Canada’s housing affordability problem continues to persist despite a significant correction in home prices, BMO economists said in a recent analysis.

In an article by BMO Chief Economist Douglas Porter and Senior Economist Robert Kavcic, it was analyzed that the belief that doubling the industry’s output and flooding the market with new units can solve the issue is wishful thinking, as the industry is already running at full capacity. While the Bank of Canada has taken measures to curb market activity, robust immigration flows fuel demand, exacerbating the strain on the housing market.

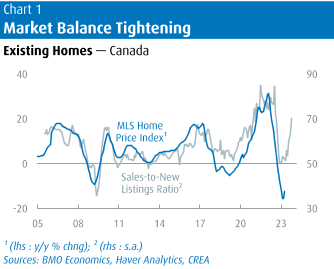

Many markets have reached a bottom after last year’s correction, but the scarcity of new listings tightens the market. Despite a 25% increase in the population, national new listings are at their lowest non-pandemic level in nearly two decades. Factors such as potential sellers holding back, a strong job market, attractive mortgages, and a robust rental market contribute to the lack of new listings.

“National new listings were running at the lowest non-pandemic level in almost 20 years, despite a population that is now larger by 25%, or by 8 million,” the article said.

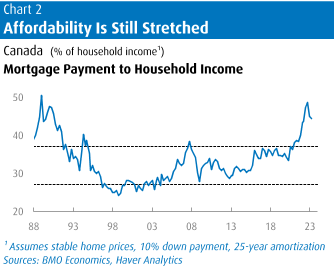

Although the structure of Canada’s mortgage market has softened the impact of higher interest rates for variable-rate holders, the correction in prices has only eliminated extreme speculation, falling short of making housing truly affordable. Maintaining affordability when mortgage rates increase would require a significant reduction in house prices, which is not expected in the near future.

“As prices level off, that leaves the national benchmark price correction at 16% peak-to-trough. That has simply scrubbed the extreme froth out of the market, but hasn’t gone far enough to actually make housing close to ‘affordable’ again,” the economists added.

The analysis also noted that when mortgage rates jump from 1.5% to 5%, maintaining affordability would require a 25% cut in the price of the house with everything else constant. The takeaway for the authors is that the pandemic-era deterioration has scarcely been touched.

“To do so would take another leg down in home prices, or a meaningful move down in mortgage rates, neither of which are on the radar for the rest of this year,” the added.

Increased housing supply is crucial to improve affordability, but relying solely on supply won’t solve the problem, according to the economists. Housing supply can only respond gradually, and there are limitations to how quickly it can increase due to workforce constraints, land availability, and material availability. Moreover, success in lowering prices may discourage future construction.

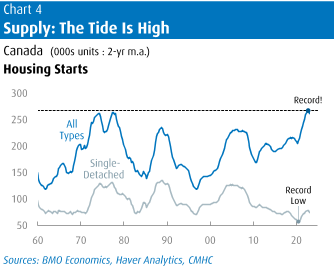

Despite a surge in new homebuilding, affordability remains a challenge. Condo construction dominates the market, while single-family homes account for a smaller proportion of new starts. The dominance of the investor class in the housing market worsens affordability, with a significant percentage of dwellings, including detached homes, owned by investors.

“For example, housing starts in 2021 and 2022 were the strongest on record for a two-year period, averaging 267,000 units, or 40% above the 50-year average pace,” the article said. “But even completions were at 40-year highs in the past two years, and dwellings under construction are running at a record 1.5 years’ of supply (at 378,000 units). The point is that supply has indeed responded in recent years, and yet the affordability needle has barely moved.”

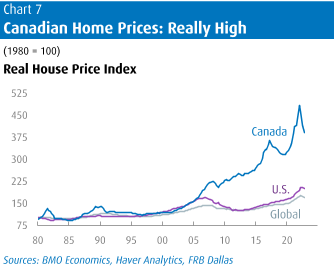

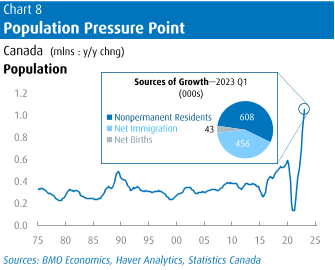

Canada’s strong population growth, driven by immigration, plays a significant role in fueling demand and weakening affordability. Real home prices in countries with rapid population growth, like Canada, have risen the fastest. The construction industry struggles to meet the demand created by historic immigration levels, further contributing to the affordability problem.

“Regression analysis suggests that every 1% rise in population will be associated over time with real home price growth of just over 3% per year. In recent years, Canada’s population has been growing at an average annual pace of 1.5% per year (and a whopping 2.7% in 2022 alone), which is consistent over time with 5% annual home price gains on top of inflation,” the authors explained. “But regardless of the starting point, there isn’t much debate that Canada’s home price inflation has been much stronger than in most other major economies over a long period of time.”

The combination of record international inflows and peak domestic demographic demand strains the construction industry, resulting in an affordability crisis. Driving down prices may discourage supply, and heightened immigration flows add to the housing demand they aim to meet. The existing infrastructure and industry capacity cannot sustain unchecked demand, perpetuating the affordability conundrum.

Information for this story was found via BMO and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.