Canopy Growth Corp (TSX: WEED) (NYSE: CGC) released its first fiscal quarter 2021 results on August 10th. The company reported net revenues of $110.4 million, versus Refinitiv’s consensus estimate of $93.5 million. Loss per share came in at $0.30 a share versus Refinitiv consensus estimates of $0.44 a share, while posting a net loss of $128.3 million and a free cash flow burn of $180 million.

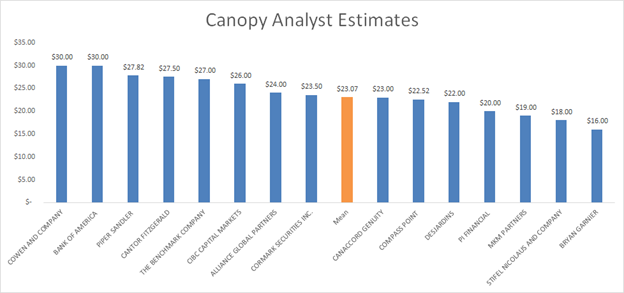

Here are the most recent 12-month price target changes from analysts that cover Canopy:

- Cowen and Company raised their price target to C$30 from C$27

- Canaccord Genuity raised their target price to C$22 from C$21

- CIBC cut their target price to C$25 from C$26

- Cormark Securities raised their price target to C$23.50 from C$21

There are currently 22 analysts that cover Canopy Growth. Of these, only one has a strong buy rating, two have buy ratings, 12 analysts, which makes up the majority of the group have hold ratings, two have to sell ratings, and one has a strong sell rating for Canopy Growth. The current mean 12-month price target is C$23.07. Vivien Azer from Cowen has the highest price target of C$30, or a 33% upside and has a outperform rating on the stock. The lowest price target comes from Nikolaas Faes from Bryan Garnier with a C$16 price target, or a 29% downside, Nikolaas maintains a sell rating on Canopy.

Analyst Bryan Spillane from Bank of America reiterated their Buy rating and C$30 12-month price target on Canopy in their note to investors, saying “Top line beat in 1Q, sequential progress forecast for 2Q21”. Canopy’s revenue came in C$22 million above their C$88 million revenue estimate for the quarter. Spillane notes the management commentary made during the call, with the main remark from management being the cost pressures due to trying to right size the business and gross margins being under 20% while management is still committed to its 40% gross margin goal.

However, Spillane now forecasts the full-year 2021 gross margin to be 18% and believes Canopy will resume their advertisements and promotions later this year after stopping them in this quarter. They also forecast that selling, general and administration, and share-based compensation expenses to be up in the second quarter. They estimate that share-based compensation will be C$45 million vs. C$31 million in the current quarter.

Despite management calling 2021 a “restructuring year” and the somewhat depressing management call, Bryan Spillane has increased his full-year 2021 and 2022 revenue numbers to C$509 million and C$769 million, respectively, up from the C$496 million and C$748 million that was previously estimated.

Canaccord reiterated their hold rating but increased their 12-month price target on Canopy to C$22 from C$21, saying this quarter was “A step in the right direction.” Canopy beat Canaccord’s revenue estimate of C$94.7 million, although analyst Matt Bottomley notes that Canopy reported a weak adjusted gross margin of ~7% vs. their estimate of 28%. Matt says the loss and interim problems that are occurring with Canopy is alright as the balance sheet is sufficient enough to take these operational losses.

Matt states that “US CBD operations set for growth.” As the company has set a bunch of initiatives to help drive growth like opening ShopCanopy.Com an online CBD platform, increasing SKU’s to 25 available, increasing the promotion on their product lines by using its partnerships with celebrities such as Martha Stewart and Patrick Mahomes, and growing their distribution of Storz & Bickel products in North American and Europe.

Canaccord is said to have increased their price target on Canopy due to the revenue beat and the reduced free cash flow burn by +40% this quarter, which allows Canopy to get to break-even and profitability faster.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

One Response

CGC stock is a dog. This article did not mention debenture which will come due soon. The debenture target price was around +/- $48 USD. No chance they will hit that. Sell