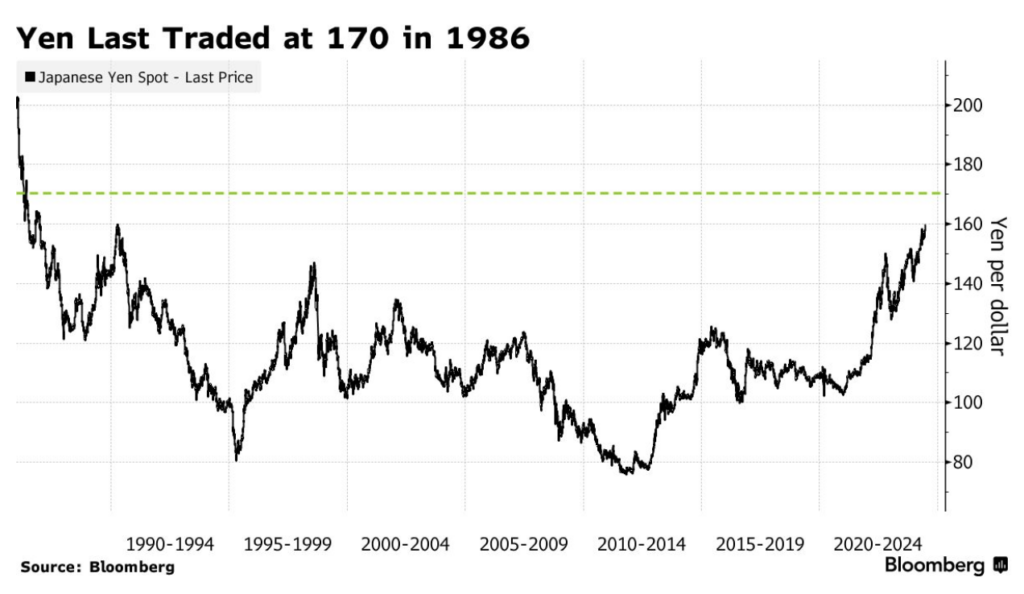

The yen faces continued pressure, with some analysts predicting it could weaken to 170 per dollar, levels not seen since 1986.

This persistent weakness stems from the significant interest rate differential between Japan and the United States. Despite warnings of potential intervention from Japanese officials, the currency market remains largely unmoved.

Information for this story was found via Reuters, Bloomberg, and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.