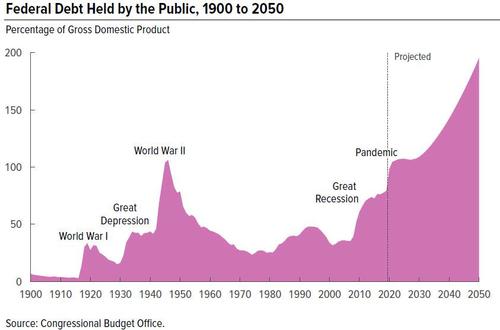

The latest economic outlook published by the Congressional Budget Office calculates that the US federal budget deficit is projected to reach $2.3 trillion, forcing debt levels to exceed 102% of GDP by the end of 2021. However, by 2031, the outlook projects that debt levels would equal 107% of the country’s GDP— the highest on record.

However, what is a new revelation compared to the CBO’s previous forecast, is that the current year’s deficit is expected to fall by almost $900 billion compared to the shortfall recorded in 2020, when the deficit ballooned to a whopping $3.1 trillion.

However, in the current calculations, the CBO did not take into account the federal government’s prospective $1.9 trillion stimulus package. In addition, the CBO is obligated to establish its base-line scenario under the assumption that present laws governing spending and revenues will remain relatively the same, and that discretionary funding in the future will be equivalent to current spending, with adjustments for inflation. This time though, the “CBO deviated from those standard procedures when constructing its current base-line for discretionary spending.”

According to the CBO, the unprecedented nature and size of the emergency stimulus in response to the Covid-19 pandemic did not garner the agency to extrapolate the $184 billion in discretionary budget spending made available so far in 2021. This means that not only did the CBO not take into account President Joe Biden’s stimulus, but it also concluded that Congress would spend less that it has been authorized to spend— which of course is nonsense.

The CBO’s current debt projections are certainly expected to enliven the ongoing debate regarding Biden’s anticipated stimulus package— especially among Republicans, who have been arguing that the country faces an unfeasible debt burden after spending over $4 trillion on the pandemic thus far. However, regardless if whether or not the latest stimulus bill will pass— it likely will, it will just be a matter of what size— the CBO admits that after 2031 anything can happen: “By the end of the period, both primary deficits (which exclude net outlays for interest) and interest outlays are rising.“

Information for this briefing was found via the CBO. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.