On August 3, Antibe Therapeutics Inc. (TSX: ATE) announced that they have paused their study of otenaproxesul because it breached the threshold for the number of patients exhibiting liver transaminase elevations. Two analysts lowered their price target on the stock thereafter.

Antibe Therapeutics currently has 6 analysts covering the stock with a weighted 12-month price target of C$6.34, a 430% upside. Out of the 6 analysts, 1 has a strong buy rating, while 5 have buy ratings. The street high sits at C$20 while the lowest comes in at C$2.

Last week, on September 24, Canaccord slashed their 12-month price target to C$5 from C$15 but reiterated their speculative buy rating. Commenting on the change, the firm commented that the pause of Otenaproxesul was “a significant setback for the company,” which has made the stock settle around its cash per share amount of ~$1.28.

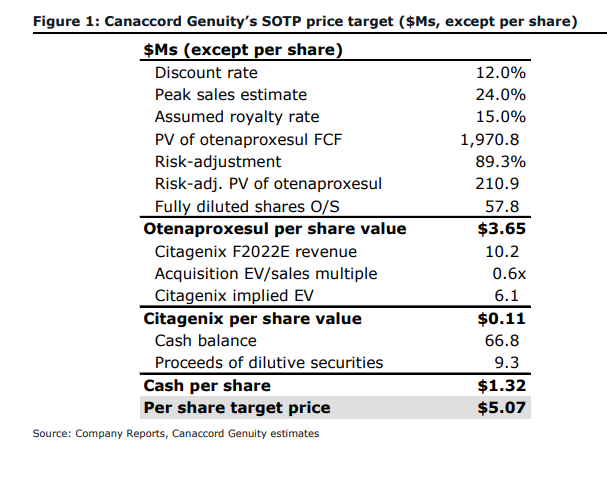

The firm slashed their 12-month price target as they now are delaying their sales forecast for Otenaproxesul and they noted they have changed “how we’ve valued the drug.” They now believe that the drug has an 11% chance of approval, instead of the 32% chance of other Phase 2/3 drugs.

In forecasting, Canaccord’s analysts now added a new $4 million AME study and a $7 million Phase 2 trial into their research and development costs. They have delayed both the phase 3 trial and receipts of all payments by 9 months, so now they believe phase 3 will start in CQ4 of 2022. Antibe currently has $66.8 million in cash as of June 30, which Canaccord believes will be sufficient to fund the majority of the companies future developments.

Canaccord also provides a “go forward” plan for Antibe. They noted that they wished to get more color from the management before adjusting their assumptions but now they have to make their own assumptions on whether or how development will resume. They now assume that if a 75mg dose is safe, the company can go ahead and request to begin another AME study. Health Canada would likely take a month to report back to the company if approved, for which Canaccord says “ATE could then subsequently run a six-week 60-80 person Phase 2 trial.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.